Private Equity and Venture Capital Activity in Southeast Asia

- Published

- Nov 26, 2018

- Share

In 2000, venture capital outside of the U.S. was in a nascent form: such investment was in a proto-embryonic stage in the major cities of Western Europe and virtually non-existent in Asia-Pacific. Today the Asia-Pacific region challenges North America as one of two key global venues for venture capital investment, mirroring the geo-political shift from the Atlantic to the Pacific witnessed in the first two decades of the 21st Century.

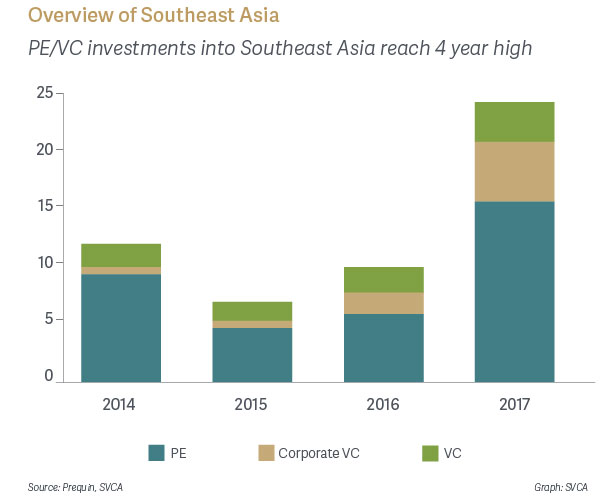

In Southeast Asia (SEA) alone, the region experienced a bumper year for both PE and VC investments, and grew almost three times to reach $23.5 billion in 2017.

The global private equity industry continues to outperform other assets classes in 2017.

The Singapore Venture Capital & Private Equity Association (SVCA) published an annual report on the Southeast Asian private equity (PE) and venture capital (VC) industry in May 2018, which gives an overview in the PE and VC industry globally and in Southeast Asia (SEA).

SVCA has kindly allowed EisnerAmper Singapore to highlight key points from the annual report. To read SVCA’s annual report and other publications, please visit: www.svca.org.sg/publications.

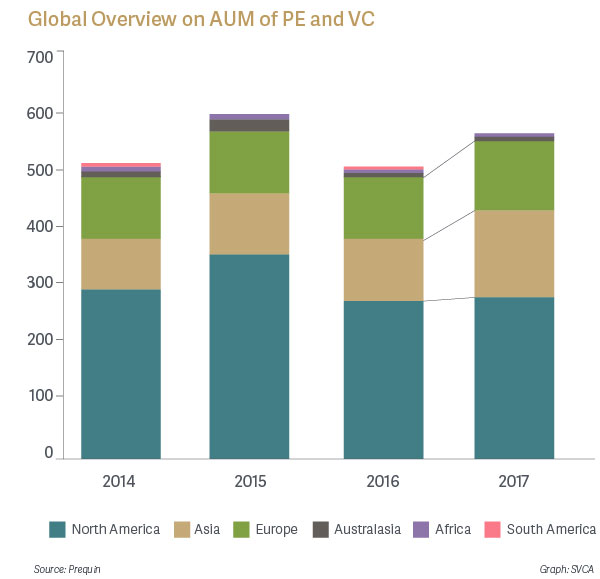

Asia PE and VC AUM grew by 37.6% to reach $158.4 billion, constituting 27.8% of global investments surpassing Europe for the first time.

Asia’s strong fundamentals, growing economies, and advancing technological capabilities are becoming increasingly attractive to global sources of funds chasing for yield.

The estimated PE/VC investments into SEA hit the $23.5 billion in 2017. This is the highest recorded level by SVCA.

“For those PE players in the middle market that have good deal sourcing capabilities, a differentiated strategy and a strong value proposition for founders, there are great opportunities at often attractive valuations,” said Ralph Keitel, Regional Lead for PE Funds in East Asia and Pacific, IFC.

“Most LPs now have meaningful allocations for Asia. But the majority of that goes to either pan-regional funds or China. Lesser developed markets such as India, and Southeast Asia in particular, are still considered to be too risky for many institutional LPs. As a result, fundraising for all but the largest funds remains very challenging.”

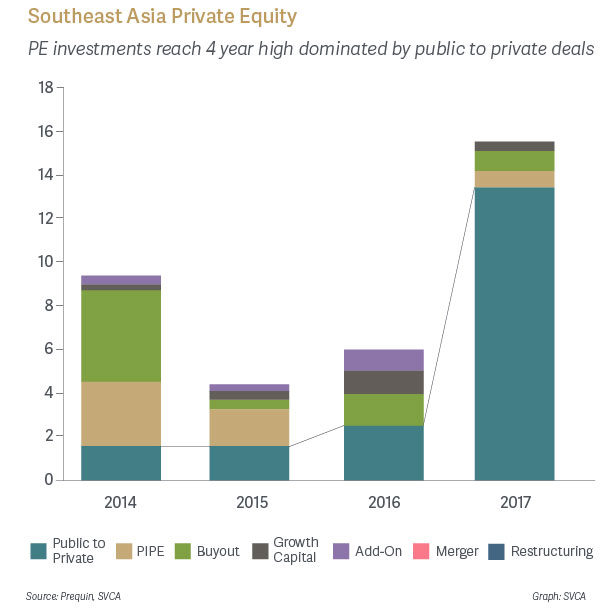

The PE deal value increased to $15.5 billion in 2017 from $9.2 billion in 2014. In particular, PE involvement in public to private transactions grew exponentially at 113% annually from 2014 to 2017. In 2017, public to private transactions grew 5.8x year-on-year dominated by the $12 billion privatization of Global Logistic Properties.

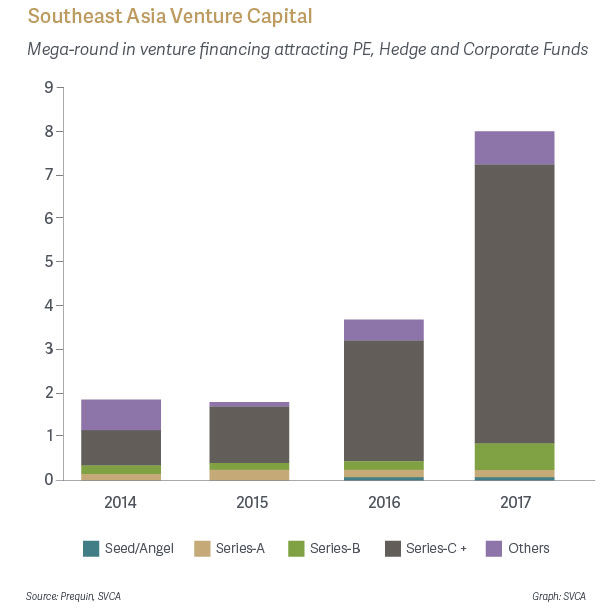

From 2014 to 2017, the venture financing increased from $1.7 billion to $8.0 billion. While early stage investment (Seed and Series-A investments) increased to $83.1 million. The successive rounds (Series-C) have increased significantly to $6.3 billion, which represent 79% of total venture investment in 2017.

Spotlight on IPO of Southeast Asian Unicorns in 2017

Razer Ltd.

Gaming tech firm Razer Ltd., a leading maker and marketer of gaming peripherals such as gaming laptops, mice, and gaming controllers, is one of Singapore’s start-up success stories. Razer launched an initial public offering in November 2017, raising HK$4.12 billion to much publicity and fanfare.

Sea Limited

Sea Limited, which attracted mega-rounds of investment from VC, PE, CVC and pension funds, began as Garena, hosting a platform for popular online games. It has since grown into a Southeast Asian powerhouse with interests in internet gaming, payment and ecommerce. Sea Limited launched an initial public offering on NYSE in October 2017 raising $884m. The IPO of two of Southeast Asia’s “unicorns” created some excitement in 2017 although stock prices of Sea Limited and Razer have since seesawed above and below their IPO price. Nevertheless, their IPOs have rewarded early investors and bode well for PE and VC investment into SEA.

The Monetary Authority of Singapore (MAS) seeks to build a vibrant VC and PE ecosystem, as part of broader efforts to develop Singapore as a financing hub for growth companies in Singapore and the region. MAS is working with the industry and government stakeholders on initiatives designed to:

- Simplify authorization processes and regulatory framework for VC managers;

- Anchor top-tier regional and global VC and PE players in Singapore;

- Deepen the talent pool;

- Enhance ancillary professional services ecosystem; and

- Build a pipeline of alternative market platforms that can facilitate private market exits for VC and PE investors.

EisnerAmper Singapore hears that the outlook for the rest of 2018 will remain strong. Companies in Asia, particularly Southeast Asia, will likely to seek earlier and larger rounds of funding from the global market. Singapore companies are also likely to be more aggressive in seeking earlier and larger rounds of funding from the local, US, China and overseas markets. Such developments will continue to drive global and local PE and VC investment and momentum to the next level.

Private Equity Intelligence | Q4 2018

- Private Equity as an Exit Option for Venture-Backed Startups

- Why U.S. Private Equity Funds Should Adopt Sell-Side (Vendor) Due Diligence with a Twist

- Private Equity and Venture Capital Activity in Southeast Asia

- The New Kid on the Block – Here to Play, Here to Stay: The Institutionalization of the Family Office

Contact EisnerAmper

If you have any questions, we'd like to hear from you.

Receive the latest business insights, analysis, and perspectives from EisnerAmper professionals.