Advisory

EisnerAmper’s Advisory Services professionals offer a full array of services to business and governmental entities of all types and sizes, not-for-profits, and high net worth individuals—both domestically and globally—to position them for long-term success.

As strategic advisors to your organization, we help you tackle your toughest business challenges and guide you through critical decisions. That’s why we have a diverse and experienced team of consultants to assist you in reaching your goals and maximizing your opportunities. We have the capacity, talent, and capability to design and scale tailored solutions quickly to the unique challenges our clients endure.

Organizations often have time-sensitive requirements that originate from major changes or out-of-the-ordinary developments, such as contemplated pending transactions, legal or regulatory challenges, the identification of previously unseen financial issues or disruptive technology incidents. When these often complex events arise, quick and easy access to specialized resources is critical.

With half a century of institutional experience, we aim to deliver targeted value. The EisnerAmper approach is to initiate each engagement by working with (and listening to) clients to determine their key issues. We then leverage our broad-based experience to develop custom solutions to meet their unique needs.

EisnerAmper delivers its advisory services through a number of specialty practices, which include Risk & Compliance Services, Financial Advisory Services, Strategy & Transformation Services, Settlement Administration, and Governmental Services.

These teams are organized into sub-specialties to focus on even greater subject-matter expertise:

Bankruptcy & Restructuring

Compensation Resources

Disaster Management & Recovery

Environmental, Social & Governance (ESG) Services

Federal Government Contracting

Forensic, Litigation & Valuation Services

Retirement Plan Administration & Consulting

Risk and Compliance

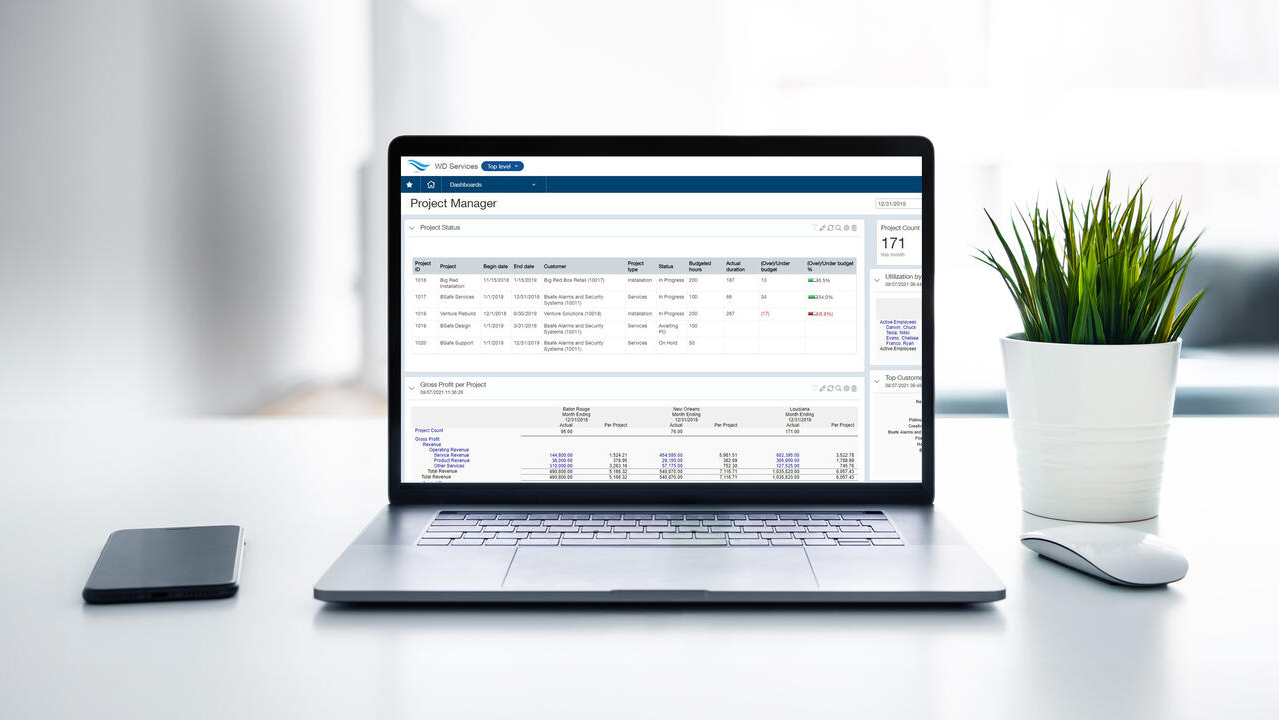

Sage Intacct Cloud Accounting

Technical Accounting

Transaction Advisory

Workday Adaptive Planning

What's on Your Mind?

Start a conversation with Mark