Coming to America

Whether you’re looking to set up a U.S. subsidiary or you are required to create a U.S. topco, you have an enormous amount of uncertainty to navigate.

Driven by the growth goals of your business, you likely have several questions about how to set up your U.S. entity and achieve expansion expectations from your stakeholders. Without dedicated resources, it can be hard to know how to get started. Some companies may already have a product in the U.S. market, with U.S. customers, while others may start off by hiring employees in the U.S. However as companies enter the U.S., they quickly discover several layers of regulations that differ from their country of origin.

Expanding a business or advancing a product in the U.S. requires necessary planning and preparation. Without an established professional network stateside, how do you navigate a complex tax and regulatory environment and attract the necessary capital to reach your growth goals?

If your company is ready to expand into the U.S. market, we have the answers to your questions. Our professionals are committed to helping businesses like yours navigate uncertainty and reach your goals by providing you with a clear path forward. We support you every step of the way, and give you the reassurance you need to get you to where you’re going—successfully.

The biggest challenges that these companies face is a fear of the unknown. Our job is to help you get a sense of comfort while making sure that you stay in compliance and take advantage of any opportunities which may exist.

Grow Your Business with Us

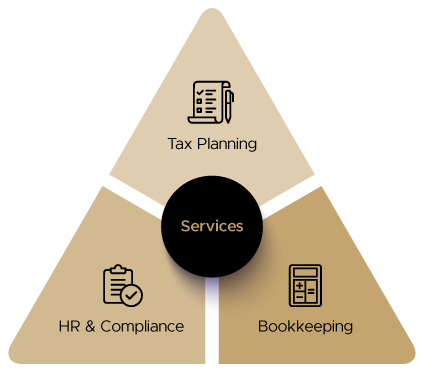

Questions will continue to arise as you grow and expand your business into the U.S. For example, “How do I set up my Employer Identification Number (EIN)?” “Sales tax isn’t like value-added tax (VAT) - how does it work?” Companies established overseas most commonly seek out our team of professionals for the following needs, general business consulting, and more:

Leverage our network of resources.

Join the Coming to America starter program.

Get scalable solutions.

Introductions to capital connections

Companies Entering the U.S. Rely on EisnerAmper

Achieving your growth an expansion goals requires a team effort. At EisnerAmper, we are committed to being an integral part of the solution. Our focus is on helping you navigate the road ahead efficiently and strategically. Beyond mere compliance, we provide value at every stage along the way and work diligently to help put you in the best position for success. You will find comfort working with us.

Coming to America Insights

Gain access to custom resources that provide insights into industry trends and market dynamics, delivered by experienced EisnerAmper professionals who are committed to your success.

What's on Your Mind?

Start a conversation with the team