Going Public Through a SPAC: Considerations for Sarbanes- Oxley (SOX) Compliance

- Published

- Oct 27, 2025

- Topics

- Share

Special Purpose Acquisition Companies (SPACs) have an accelerated timeline for target companies to go public compared to traditional IPOs and for Sarbanes-Oxley (SOX) Compliance. The Sarbanes Oxley Act is a federal law that outlines the importance of transparency, accuracy, and reliability of financial reporting. This Act strives to protect investors, making it imperative to maintain compliance, especially when going public through a SPAC. For SPACs, this typical grace period for newly public companies applies most commonly to the date the SPAC went public, and not the date the de-SPAC transaction was completed, and the de-SPAC does not trigger another grace period. Once it is determined that SOX compliance and reporting is required, the question often becomes whether Management or Management and the Company’s Auditors are required to opine on the effectiveness of the internal controls over financial reporting (ICFR), respectively compliance with SOX 404a or SOX 404b, while noting that Emerging Growth Company status maximum of 5 years is from the date of the SPAC IPO, if thresholds for SOX 404b are not triggered prior.

Additionally, the SOX 302 certification requires the CEO and CFO to personally certify the accuracy and effectiveness of the financial reporting and disclosure controls beginning with the first quarterly financials. There is no grace period for compliance with SOX 302.

Key Takeaways:

- SPACs have a faster timeline for going public compared to traditional IPOs, requiring quicker compliance with SOX regulations, specifically regarding internal controls over financial reporting.

- Companies undergoing the de-SPAC process need to be vigilant about SOX compliance considerations, understand exemptions and requirements, such as SOX 404a and 404b, while emphasizing proactive preparation.

Understanding the SPAC Process

For companies going public through the traditional IPO route, there is a grace period to comply with SOX during their first annual reporting period. However, for SPACs, the typical grace period for newly public companies applies most commonly to the date the SPAC went public, not the date the de-SPAC transaction was completed. This may be the case if the SPAC’s 8-K is amended to include the target company’s prior-year financials. Once it is determined that SOX compliance and reporting is required, the question becomes whether management or both management and the company’s auditors are required to opine on the effectiveness of the internal controls over financial reporting (ICFR) and compliance with SOX 404a or SOX 404b, respectively.

The de-SPAC Process: Considerations and a Sample Timeline

The de-SPAC process is when a private company merges with a publicly listed SPAC, making it publicly traded. If the company has completed the de-SPAC process, it needs to be aware of the various SOX compliance considerations.

| May Be Exempt from SOX Reporting |

Management’s Attestation (SOX 404a) |

Management and Auditor’s Attestation (SOX 404b) |

|---|---|---|

|

|

|

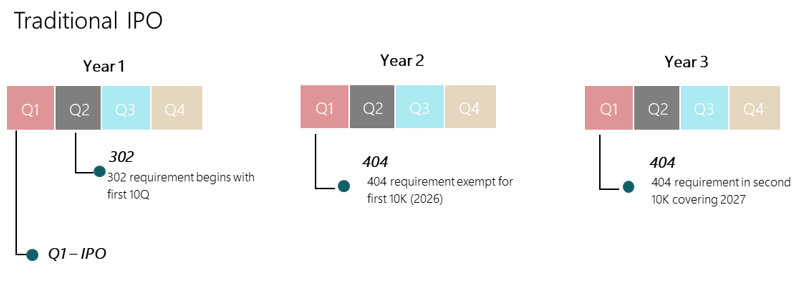

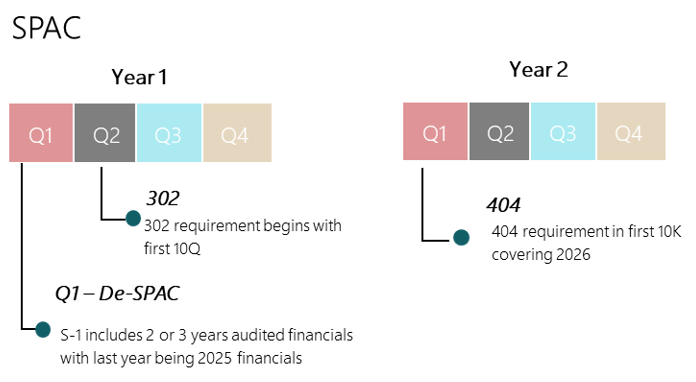

Some de-SPAC transactions may require SOX 404a or 404b compliance in the year the transaction is completed. Below is a comparison sample timeline detailing SOX compliance requirements for a SPAC vs a company going public through a traditional IPO.

Challenges and Best Practices for SOX Compliance

As a SPAC, it can be difficult to curate SOX compliance and even more challenging to maintain it. Due to the quicker turnaround of a SPAC merger, most companies have less time to proactively establish controls and safeguards, which can potentially lead to operational disruptions, reporting discrepancies, and resource constraints.

Once it is determined which compliance framework, SOX 404a or SOX 404b, is required, the company should immediately begin implementing internal controls to establish and maintain federal compliance. Compared to traditional IPOs, this process needs to start sooner rather than later to meet the expedited deadlines and avoid potential risks and penalties.

Best practices for SPACs wanting to achieve SOX compliance include, but are not limited to:

- Establish internal controls over reporting and documentation processes for accuracy and safety

- Assign responsibilities and system access to specific individuals

- Integrate innovative technologies to automate, track, and manage systems

- Evaluate and test controls

- Identify gaps and solutions to mitigate risks

By following these practices, companies are better positioned to foster a company-wide environment of compliance, mitigate risks, and follow their outlined SOX requirements.

Finding SOX Compliance with an Experienced Partner

Working with a team of professionals is a proactive compliance solution. At EisnerAmper, our SOX compliance team combines decades of industry experience, innovative technologies, and a collaborative approach to navigate evolving compliance requirements and enhance processes successfully. To learn more about how our team can guide you on your journey to going public, contact us below.

What's on Your Mind?

Start a conversation with Nina