Private Equity

Lifecycle Value

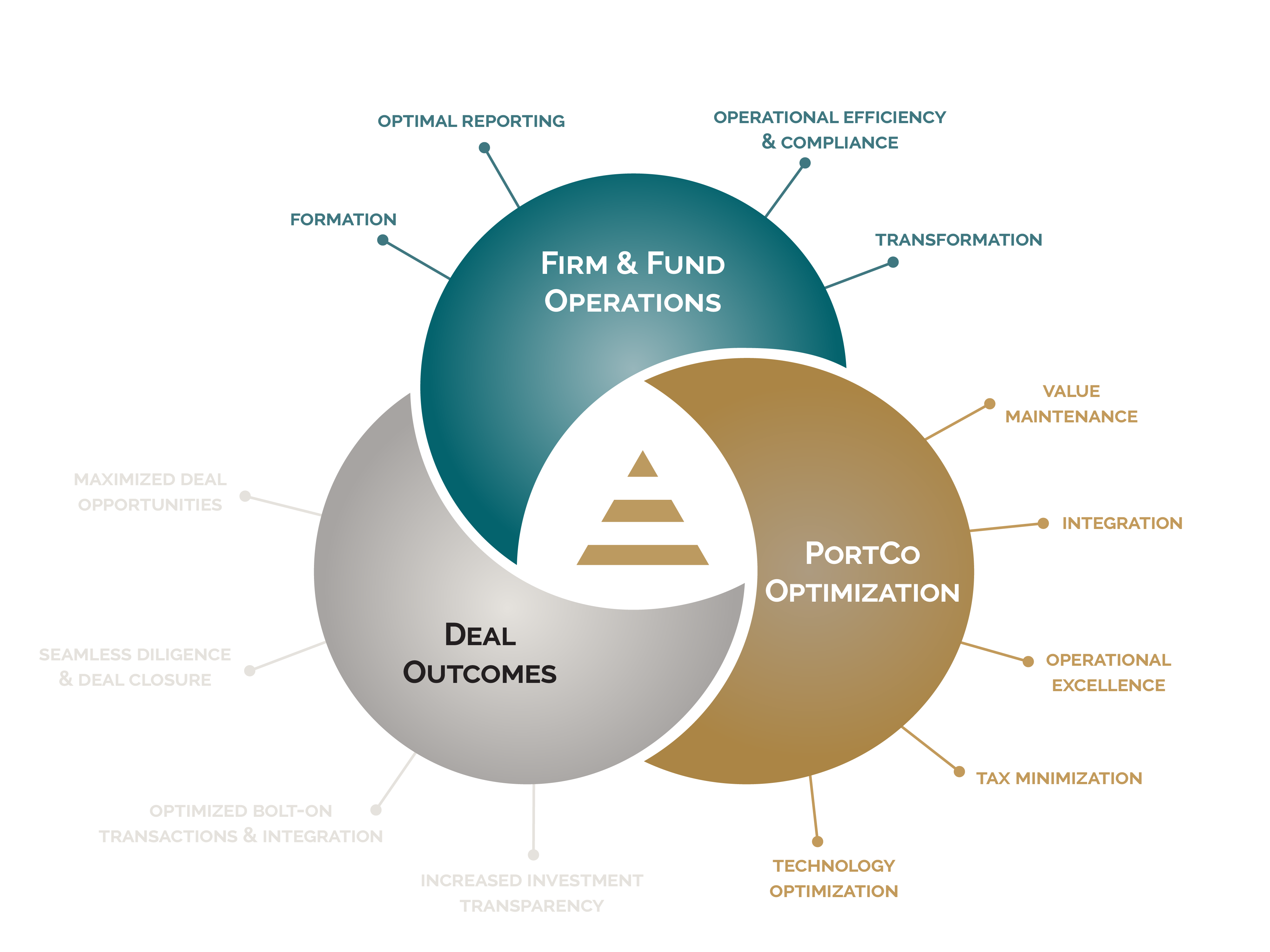

Empowering Private Equity firms to achieve middle market growth with solutions covering the investment lifecycle.

Why Choose EisnerAmper?

Our Core Services

We provide tailored solutions to private equity firms, offering services for funds, deals, and portfolio companies designed to support you throughout the entire private equity lifecycle.

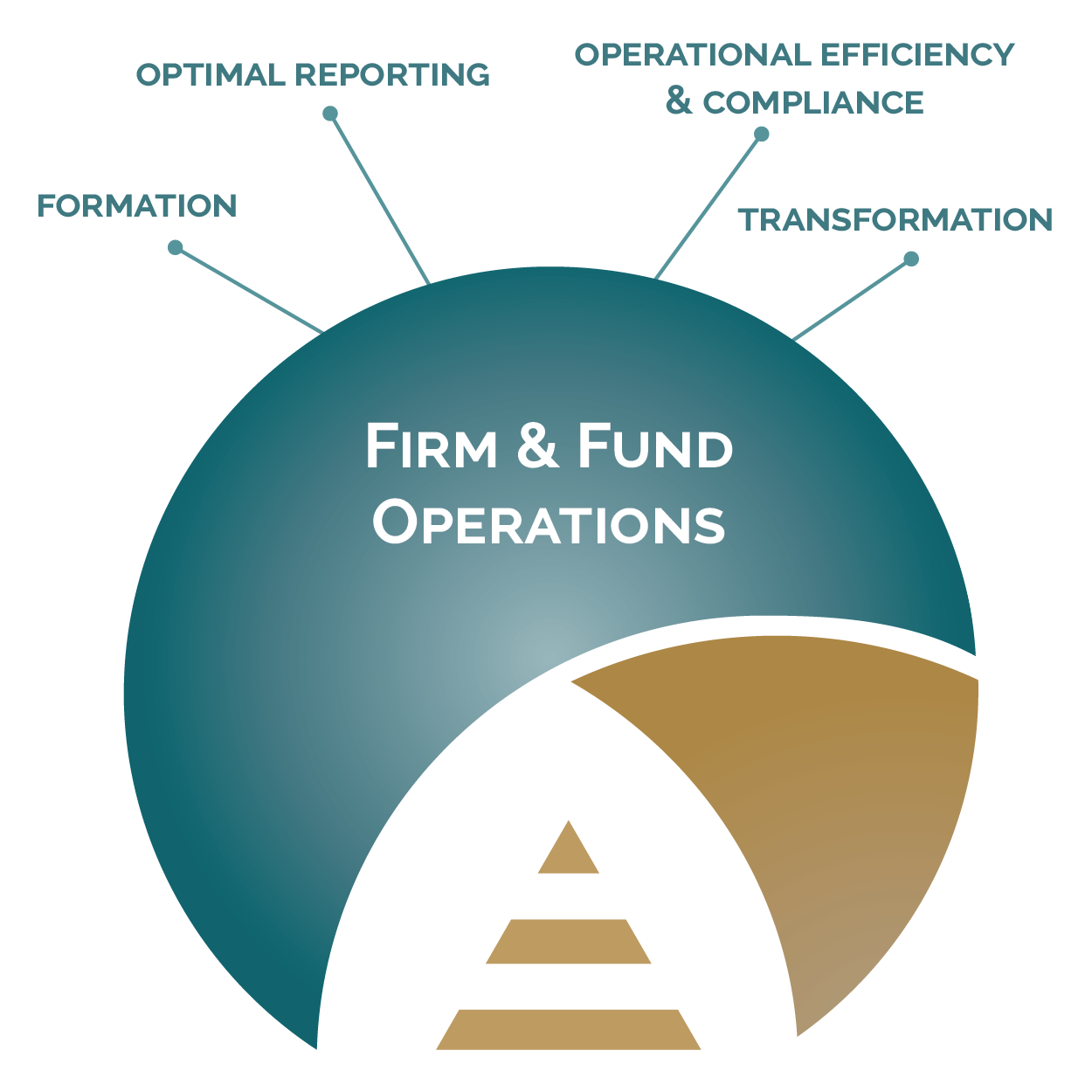

Firm & Fund Services

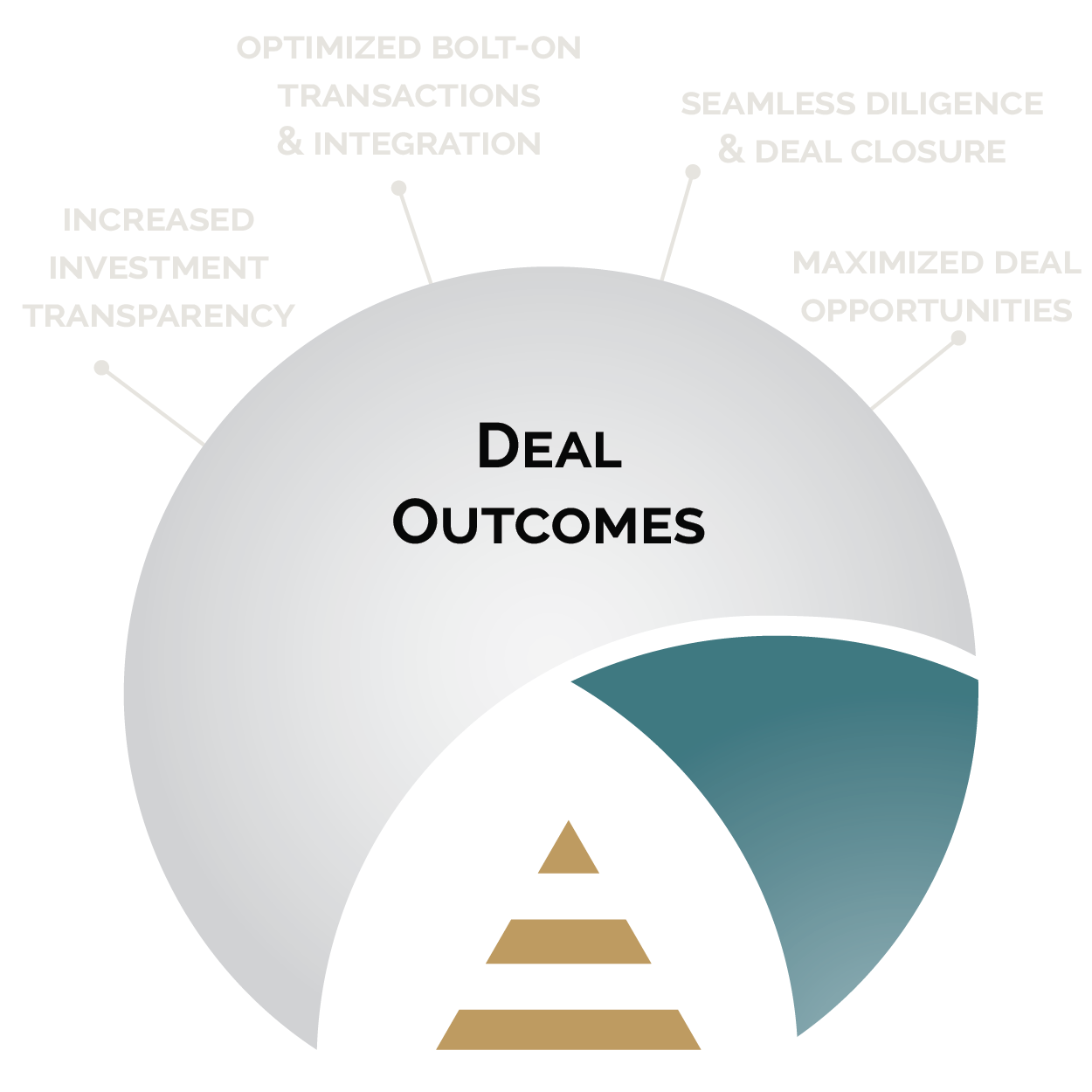

Deal Services

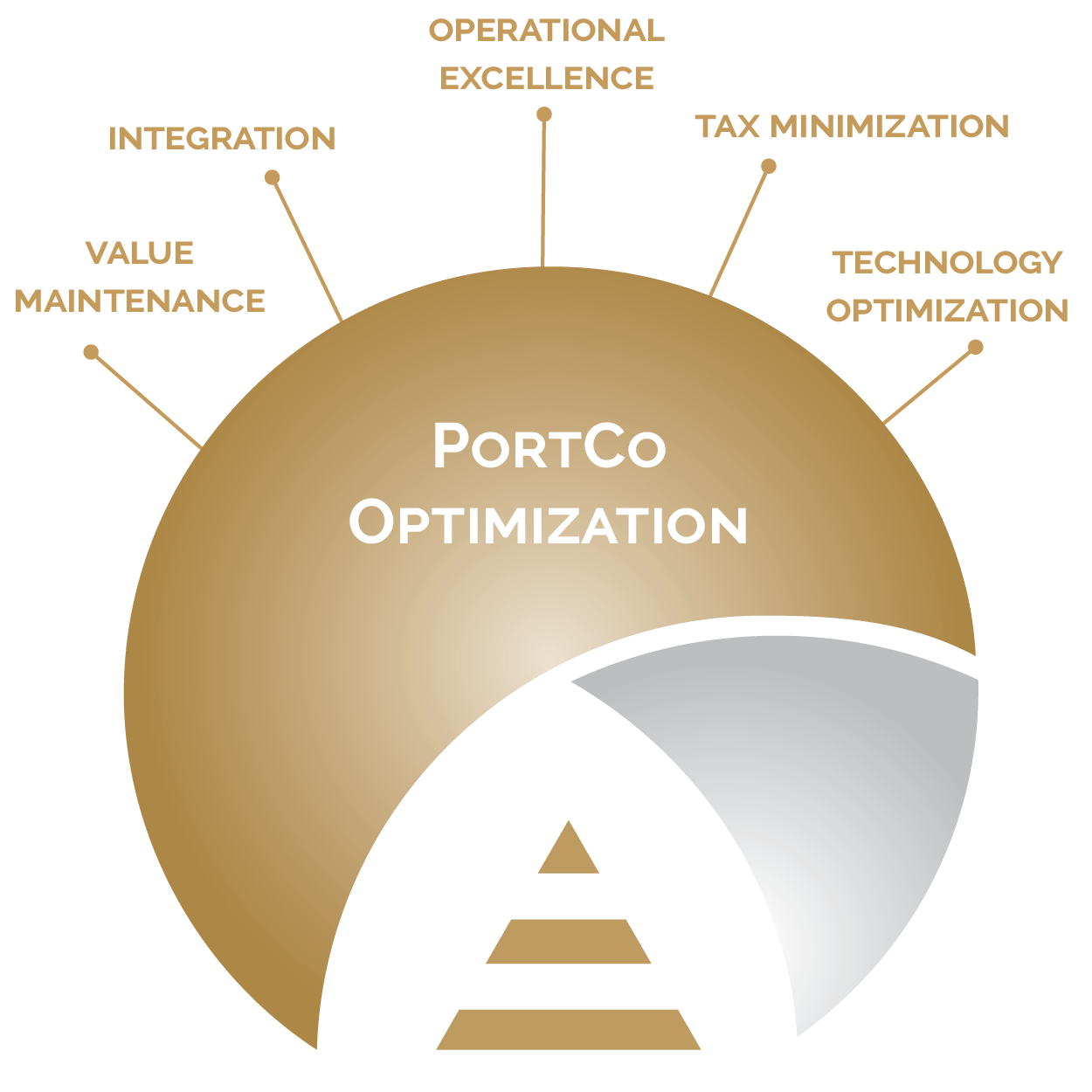

Portfolio Company Services

Our firm and fund services are designed to streamline your private equity operations, freeing you to concentrate on your core investment strategies. These services simplify the complexities of fund management, helping firms achieve efficiency and compliance at every stage.

- Formation: Setting up a fund becomes straightforward, leading to a faster launch and an easier path to attracting capital.

- Optimal Reporting: Easy-to-understand reports provide clear information needed to make smart decisions and keep investors informed about fund performance.

- Operational Efficiency and Compliance: Streamline operations and focus on tax efficiency and regulatory and risk compliance to protect your fund's value and boost returns.

- Transformation: Leverage digital automation and AI to transform your business with innovative and efficient solutions.

How We Can Help

- Fund structuring

- Management company setup

- Private client services

- Fund administration

- Investor reporting

- CFO advisory

- Fund tax reporting

- Fund audit

- FACTA and CRS

- Regulatory and risk compliance

- Portfolio valuation services

- Technology/Data strategy & selection

- IT risk, data privacy, and cybersecurity

Deal Services

Our deal services provide private equity firms and institutional investors with critical support throughout the investment lifecycle. By delivering thorough financial, tax, and operational due diligence, these services unlock price discovery, reduce transaction risk, and inform strategic decision-making.

- Maximized Deal Opportunities: Firms can identify and act on the best investment prospects, leading to a sharper focus on high-potential targets and better chances for successful deals.

- Seamless Diligence and Deal Closure: The due diligence process is streamlined, helping deals close smoothly and efficiently. This reduces potential roadblocks and accelerates transactions.

- Optimize Bolt-on Transactions and Integration: Add-on acquisitions can be integrated effectively, realizing combined efficiencies and building greater value within portfolio companies.

- Increased Investment Transparency: Enhancing investment transparency by conducting comprehensive financial, operational, and tax due diligence.

How We Can Help

- Buy & sell-side financial due diligence

- Quality of earnings & working capital

- Federal, state, and international tax due diligence

- M&A deal and tax structuring

- Cyber due diligence

- Post-Deal integration

- Portfolio company valuation

- Exit strategy

- IPO readiness

- Carve-outs

Portfolio Company Services

Our portfolio company services are designed to help private equity firms enhance their performance and increase the value of their middle-market investments. We work alongside your portfolio companies to implement strategies that lead to sustainable growth and a stronger return on investment.

- Value Maintenance: Protecting existing investment value and enhancing it with new portfolio company improvements that can translate to higher returns and a more attractive asset for future exit.

- Integration: When new acquisitions are made, smooth integration helps avoid disruption, leading to a stronger combined entity and faster realization of synergies.

- Operational Excellence: Optimizing day-to-day operations for peak efficiency. This means reduced costs, improved processes, and a more robust foundation for growth, all underpinned by a focus on data analytics and digital tools.

- Tax Minimization: Structuring operations and transactions to minimize tax burdens. This preserves more capital within the company, directly boosting profitability.

- Technology Optimization: We implement technology that is at the forefront of digital transformation and AI, enabling your business to better handle future challenges and achieve maximum growth.

How We Can Help

- Finance transformation

- Tax minimization

- Tax compliance

- Target operating model design

- Technology strategy, selection, & integration

- Cyber/Technology risk

- Outsourcing & managed services

- AI and digital transformation

- Technical accounting advisory

- PE-backed audit

- IPO readiness

- Portfolio company valuation

- Purchase accounting

- Finance operations improvement

- Human capital management

- Governance, risk & controls

- SOX readiness

- Fund Audit

- Internal Audit, Risk & Controls

- Compensation & Benefits

- Outsourcing & Managed Services

Introducing The PE Edge: A Middle-Market Perspective on Transactions in Partnership with Pitchbook

Explore Our Insights

Private Equity Dealbook