The Silver Lining – Trends in Life Sciences in 2025

- Published

- Aug 22, 2025

- Topics

- Share

More than halfway into 2025, the life sciences industry appears to be on track for robust growth, fueled by the One Big Beautiful Bill Act (OBBBA) offering attractive incentives for both investors and from a research and development (R&D) perspective, along with continued interest from private equity funds. This renewed optimism follows a more cautious start to the year for a sector that has been dramatically impacted by macroeconomic volatility and the introduction of U.S. tariffs.

The One Big Beautiful Bill Act

After a delay in some IPOs for life sciences companies at the start of 2025 due to tariffs, the OBBBA is slated to make earlier exits more tax-efficient and attractive to investors through changes to qualified small business stock (“QSBS”) under IRC Sec. 1202. For QSBS acquired after July 4, 2025, the OBBBA establishes a tiered exclusion system based on holding periods:

- 50% exclusion - for stock held for at least three years

- 75% exclusion - for stock held for at least four years

- 100% exclusion - for stock held for at least five years

The lifetime exclusion cap also increases to the greater of ten times the basis or $15 million, indexed for inflation, also for stock issued after July 4, 2025.

Despite rising R&D costs due to tariffs on lab equipment and biologics inputs, particularly for early-stage biotech companies, the OBBBA introduces significant tax relief for qualifying businesses:

- Immediate expensing of domestic R&D expenditures is reinstated for tax years beginning after December 31, 2024, allowing early-stage companies to deduct these expenses in the year incurred and preserve cash flow.

- Retroactive relief is available for small businesses (≤$31M in average gross receipts), allowing amended returns for 2022–2024 to reclaim previously amortized R&D expenses.

- Catch-up deductions for unamortized R&D costs from prior years may be taken either fully in 2025 or spread over two years (2025–2026), offering flexibility in managing taxable income.

Private Equity

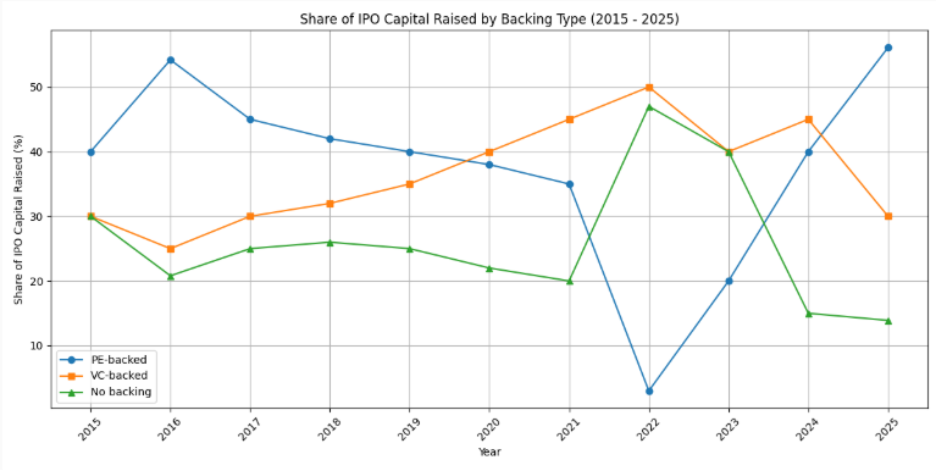

Private equity funds continue to remain active in investing in life sciences companies, particularly in diagnostics, CROs, and specialty pharma, favoring companies with revenue visibility and regulatory clarity. According to Pitchbook’s U.S .Private Equity Outlook: Midyear Update, in the IPO market, they have accounted for more than 50% of the total IPO capital raised in the U.S. This reflects the market’s preference for mature, cash-flow-positive life sciences firms with operational stability compared to VC-backed companies, which have a higher risk to investors.

In addition, with IPO markets still recovering, many life sciences companies are staying private longer, prompting private equity firms to extend their investment horizons. Dual-track processes, when companies simultaneously prepare for IPO and M&A, are gaining traction as companies seek optionality in exit strategies.

Conclusion

Looking ahead, the life sciences industry is poised for continued growth due to record employment, strong R&D pipelines, and a more accommodative capital environment. However, regulatory uncertainty, particularly around tariffs and Medicaid reimbursement, may impact capital planning.

If trade tensions ease and IPO markets stabilize, a wave of delayed exits could materialize. According to MTS Health Partners, while there is uncertainty regarding the U.S markets and a global recession occurring in 2025, the S&P 500 is at an all-time high as of July 2025 and biotech indices have had strong performances (10.5% increase) in July 2025, which indicates that life sciences companies should stay prepared for an IPO or financing in the second half of 2025 as the resurgence of IPO activity may move quickly. For life sciences companies, maintaining audit and due diligence readiness will be critical as they navigate the evolving capital landscape.

What's on Your Mind?

Start a conversation with Eli