Are the Increases in Freight Costs Capitalizable in Accordance with U.S. GAAP? The Answer Is: It Depends.

- Published

- Dec 21, 2021

- Topics

- Share

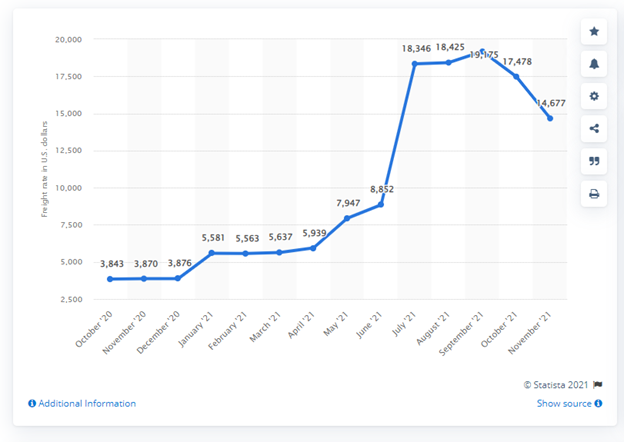

From the start of the COVID-19 pandemic, there has been a large disruption in the overall global availability of shipping containers, which has led to significant delays in bringing in goods from overseas as well as an increase in related shipping costs. This disruption was partly fueled by a drop in demand early on in the pandemic, with containers becoming stranded; when demand picked back up, the shortage of containers in the trade flow resulted in higher container costs to bring in goods from overseas. Average time for goods to be received from overseas has increased from 30 days prior to the pandemic to over 70 days currently, according to a recent New York Times article. High demand for goods purchased from overseas, combined with less containers available for the goods to be received, created an environment in which container costs reached record highs in September 2021, and have only recently started to come down, as demonstrated in the table below from Statista:

Container freight rates from China/Eastern Asia to the West Coast of North America from October 2020 to November 2021

(in U.S. dollars)

Questions arise for consumer products and other companies on how to properly account for these increased freight costs related to inventory acquired, in accordance with Accounting Standards Codification (“ASC”) 330, Inventory, and whether these costs should be capitalized or expensed.

The definition of cost as applied to inventories generally means the sum of applicable expenditures and charges directly or indirectly incurred to bring inventory to its existing condition and location. As a result, material costs, freight, duty, etc. should all be reflected in the cost of the company’s acquired inventory. Therefore, these increased freight costs should be capitalized into the cost of inventory subject to certain exceptions, as discussed below. ASC 330 provides that certain abnormal costs should be expensed in the period incurred; however, this relates to costs incurred in the production of inventory and not costs incurred in acquiring inventory.

While companies should be capitalizing all costs incurred in acquiring inventory, companies must also continue to monitor whether the total costs, once capitalized, exceed the estimated net realizable value of the inventory upon subsequent sale. ASC 330 provides that inventory should be measured at the lower of cost or net realizable value, as defined in the standard. In an ideal scenario, companies can increase prices to account for the increased costs; however, this is often not the case (for example, when contracts only allow price changes at set times throughout the life of the contract), so companies must remain diligent in monitoring how they value their overall inventory.

What's on Your Mind?

Start a conversation with Christopher

Receive the latest business insights, analysis, and perspectives from EisnerAmper professionals.