Q4 2019 - Hedge Fund Accounting Update

- Published

- Dec 11, 2019

- Share

With respect to accounting and financial reporting guidance for investment companies, particularly hedge funds, 2019 has been a relatively quiet year. Although the Financial Accounting Standards Board (FASB) has not issued Accounting Standard Updates (ASU) to U.S. Generally Accepted Accounting Principles (GAAP) substantially impacting the hedge fund industry, accounting and finance teams have been busy adopting, or preparing to adopt, ASUs issued in previous years.

Noteworthy ASUs and industry publications impactful to the hedge fund industry include:

- ASU 2018–13. Fair Value Measurement (Topic 820): Disclosure Framework – Changes to the Disclosure Requirements for Fair Value Measurement

- ASU 2016-18. Statement of Cash Flows (Topic 230): Restricted Cash

- Valuation of Portfolio Company Investments of Venture Capital and Private Equity Funds and Other Investment Companies – Accounting and Valuation Guide

ASU 2018-13: Changes to fair value measurement disclosure requirements

Date issued: August 2018

Effective date: For all entities, fiscal years and interim periods within those fiscal years beginning after December 15, 2019. Early adoption is permitted

Refer to our October 2018 Asset Management update for an in-depth look at the FASB’s modification of fair value disclosure requirements.

The following represents a summary of changes to the disclosure requirements:

Removed disclosure requirements

- The amount of and reasons for transfers between Level 1 and Level 2 of the fair value hierarchy.

- Policy for timing of transfers between levels.

- Description of the valuation process for Level 3 fair value measurements.

- For non-public entities, disclosure of the changes in unrealized gains and losses for the period included in earnings for Level 3 fair value measurements held at the end of the reporting period.

Modified disclosure requirements

- In lieu of a roll-forward for Level 3 fair value measurements, a non-public entity is required to disclose of transfers into and out of level 3 of the fair value hierarchy and purchases and issuances of Level 3 assets and liabilities.

- For investments in certain entities that calculate net asset value, an entity is required to disclose the timing and liquidation of an investee’s assets and the date when redemption restrictions might lapse ONLY if the investee has communicated the timing or announced the timing publicly.

ASU 2016-18: Restricted Cash

Date issued: November 2016

Effective date: For most private investment funds, fiscal years beginning after December 15, 2018, and interim periods within fiscal years beginning after December 15, 2019.

Prior to ASU 2016-18, ASC 230 (Statement of Cash Flows) did not address the classification of activity related to restricted cash and restricted cash equivalents within the statement of cash flows. Accordingly, the ASU has clarified the following items to reduce diversity in the reporting of restricted cash and restricted cash equivalents in the statement of cash flows:

| ASC 230 | ASU 2016-18 | |

|---|---|---|

| Balance sheet presentation of cash and restricted cash equivalents. | Unchanged | |

| Definition of restricted cash and restricted cash equivalents. | Unchanged and Undefined | |

| Items included in “total” line items in the statement of cash flows. | Cash and cash equivalents | Cash, cash equivalents, restricted cash, restricted cash equivalents |

| Reporting of transfers between cash and restricted cash in the statement of cash flows. | Yes | No |

| Reporting of cash receipts/payments into/from related accounts that hold restricted cash. | Cash inflow/ outflow of respective account and non-cash disclosure | One single cash flow activity |

| Reconciliation of total cash reported on the statement of cash flows to the balance sheet if restricted cash is presented on multiple line items on the balance sheet. | Not required | Required |

Insight:

The ASU does not define restricted cash and restricted cash equivalents. Further, its intent is not to change the practice or historical policy for what a private investment fund reports as restricted cash or restricted cash equivalents.

Certain private investment funds may classify restricted cash in multiple line items in the balance sheet, including “due from broker.” Depending on a particular entity’s policy, restricted cash and/or cash equivalents may include collateral, margin borrowings, and/or deposits for derivatives or securities sold short as restricted cash and/or restricted cash equivalents. In absence of a formal policy, each private investment fund must develop a policy on how it considers restricted cash versus amounts due from broker.

Regardless of the entity’s balance sheet presentation, restricted cash should be included in the total “cash, cash equivalents, restricted cash, and restricted cash equivalents” line items in the statement of cash flows.

Illustrative examples

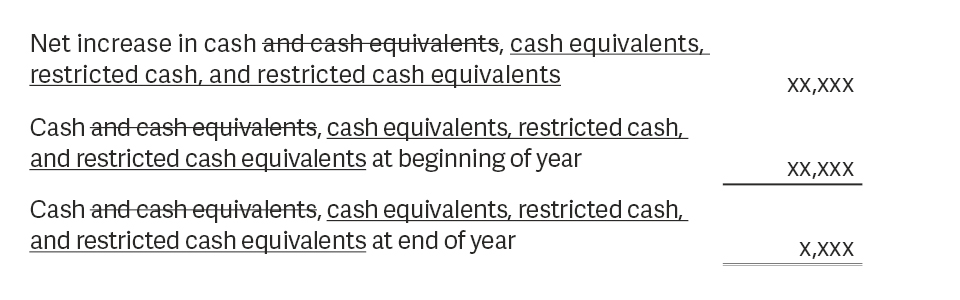

“Total” line items in the statement of cash flows:

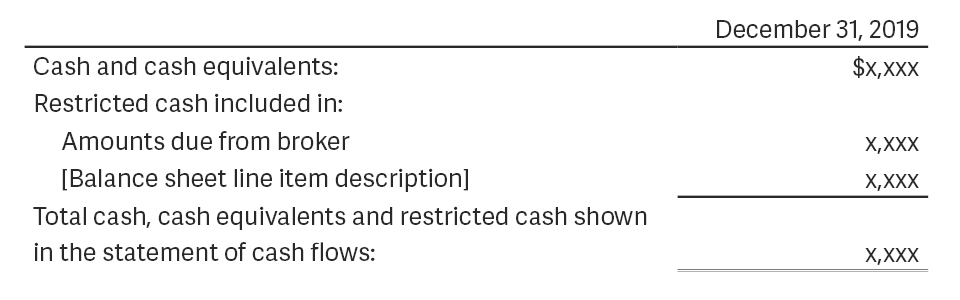

Reconciliation of restricted cash included in multiple balance sheet line items:

The following reconciliation can be included either on the face of the balance sheet or in the notes to the financial statements:

AICPA Valuation Guide

In August 2019, the American Institute of Certified Public Accountants (AICPA) issued a new valuation guide for investment companies. The guide is non-authoritative (no new accounting principles are established); however, it expands on valuation topics and methodologies included in ASC 820 and provides illustrative examples.

Engaging Alternatives – Q4 2019

- Considerations for a Private Equity Fund Investing in Real Estate

- From Hedge Fund to Family Office

- Hedge Fund Accounting Update

- IRS Releases “Frequently Asked Questions” and Revenue Ruling on Virtual Currencies

- Ireland Plans to Become Domicile of Choice for Private Equity Funds Investing in Renewable Energy Assets

- Alternative Investment Outlook for Q4 2019 and Early 2020

What's on Your Mind?

Start a conversation with Jeffrey

Receive the latest business insights, analysis, and perspectives from EisnerAmper professionals.