How Venture Capital Investors Must Adapt to Evolving Tax Law

- Published

- Oct 9, 2024

- Topics

- Share

Section 1202 QSBS

The old adage ‘if it seems too good to be true, it probably is’ may describe how venture capital investors feel any time Congress introduces a bill to reduce the tax benefits provided by the qualified small business stock (QSBS) exclusion under IRC Sec. 1202. Although reducing these benefits would overall impact venture capital investors, QSBS still provides a tremendous benefit, particularly in a period where tax rates could be on the rise. And while some of these attempts have gained momentum, none have ultimately become law.

Previous Proposal

The most recent serious attempt to roll back some of the benefits of IRC Sec. 1202 that moved through Congress was back in 2021. The Build Back Better Act of 2021, which eventually morphed into the Inflation Reduction Act of 2022, originally contained a provision that would reduce some benefits.

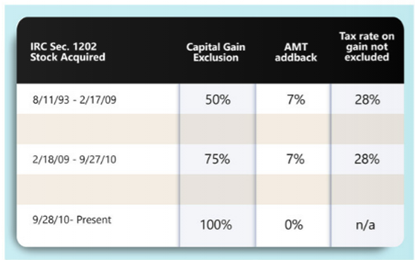

To generate more revenue for the environmental provisions of the bill, the BBBA proposed reducing those eligible for 75% or 100% QSBS capital gain exclusion to 50%, effective on or after September 13, 2021. This would have only applied to taxpayers with an adjusted gross income (AGI) equal to or exceeding $400,000. Trusts and estates would only have been eligible for 50% capital gain exclusion regardless of their taxable income. The 50% capital gain portion not excluded would have been subject to a 28% capital gains tax rate and the 3.8% net investment income tax, while the 50% excluded portion would have been subject to the Alternative Minimum Tax (AMT).

The Senate eventually stripped this provision out of the bill when it became the IRA. No subsequent attempts to limit the application of IRC Sec. 1202 have gained any significant moment.

Early-stage Investment & Exclusions

IRC Sec. 1202 was enacted to encourage small business investment by providing tax benefits to those willing to take on the risk and uncertainty associated with early-stage companies. It also outlines what requirements must be met to be considered a qualified small business (QSB).

With certain exceptions, a QSB is a C corporation engaged in an active business with the tax basis of gross assets under $50 million. For an investor to qualify for QSBS treatment, they must acquire stock of the corporation at its original issuance and hold it for at least five years. QSBS can be held by non-corporate taxpayers such as partnerships, LLCs, trusts, individuals, and S corporations.

A taxpayer can exclude up to the greater of:

- $10 million less excluded capital gains in prior tax years, or

- ten times the taxpayer’s adjusted basis in the QSBS.

This exclusion does not apply to the sum of all the taxpayer’s QSBS gains. Instead, it is applied to each QSBS since the exclusion limitation is determined on a per issuer, per taxpayer basis.

A companion to IRC Sec. 1202, IRC Sec. 1045 allows a taxpayer to rollover proceeds, holding period, and basis from the sale of QSBS held for more than six months, but under five years, into a new or multiple QSBS within sixty days of sale. This strategy is commonly employed by venture investors and funds since it avoids taxable capital gains while allowing investors to seamlessly reinvest their capital into new QSBS.

Adjusting Capital Investments

An investor who purchases QSBS would be well-served to evaluate their personal tax situation, investment allocation, structuring, and due diligence processes. It is a good time for investors to consider how much capital as a percentage of their portfolio they would like to have in the venture space; venture capital investments are typically high-risk, high-reward propositions. The proposed tax change must be factored into the risk-adjusted return on capital equations utilized by investors and their advisors. In the simplest of scenarios, where a taxpayer in the highest tax bracket realizes a $10 million capital gain from sale of QSBS purchased after September 28, 2010, their tax liability balloons from zero to $1,590,000.

Proactive Planning

Investment fund managers can use any proposed legislation as an opportunity to proactively speak with their tax advisor and investors about the tax implications of their strategy. Existing or new fund managers who can articulate their tax plan to investors will have an edge when it comes to investor relations and raising capital. It is essential that managers have a process in place to identify and document investments that are eligible for QSBS treatment under IRC Sec. 1202 and IRC Sec. 1045. There are many potential pitfalls throughout the investment, sale, and rollover process in which an investor can mistakenly lose QSBS status. Faulty documentation, failing to maintain the active business requirement, improperly executing an IRC Sec. 1045 rollover in a timely fashion, failing to account for convertible options, and not acquiring original issue stock are just a few common oversights that have costly ramifications for investors.

While it is currently unlikely that Congress will target the QSBS exclusion, the tax treatment of QSBS would remain favorably even if Congress rolled back some of the benefits. Even with reduction of the exclusion amount, early-stage investment is clearly encouraged regardless of what tax bracket one falls into. There are many opportunities for investors and investment managers alike to take advantage of this treatment and vigilantly monitor potential tax scenarios. Proper tax planning and execution of QSBS is essential to boosting post-tax returns that are simply unavailable to competing alternative asset classes.

The EisnerAmper Financial Services team has decades of experience assisting clients with the nuances of IRC Sec. 1202. Contact us today to find out how we can assist you with adapting to evolving tax law.

What's on Your Mind?

Start a conversation with Sarah

Receive the latest business insights, analysis, and perspectives from EisnerAmper professionals.