IRC Sec. 1202: The Most Overlooked Tax Break for Long-Term Investors

- Published

- Nov 18, 2024

- Topics

- Share

Business funders who are just learning about the exclusion of gain from qualified small business stock (QSBS) invariably have several questions. What is the IRC Sec. 1202 exclusion? Can my fund and investor base take advantage of it? How do I make sure I qualify? These and other questions are important to address to avoid missing out on this favorable provision.

What is the IRC Sec. 1202 Exclusion?

The general rule for gain from the sale or exchange of stock held more than one year is that it is treated as long-term capital gain. Currently, long-term capital gains are taxed at a maximum federal tax rate of 20%, plus an additional 3.8% for the Net Investment Income Tax (NIIT).

To encourage investment in small business, Congress enacted IRC Sec. 1202 on August 10, 1993. One purpose of the legislation was to encourage the flow of capital to small businesses, which may have difficulty in attracting equity financing, by rewarding investors who took risks in investing in small businesses with more favorable tax treatment.

To this end, IRC Sec. 1202 generally permits a non-corporate taxpayer who holds QSBS for more than five years to exclude up to 100% of any gain on the sale or exchange of stock. The amount of gain eligible for exclusion is limited to the greater of:

- Ten times the taxpayer’s basis in the stock each taxable year, or

- $10 million gain ($5 million if married filing separately) from stock in that corporation over the taxpayer’s lifetime.

The limitation on excludable gain is applied per issuer.

What are the Requirements for QSBS?

To qualify for the QSBS exclusion, the following requirements must be met:

- The stock must be issued by a domestic C corporation after August 10, 1993,

- Aggregate assets of the corporation did not exceed $50 million before and immediately after the stock issuance,

- The stock is original issue stock acquired in exchange for:

- Money or other property (not including stock), or

- As compensation for services provided to the corporation (other than for services performed as an underwriter of the stock),

- The issuing corporation must use at least 80% of its assets in an active trade or business, as specified under IRC Sec. 1202,

- The stock is held by a non-corporate taxpayer (taxpayers, LLCs, S corporations, underlying partners, individuals), and

- The stock is held by the taxpayer for more than five years.

These requirements can be complex depending on each criterion. Additionally, Sec. 1202 provides restrictions governing redemptions.

The capital gain exclusion percentage depends on the purchase date of the QSBS, as illustrated below.

| IRC Sec. 1202 Stock Acquired | Capital Gain Exclusion | AMT addback | Tax rate on gain not excluded |

|---|---|---|---|

| 8/11/93 - 2/17/09 | 50% | 7% | 28% |

| 2/18/09 - 09/27/10 | 75% | 7% | 28% |

| 9/28/10 - Present | 100% | 0% | n/a |

The exclusion of QSBS gains from income also prevents taxpayers from being subject to the additional 3.8% NIIT; generating a total federal income tax savings of up to 23.8%. However, each state has its own set of rules in conforming or decoupling from this federal rule. Investors should talk to their tax advisors to determine their state’s rules.

Choice of Entity Considerations for QSBS

Whether or not to invest in a pass-through entity versus a C corporation will depend on the circumstances. The ability to take advantage of the QSBS exclusion is just one factor to consider. There are multiple considerations related to tax, legal, and general business issues, based on the specific facts and circumstances, including:

- Current tax rates;

- Single taxation vs. double taxation;

- IRC Sec. 199A 20% qualified business income (QBI) deduction for pass-throughs;

- Losses: If the business is going to throw off tax losses in the earlier years, one may want to consider a pass-through vehicle to potentially reduce taxes sooner. Losses in a corporation will sit unutilized until there is taxable income in the future and are not passed through to the stockholder;

- Liability: Liability coverage varies in different entity forms;

- Step-up in basis: It is important to think about the exit strategy. A purchaser of C corporation stock does not receive a step-up in basis of the assets. Therefore, consideration will vary for a stock sale vs. an asset sale or sale of partnership interest.

The chart below illustrates the tax savings that can be generated through a C Corporation structure and the Sec. 1202 exclusion:

|

|

Tax As Pass-Through Versus C Corporation |

A |

B |

|

|

|

Pass-Through |

C Corporation |

|

1 |

Tax on year one-five income of $1 million. Tax on year one-five distributions ($1 million in the case of a pass-through business, $790,000. |

$296,000.00 |

$210,000.00 |

|

2 |

($1 million in the case of a pass-through business, $790,000 in the case of a C corporation) |

N/A |

$188,020.00 |

|

|

Total tax on income/distributions |

$296,000.00 |

$398,020.00 |

|

3 |

Tax on gain from sale of business of $2,900,000 ($3 million value less $100,000 stock basis) |

$580,000.00 |

$- |

|

|

Total tax over life cycle of business |

$876,000.00 |

$398,020.00 |

In one case, the entity is formed as a QSB that can receive the QSBS exclusion, while in the other, the entity is a pass-through entity ineligible to use IRC Sec. 1202. In both cases, the entity has $1 million of taxable income in years one-five, has a tax basis of $100,000 in the entity’s stock, and sells the business after year five.

Pass-Through Treatment (Scenario A)

The income from the pass-through will be eligible for the 20% qualified business income deduction (QBI) for taxable income of $800,000. Assuming the highest income tax rate of 37%, this will result in a tax bill of $296,000. The sale of the company in year five for $3 million results in a taxable gain of $2.9 million, taxed at the 20% capital gains rate for a tax bill of $580,000. As shown in the table, the total tax for a pass-through would be $876,000.

C Corporation Treatment (Scenario B)

Conversely, a C corporation in the same position will pay two levels of tax: the 21% corporate tax rate on the $1 million in income ($210,000 in tax) and a 23.8% qualified dividend rate on distributions of $790,000 ($188,020 in tax); for a total tax bill of $398,020. Unlike the pass-through entity, the C corporation may exclude all of the gain from the sale of business’ stock after year five due to the QSBS exclusion.

Complex Considerations for QSBS

Once a taxpayer understands the requirements for the IRC Sec. 1202 exclusion that can impact their choice of entity, they may encounter more situations that will require thoughtful analysis to work through the complexities. Investors may have questions about whether they can sell their QSBS before the end of the five-year holding period and what kinds of equity can qualify for QSBS treatment.

IRC Sec. 1045 – Rollover of Gain from QSBS

In some cases, investors may sell QSBS that has been held for more than six months but less than the required five years. IRC Sec. 1045 allows a taxpayer in this situation to potentially roll over gain from the sale of their QSBS. The taxpayer must purchase new QSBS within sixty days of the sale and make an election on their income tax return. The holding period for the QSBS acquired in an IRC Sec. 1045 rollover transaction generally “tacks on,” meaning the period of time the original QSBS was held will be counted for the replacement QSBS’ holding period.

Options, Warrants, and Convertible Debt

A question that comes up often in venture capital is whether convertible debt, options, or warrants qualify for the exclusion. The instrument itself does not qualify. However, once the instrument is exercised or converted to original issue stock, it may qualify. It is important to measure each QSBS criteria on the date of conversion or exercise. The holding period for each instrument is as follows:

- Stock-based compensation: date of acquisition

- Incentive stock options: date of exercise.

Restricted stock without an IRC Sec. 83(b) election: date of vesting. - Restricted stock with an IRC Sec. 83(b) election: date of election.

Simple Agreement for Future Equity (SAFE) Notes

Yet another question to consider is whether the use of a Simple Agreement for Future Equity (SAFE) note would make sense. As the name implies, SAFE notes are simplified agreements whereby an investment converts to equity in a future financing round or other triggering event in exchange for an immediate cash investment. When structured properly, SAFE notes are not a debt instrument, do not accrue interest, and tend to be simpler than a convertible note.

SAFE notes require an analysis to determine their proper federal income tax classification as debt or equity (or something else). A SAFE agreement can potentially be categorized as debt, a prepaid forward contract, or equity. Accordingly, the first step is to determine how exactly the SAFE agreement should be categorized. There are several factors that have been identified by the courts and the IRS that need to be considered to determine if the agreement is more like debt or equity, including:

- The names given to the certificates evidencing the indebtedness,

- The presence or absence of a fixed maturity date,

- The source of payments,

- The right to enforce payment of principal and interest,

- The participation in management flowing as a result,

- The status of the contribution in relation to regular corporate creditors,

- The intent of the parties,

- “Thin” or adequate capitalization,

- The identity of interest between creditor and stockholder,

- The source of interest payment,

- The ability of the corporation to obtain loans from outside lending institutions,

- The extent to which the advance was used to acquire capital assets, and

- The failure of the debtor to repay on the due date or seek a postponement.

No single factor is considered determinative as to whether the instrument should be characterized as debt or equity. Each SAFE note needs to be carefully analyzed to determine its federal income tax classification.

Provided the SAFE agreement can be categorized as equity, the five-year holding period would begin at the date the agreement is executed, and the investor should be able to “tack” (add-on) the amount of time they held note to the amount of time they hold the future equity after the triggering event. However, it should be noted that SAFE notes are comparatively new (first appearing in 2013) and there is currently no guidance from the IRS explicitly stating that SAFE notes are equity for purposes of QSBS, nor has the issue been considered by any courts to date.

Carried Interest

Another question is whether carried interest or a special profits interest are eligible for the QSBS exclusion. Is the general partner (GP) deemed to have held the stock through the partnership for the five-year period if there is a crystallization of carried interest only when the QSBS is sold? Some commentators say “no,” while others say “yes.”

IRC Sec. 1202 states that a partnership interest must be held both on the date the partnership acquired the QSBS stock and through the date of sale in order to qualify for the exclusion. However, it also provides a limitation that requires that the excluded gain be limited to that which is allocable to the interest held at the time of acquisition (i.e., the time the partnership acquired the stock.) This reference to the date of acquisition is ambiguous and could be interpreted to include the rights that the GP had at day one, or it could mean the smallest interest held throughout the holding period.

There are no regulations or even legislative history to address this question. However, the IRS has issued regulations related to IRC Sec. 1045 stating that if a partner’s interest in the partnership varies during the five-year holding period, only the smallest “capital interest” percentage held during the QSBS holding period may be used. While IRC Sec. 1045 regulations are not directly applicable to IRC Sec. 1202, it is not clear whether the IRS might argue that the IRC Sec. 1045 interpretation should apply to carried interests for purposes of IRC Sec. 1202. In that case, only capital interests would be measured. In the absence of regulations, it remains ambiguous.

Opportunities with QSBS

As detailed above, there are several considerations in determining QSBS status which can lead to opportunities. Firms need to think expansively when applying this code section. The statute and regulations of IRC Sec. 1202 are not robust. This has allowed for broader application and interpretation. It is important to think beyond the standard venture capital startup company acquisition. In particular, growth equity funds and leveraged buyout funds may enjoy tremendous benefits in this provision as well.

Consider the following examples:

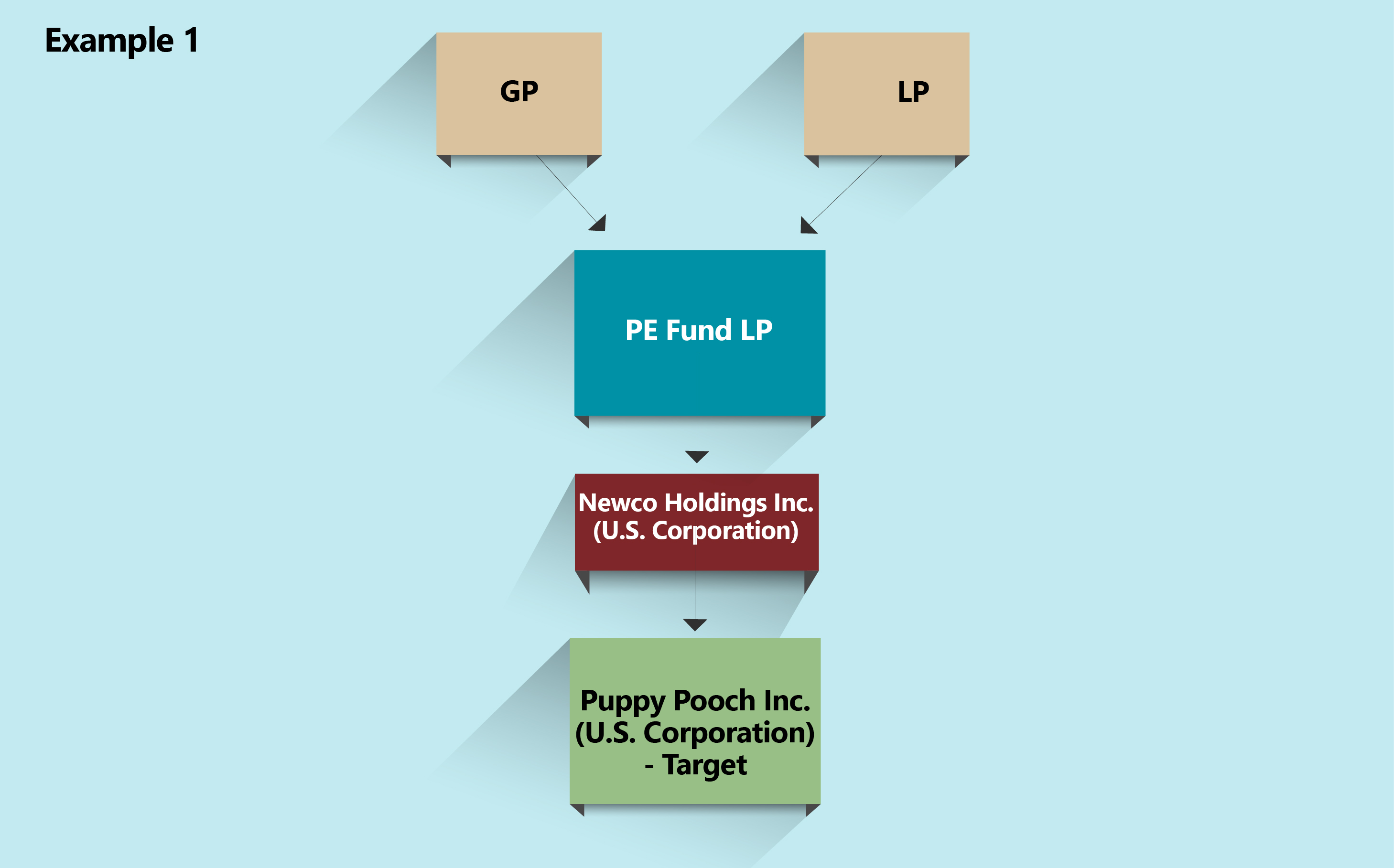

Example 1

Private Equity Fund LP (Fund) wishes to purchase the stock of Puppy Pooch Inc. (PP Inc.), a domestic C corporation that manufactures puppy apparel, for $35M, with an adjusted tax basis of assets of $12M. In order to facilitate the acquisition, the Fund forms Newco Holdings, Inc. (Holdings), a domestic C corporation, to purchase PP Inc. as a platform acquisition. The Fund pays cash for newly issued stock in Holdings. Holdings then immediately purchases the stock of PP Inc.

In this scenario, if the Fund holds the stock of Holdings for over five years prior to sale, would the gain on the sale of Holdings stock qualify for the QSBS exclusion? Is this considered to be good original issue stock? Intuitively, one may think that PP Inc. didn’t issue new stock and instead the Fund effectively purchased existing stock from the founder, the seller. However, there were business reasons to create Holdings, which in turn issued original issue stock in exchange for cash. In addition, the active trade or business requirement for Holdings should be met because of the parent-subsidiary look-through rule of IRC Sec. 1202 (attribute the assets and activities of a 50%-or-greater-owned subsidiary to the parent). Based on a reading of the rules and regulations, there doesn’t seem to be anything that addresses this specifically precluding this transaction from qualifying.

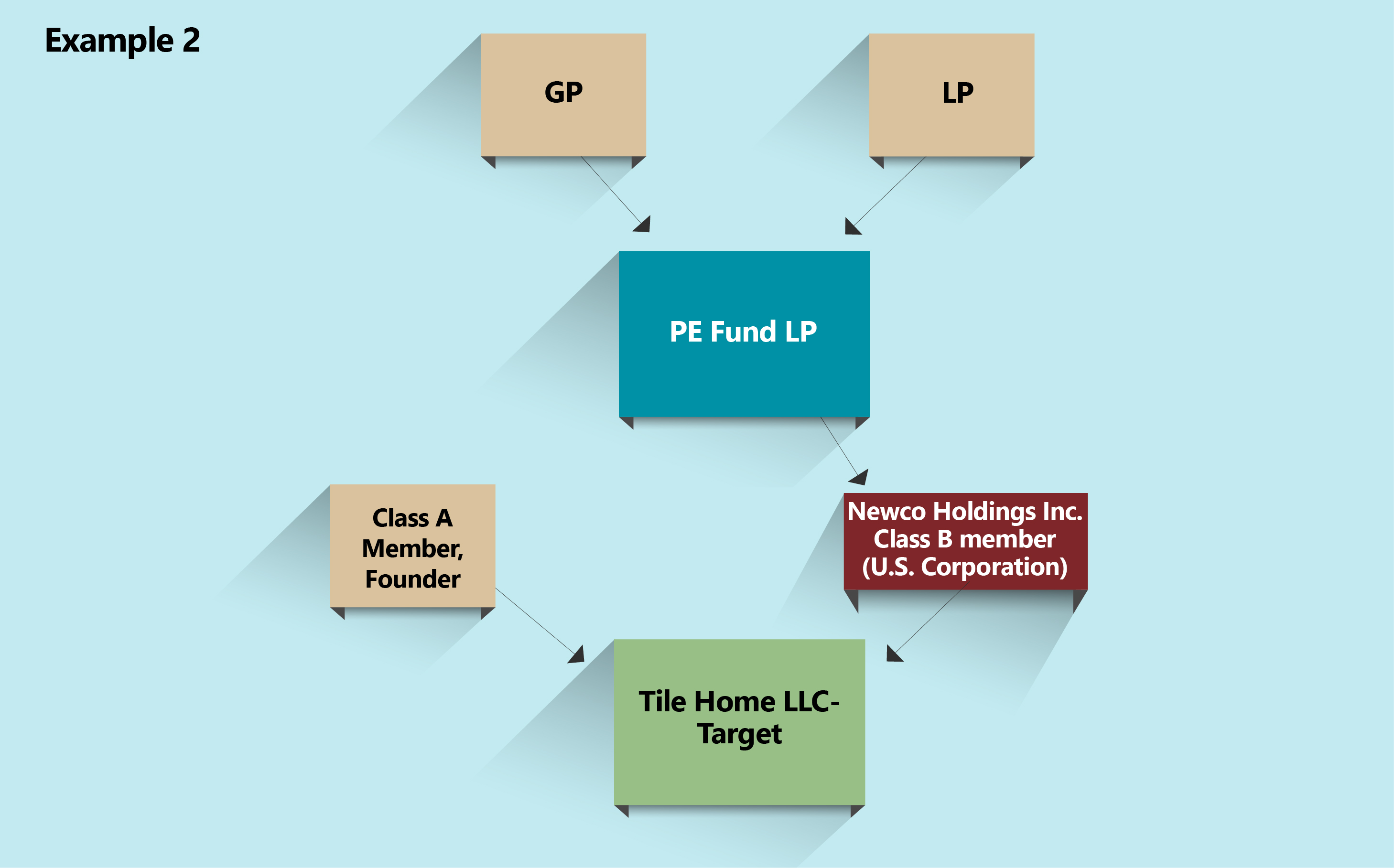

Example 2

Private Equity Fund LP (Fund) forms a new corporation, Newco Holdings Inc. (Holdings), to acquire Tile Home LLC (TH), a domestic partnership that distributes tiles (structure below). Our question here is: if the business activity below the corporation is conducted in partnership form, does the business activity of the partnership qualify and get attributed to the corporation, so that Holdings would qualify as QSBS?

IRC Sec. 1202 specifically addresses this issue in a corporate parent-subsidiary structure with a look-through approach for 50% corporate subsidiaries. The Code is silent as to businesses conducted through partnerships. On the flip side, one may argue that the Code does not explicitly allow for a qualified trade or business to be operated through a partnership either. But it appears there is no compelling reason to exclude the operation of active trades or businesses through partnerships, given the policy behind IRC Sec. 1202, to encourage investment in small businesses and given that pass-through entities are commonly utilized in structuring business operations.

It is still possible that Treasury could issue regulations to limit both these scenarios. In the case of Example 1, there is a provision at the end of IRC Sec. 1202 that authorizes the IRS to issue anti-abuse rules; specifically, to include regulations to prevent split-ups, shell corporations, partnerships, or otherwise. And for Example 2, the IRS could still issue regulations to limit the ability to operate an active business through a partnership. However, the IRS has had 27 years to issue regulations, with no guidance released.

Substantiation and IRS Enforcement

Firms should liaise with their respective deal team. They should be aware of the benefits of this provision when seeking deals as it directly translates to tax savings and additional cash. Best practice is to identify transactions that may qualify during the acquisition process, then tag them and track them, from initial purchase through date of sale, to ensure qualifications have been met throughout the holding period. Unfortunately, there have been occurrences where good original issue QSBS was disqualified upon a restructuring, so identifying, tagging and tracking the investment is key.

The IRS has recently increased its scrutiny of taxpayers claiming the IRC Sec. 1202 exclusion. Accordingly, taxpayers need to document their qualifications carefully in order to reduce the risk of disqualifying themselves from the exclusion. To this end, firms should have annual updates prepared analyzing their QSBS maintenance requirements. This study should verify that they are still meeting the active business requirements and determine if there have been any disqualifying redemptions or transfers. Firms can reach out to a trusted tax advisor to verify that they are continuing to meet the QSBS requirements.

If firms have not identified the investments in their portfolio that may qualify, it’s not too late. They can look over their portfolios immediately, then tag them and track them. Firms should engage a trusted tax advisor who can conduct a study to outline their potential QSBS qualifications.

What's on Your Mind?

Start a conversation with Kayla