Benefits of Choosing REITs for Your Real Estate Private Equity Fund Structure

- Published

- Aug 21, 2024

- Share

This article covers the strategic use of Real Estate Investment Trusts (REITs) within real estate private equity fund structures. We’ll delve into the historical tax benefits for tax-exempt and foreign investors and analyze the new opportunities created by the Tax Cuts and Jobs Act (TCJA) for U.S. investors. We’ll also explore the administrative and cost-saving advantages for fund managers.

The Basic Rules of REITs

Before implementing a REIT structure, it’s important to understand the legal and tax implications. Failure to comply can result in hefty penalties and possibly losing REIT status. A REIT must also meet certain requirements to allow the deduction for dividends paid to shareholders. This deduction is how REITs avoid the double taxation inherent in C corporations.

The key requirements for REIT qualification include:

- Ownership: A REIT must be owned by 100 or more shareholders, with no more than 50% ownership by five or fewer individuals.

- Income: At least 75% of gross income must be derived from real estate sources (rents, mortgage interest). Additionally, 95% must come from the 75% category and other passive income (interest, dividends).

- Assets: For qualification purposes, the value of the REIT assets must be comprised of at least 75% in real estate assets, cash, and government securities.

- Distributions: Generally, a REIT must distribute at least 90% of its REIT taxable income to its shareholders each year to maintain REIT status, but most distribute 100% to avoid entity-level taxes.

Impermissible Tenant Service Income

Certain types of income that a REIT may receive from tenants are considered impermissible tenant services income (income that derives from services generally provided for a tenant's convenience and not customarily provided in connection with renting space). This impermissible income does not qualify for the income tests noted above and, above a certain threshold, may taint all the income from a particular property.

The tax code allows a taxable REIT subsidiary (TRS), a C corporation generally substantially or wholly owned by a REIT, to provide such services to tenants. This mitigates the negative tax impact if a REIT performs the services directly. Alternatively, an independent contractor can also be used, but certain criteria must be met to ensure this is handled properly from a REIT perspective.

REIT Tax Advantages

Tax-Exempt and Foreign Investors

REITs can provide significant tax benefits for tax-exempt and foreign investors by:

- Blocking Unrelated Business Taxable Income (UBTI) and Effectively Connected Income (ECI): REITs transform rental income into dividends, exempt from UBTI for tax-exempt investors. This structure may minimize and/or possibly eliminate ECI concerns for foreign investors.

- Mitigating Impact of TCJA Changes: Previously, tax-exempt investors could offset UBTI from one activity with losses from another. The TCJA eliminated this benefit, but this new restriction is irrelevant as REIT eliminates UBTI.

U.S. Investors

The TCJA introduced new benefits for U.S. Investors:

- Section 199A Qualified Business Income Deduction: REIT dividends qualify for the 20% deduction without wage and basis limitations, unlike income from directly held properties. As such, high-net-worth individuals may have substantial savings by utilizing a REIT structure. Although currently set to expire at the end of 2025, a bill that proposes to extend the QBI deduction indefinitely has been introduced.

- Simplified State Filings: REITs file state returns where properties are located. A REIT structure shields investors from having to file in those same states as dividends are taxed in the investor’s resident state, eliminating the need for multiple state filings, and withholding requirements for shareholders.

REIT Compliance and Regulatory Considerations

- Faster K-1 Delivery: REITs can help eliminate Form K-1 delivery delays common in partnerships due to incomplete information from underlying investments.

- Reduced Compliance Costs: A REIT structure simplifies tax preparation and typically reduces overall compliance costs for the fund and its investors because the only activities flowing to investors are dividend income. There are costs in maintaining REIT status, but they are typically outweighed by the overall benefit.

Why Fund Managers Should Consider REITs

The REIT structure can offer substantial value for funds targeting institutional, tax-exempt, and foreign investors. While U.S. investors lose pass-through benefits, the TCJA’s tax breaks provide significant mitigating tax incentives.

Fund sponsors should consider the REIT entity to optimize investor returns and streamline fund administration. Sophisticated investors may even expect a REIT structure for their underwriting requirements.

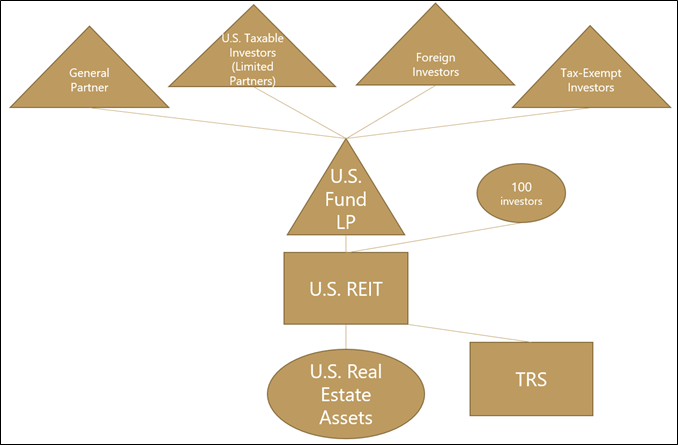

An example of a REIT structure within a real estate private equity fund is presented in the following organizational chart:

Contact our team below if you’re unsure if a REIT structure is right for your real estate private equity fund. We’ll help you navigate the complexities and determine the best structure to meet your specific goals.

What's on Your Mind?

Start a conversation with the team

Receive the latest business insights, analysis, and perspectives from EisnerAmper professionals.