How to Properly Categorize Capital Expenditures and Repairs

- Published

- Dec 12, 2024

- By

- Avi Jacob

- Share

As real estate investors, understanding the distinction between improvement spending that must be capitalized and improvement spending that can be treated as repair is crucial. This can lead to substantial tax savings and improved financial management. Under the Tax Cuts and Jobs Act (TCJA) 2017, provisions for capital expenditures were expanded significantly.

Why Proper Categorization of Expenses Matters for Tax Savings

As a result of the expanded provisions, tax professionals are looking more closely at when they can expense rather than capitalize. Below are three main reasons why expensing is more beneficial than capitalizing for many businesses.

- With the bonus depreciation rates declining, expensing allows the taxpayer to take the full deduction of the improvement spending in the current tax year. This assists taxpayers with matching tax expenses with actual cash spending.

- Tax professionals are also assisting their clients with long-term planning with regards to future sales. By treating improvement costs as repair expenses instead of capitalizing, businesses are avoiding future exposure to depreciation recapture.

- As more states opt for nonconformity to federal bonus depreciation, businesses are seeing adverse effects of implementing bonus depreciation.

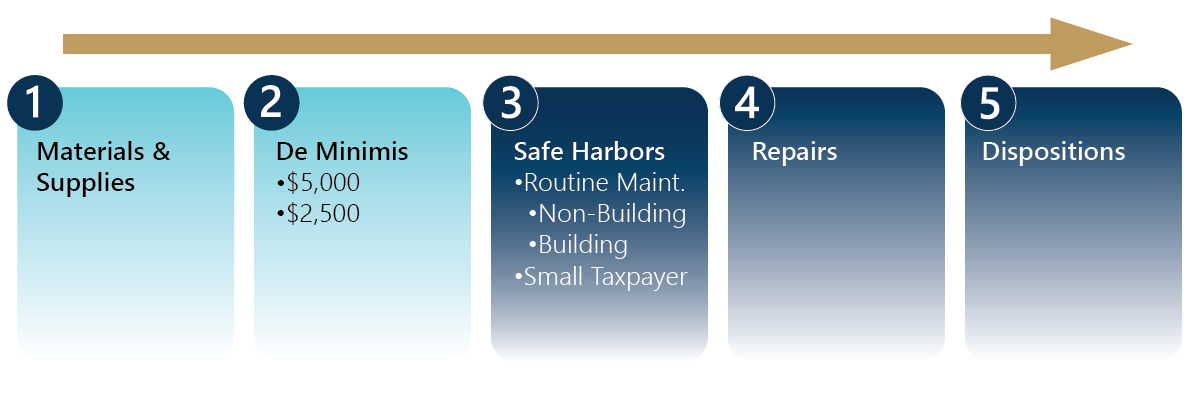

Opportunities in Repair Regulations for Immediate Deduction

The “repair regulations” have five different categories of opportunity where taxpayers can evaluate whether spending related to an improvement includes components eligible for immediate expensing. These five categories are summarized in the chart below.

- Materials & Supplies – At each step, consider whether the cost is for materials or supplies that can be deducted immediately or when the material or supply is used.

- De Minimis – If the business has an accounting procedure or written policy under which assets or improvements with “de minimis” costs are expensed, it can elect to follow this policy for tax purposes. This safe harbor is limited to items under $5,000 if the taxpayer has an “applicable financial statement” or under $2,500 if it does not have an applicable financial statement.

- Safe Harbors – If the costs are greater than de minimis, see whether a safe harbor applies that would permit expensing. For example, a routine maintenance safe harbor for buildings permits expensing damaged or worn parts that are routinely tested and replaced more than once during the ten years after the building is placed in service.

- Repairs – If none of these apply, see whether the costs are a repair.

- Dispositions – If the costs still must be capitalized, see whether they qualify for bonus depreciation or IRC Sec. 179 expensing while also seeing if an old asset was demolished as part of the improvement. In that case, you can take a disposition loss for the old asset.

If a taxpayer’s improvement doesn’t fall under the first two categories listed above, their tax professionals would evaluate the following three categories for each improvement. Evaluation of these categories, safe harbors, repairs, and dispositions, are frequently included in cost segregation studies.

Capital Improvements vs. Repairs: What’s the Difference?

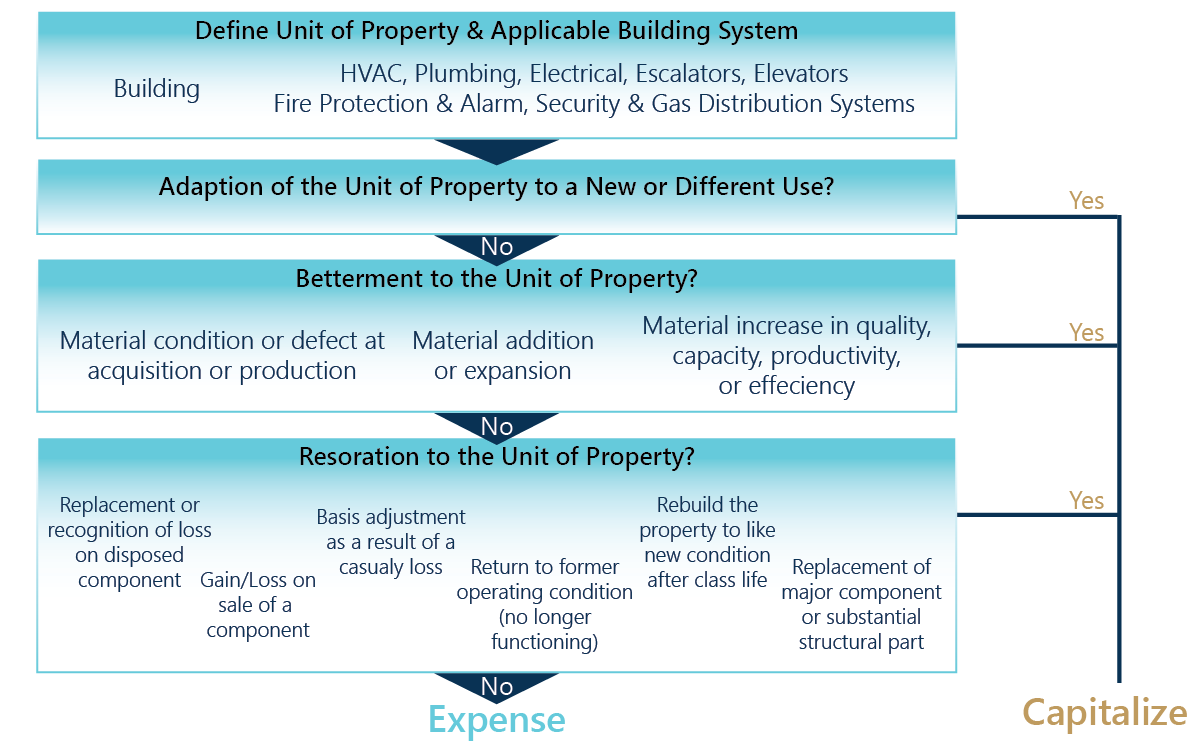

The most complicated of the five categories to evaluate is repairs. To assess this, tax professionals need to analyze whether the improvement spending can be expensed rather than capitalized.

The first step in this process includes identifying the unit of property (UoP) impacting the improvement spending. Once the UoP is identified, the next step consists of running a series of tests, referred to as the “BAR” test, which evaluates whether the improvement spending would be determined as a betterment, adaptation, or restoration.

The following chart lists the seven building systems and their major components. When applying the BAR tests, each building system OR the overall building is analyzed as the UoP. The unit of property is crucial because it quantifies our basis for making comparisons.

|

Systems |

Major Components of Building Systems |

|---|---|

|

HVAC |

Air handling units, boilers, condensing units, fans, furnaces, heat exchangers, heat pumps, make-up air units, refrigeration compressors, water chillers, etc. |

|

Plumbing |

Bathtubs, piping, pumps, sinks, toilets, urinals, water heaters, etc. |

|

Electrical |

Generators, light fixtures, panel boards, safety switches, switchboards, transformers, etc. |

|

Elevators & Escalators |

All elevators & escalators |

|

Fire Protection & Alarm |

Alarms, emergency exit signs & lights, heat & smoke detection devices, sprinkler heads & mains, water piping, etc. |

|

Security (Building) |

Alarm systems, electronic access systems, locks, monitoring devices such as cameras, etc. |

|

Gas Distribution |

Meters & gas distribution pipes |

|

Structure (Building UoP) |

Building components not included in other building systems. Examples are doors, windows, roof, ceilings, etc.… and structural components |

Now that we understand the UoP, see the chart below which summarizes how we apply the BAR tests to various UoP to determine whether a cost is a repair or an improvement.

As a practical example, let’s walk through an improvement that includes a roof replacement.

The first thing to evaluate is whether the improvement project is part of an adaptation. This would be the case if the new roof adapts the building to a new or different use.

If the roof replacement was not determined to be an adaptation, we would then evaluate whether it would qualify as a “betterment.” This would be the case where the roof replacement corrected a building defect.

If the replacement was not a betterment, consider whether it was a restoration. If the entire roof decking, coverings, asphalt, and insulation were replaced, this would need to be capitalized as the replacement of a major component or substantial structural part of the building.

Once it is determined that all three definitions are not met, the taxpayer would be allowed to take the roof replacement as a deductible repair for immediate expensing.

Additional Repair Analysis Examples

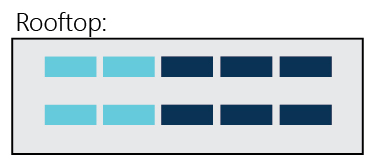

The following three examples show a repair analysis for HVAC air handling units (AHUs), with an emphasis on restorations and whether the taxpayer is replacing a major component or substantial structural part of a building system or unit of property. In the first example, the business ignores the state tax implications. It capitalizes everything and uses bonus depreciation. In the second example, the taxpayer applies the repair regulations to identify some of its “capital” expenditures as 100% deductible repairs.

Example 1

| Assumptions: | Results: | Rooftop: |

|---|---|---|

|

Single Building

|

|

|

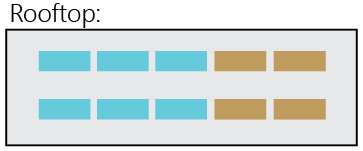

Example 2

| Assumptions: | Results: | Rooftop: |

|---|---|---|

|

Single Building

|

|

|

Example 3

| Assumptions: | Results: | Rooftop: |

|---|---|---|

|

Building 1

|

Building 1

|

|

|

Building 2

|

Building 2

|

|

Alternative Options if Improvement Must be Capitalized

If the improvement does not meet any of the expensing criteria above, taxpayers still have some options.

Once an improvement is capitalized, tax professionals would then evaluate whether the next best option is to utilize bonus depreciation or IRC Sec. 179. By using these options, taxpayers may still be able to take substantial deductions for improvement spending in a given tax year.

It is important to reiterate that, unlike repair expensing, these methods of accelerated deductions may not be treated the same for federal and state purposes. Additionally, these methods may include a need for some level of recapture should the assets one day be sold.

Bonus Depreciation: Eligible Property and Limitations

With the TCJA, the scope of eligible assets for special depreciation, better known as bonus depreciation, has been expanded.

While the concept of bonus depreciation has been around for quite some time, the main change incorporated into effect by the TCJA was that the assets only had to be “new to you.” This meant that even if the assets were previously placed in service for a different taxpayer, the purchasing taxpayer could now still take advantage of this accelerated method of deducting eligible capitalized assets.

To be eligible for bonus depreciation, the asset would need to be tangible property depreciated under MACRS with a recovery period of 20 years or less that is not considered excepted property.

Common assets that qualify for bonus depreciation would be personal property, furniture, fixtures and equipment, land improvements, and qualified improvement property.

Common excepted property not eligible for bonus depreciation would include property depreciated under the alternative depreciation system (ADS), property converted to personal use in the same tax year acquired, and property under which an election was made to forgo bonus depreciation.

It should be noted that as the tax law currently stands, bonus depreciation rates have been decreasing by 20% year over year since 2022, ultimately sunsetting in 2027.

| 2022 | 2023 | 2024 | 2025 | 2026 | 2027 |

|---|---|---|---|---|---|

| 100% | 80% | 60% | 40% | 20% | 0% |

Expanded Scope to Include Qualified Improvement Property (QIP)

With the CARES Act in 2020, QIP was given a technical correction to be treated as 15-year property so long as a real property trade or business election to forgo business interest limitations is not in effect.

QIP is defined as any improvement to an interior portion of a building that is a nonresidential real property if the improvement was placed in service after the date that the building was first placed in service by any taxpayer.

QIP also does not include the cost of any improvement attributable to the following:

- Enlargement of the building

- Any elevator or escalator

- The internal structural framework of the building

As noted above, while not all improvements qualify for bonus, some of these assets may still have alternative options for immediate deductions through IRC Sec. 179 expensing.

Understanding IRC Sec. 179: What Qualifies and How It Works

IRC Sec. 179 is a tax provision that permits up to the full purchase price of a qualifying asset to be deducted completely in the year of purchase so long that it does not exceed certain spending cap limitations, as seen in the table below.

| Tax Year | 179 Expensing Limit* | 179 Spending Cap** | Bonus Dep Rate |

|---|---|---|---|

| 2024 | $1.22M | $3.05M | 60% |

| 2023 | $1.16M | $2.89M | 80% |

| 2022 | $1.08M | $2.70M | 100% |

While qualifying assets under IRC Sec. 179 include company necessities like computer equipment, office furniture, and business-related vehicles, the TCJA extended the scope of IRC Sec. 179 eligible assets to include improvements to the following building systems:

- Roofs

- Fire alarm and protection systems

- Security systems

- HVAC

- Qualified Improvement Property

One additional caveat to using IRC Sec. 179, outside of its maximum spending limitations, compared to other deductions related to capitalized costs is that IRC Sec. 179 cannot be used to create losses for businesses.

- With its limitations being considered, due to bonus rates declining along with the expanded scope of eligible assets under IRC Sec. 179 in comparison to bonus depreciation, businesses and their tax professionals should evaluate various scenarios where taxpayers may be eligible for increased deductions by way of IRC Sec. 179 over bonus depreciation.

State-Specific Considerations for Capital Expenditures

This chart summarizes state tax rates for three popular states and whether they conform to federal bonus depreciation and IRC Sec. 179 expensing.

| State | Corp. Tax Rate | IRC Sec. 179 Expensing | Bonus Description |

|---|---|---|---|

| California | 8.84% | Yes, but expensing is limited to $25,000 with a $200,000 investment limitation. | No Bonus |

| Illinois | 9.50% | Conforms | No Bonus |

| Michigan | 6.00% | Conforms | No Bonus |

| New York | 6.50% | Generally Conforms | No Bonus |

| North Carolina | 2.50% | Conforms | 85% add-back |

Key Examples of IRC Sec. 179 in Action with State Considerations

Here are a few more examples that demonstrate the workings of IRC Sec. 179.

Example 4

If a Michigan corporation capitalizes $10 million as QIP and deducts it using 100% bonus depreciation, the business will save $2.1 million on its federal income tax return. Since Michigan generally conforms to the federal tax code on a rolling basis but does not conform to bonus depreciation, the corporation will be limited to a depreciation deduction of 3.33% (for 15-year QIP using the straight-line method and the half-year convention). The same $10 million will result in tax savings of $19,980.

| Type of Deduction | Basis |

Deprec. Rate |

Deduction |

|

Tax Savings |

|---|---|---|---|---|---|

| Federal | $10,000,000 | 100% | $10,000,000 | 21.00% | $2,100,000 |

| State | $10,000,000 | 3.33% | $333,000 | 6.00% | $19,980 |

| Total | $2,119,980 |

Example 5

The same Michigan corporation spends $10 million on possibly capital expenditures. Working with its tax advisors, the corporation identifies $5 million of the costs as repairs. The federal tax savings do not change; the corporation deducts $5 million in repairs and $5 million of bonus depreciation for federal tax savings of $2.1 million. Since Michigan conforms to the federal treatment of repairs, for state purposes, the corporation will have a $5 million repair deduction and a $166,500 state depreciation deduction, resulting in state tax savings of $309,990. Applying the repair regulations saved the business an additional $290,010 in taxes in the first year compared with Example 4.

| Type of Deduction | Basis |

Deprec. Rate |

Deduction | Corp. Tax Rate |

Tax Savings |

|---|---|---|---|---|---|

| Federal Asset | $5,000,000 | 100% | $5,000,000 | 21.00% | $1,050,000 |

| Federal Repair | N/A | N/A | $5,000,000 | 21.00% | $1,050,000 |

| State Asset | $5,000,000 | 3.33% | $166,500 | 6.00% | $9,990 |

| State Repair | N/A | N/A | $5,000,000 | 6.00% | $300,000 |

| Total | $2,409,990 |

When looking at these examples, please remember that if the Michigan corporation had spent $1 million instead of $10 million, it could have used IRC Sec. 179 to expense the entire cost for federal and state purposes. On the other hand, a California corporation would be limited to expensing $25,000 under IRC Sec. 179 and could spend no more than $400,000 on IRC Sec. 179 property to claim an IRC Sec. 179 expensing deduction. Please consult with your state and local tax advisors for further guidance on various jurisdictions.

Conclusion

Determining whether costs can be expensed as a repair may be time-intensive, but it can result in significant tax savings, especially for state tax purposes. It is beneficial to conduct thorough cost segregation studies and seek guidance from qualified advisors specializing in real estate. These steps will help investors to fully leverage available tax incentives, ultimately contributing to a more robust and efficient tax strategy. If you need help identifying which option is suitable for you, reach out to our team to evaluate which tax strategy would work best for your tax situation.

What's on Your Mind?

Start a conversation with Avi