Part 4: More than Transferring a Title: How Do I Successfully Transfer Responsibility and Ownership of My Real Estate Empire?

- Published

- Sep 14, 2020

- Share

As a real estate family, you might be thinking about transition or creating a dynasty with the assets you have accumulated over a lifetime. There as many options for you as there are real estate properties to invest in. The dilemma is understanding the right option for you. Families who own real estate are unique in many ways; however, one aspect they have in common is they own and manage properties together. You are not just a family, but a family who owns and shares assets. Meaning, there is more than blood working as the glue to keep your family members in the orbit of one another. The question we hear most often from parents is: Will these properties become a burden or benefit to my family?

As a real estate family, you might be thinking about transition or creating a dynasty with the assets you have accumulated over a lifetime. There as many options for you as there are real estate properties to invest in. The dilemma is understanding the right option for you. Families who own real estate are unique in many ways; however, one aspect they have in common is they own and manage properties together. You are not just a family, but a family who owns and shares assets. Meaning, there is more than blood working as the glue to keep your family members in the orbit of one another. The question we hear most often from parents is: Will these properties become a burden or benefit to my family?

The short answer is… it depends. Property and assets in themselves are neutral. Yes, some aspects about property like location can impact standalone value which we are not factoring into this article as the assumption is that you are a sophisticated real estate family who has exercised the correct due diligence. Much of the knowledge regarding how to manage your portfolio was learned over years of experience and is second nature for you. The same level of acumen may not be as readily available for your family and we have another article that addresses the stewardship pathways, in which heirs can be developed for technical competence over the years.

Decision-making changes when parents decide to pass their real estate portfolio to their family members. If you are the solo decision maker relative to the real estate, the buck stops with you. You may have trusted advisors, yet you make the final call. There is some stress under that weight; yet you have thrived with that entrepreneurial freedom. If you decide to pass ownership or management to any family members there are a few things to consider:

- Who should own the assets?

- Who should manage the properties?

- Should there be an equal division?

- What happens if there are disagreements in direction?

- Should my children own outright or in trust?

Being a beneficiary, or recipient, of properties from a family member is a privilege and it comes with some responsibilities such as shared decision-making, collaboration, cooperation, problem-solving and enhanced communication skills as there are more people involved in the decision-making process. These are important skills, many of which we do no learn at home or employ within our family. The activation and practice of these types of skills for your family, prior to deciding on structure or transfer, is the linchpin for success in wealth transfer.

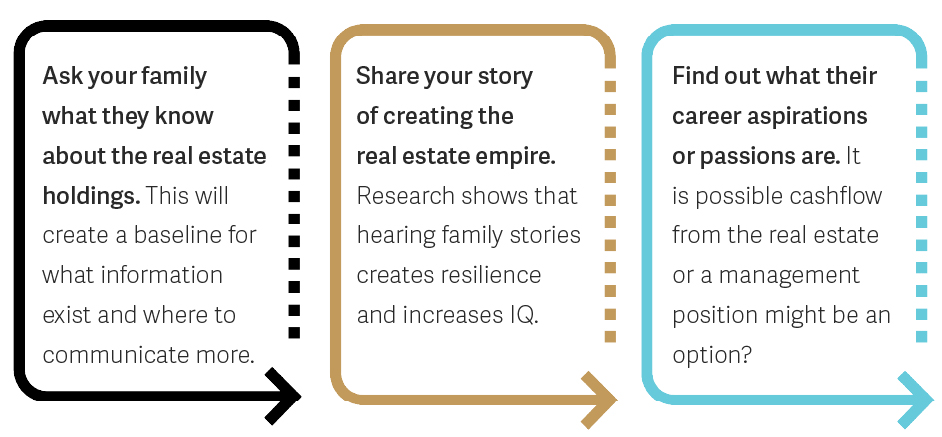

This is just the tip of the iceberg when considering how to handle a transition from you to your family, and it does not include how you communicate your vision or the natural dynamics that will arise when you make any of the decisions above. However, understanding what your family is capable of and their limitations might make thinking about transitions easier.

Foundations for the Future: Real Estate Succession Planning

- Part 1: The Real Estate Family’s Considerations for Success

- Part 2: Considerations (or Opportunities) for Growing a Family Owned Real Estate

- Part 3: A Dispute Resolution Guide for Real Estate Families

- Part 4: More than Transferring a Title: How Do I Successfully Transfer Responsibility and Ownership of My Real Estate Empire?

What's on Your Mind?

Start a conversation with Natalie

Receive the latest business insights, analysis, and perspectives from EisnerAmper professionals.