Living and Working in Singapore

- Published

- Nov 30, 2021

- Share

By Keith Wong

Many businesses and individuals have discovered the benefits of Singapore’s high standard of living as well as its relatively attractive corporate regime and business incentive programs. Singapore is regularly ranked as one of the safest cities in the world. Residents enjoy excellent health care, education, housing, recreation, and transport facilities in a politically stable and low-crime environment.

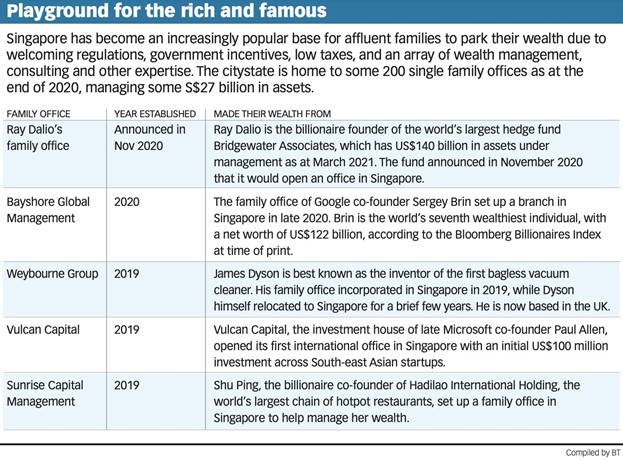

Many businesses and family offices have chosen Singapore to be their base for headquartering their operations or for managing their family offices.

In 2020, the Accounting and Corporate Regulatory Authority (ACRA) revealed that more than 63,000 business entities were incorporated, bringing the total number of Singapore-based businesses to just over 537,000. Since the Singapore Variable Capital Company (VCC) structure was made available for registration in January 2020, there have been at least over 300 VCCs setup by June 2021.

The Monetary Authority of Singapore’s recent parliamentary reply estimated there were as many as 400 single family offices operating in Singapore at the end of 2020.

The Oppenheimer family, who used to own the De Beers diamond empire has just recently set up a single family office in Singapore. Also, Kelly Ng of The Business Times compiled the following information.

Why Singapore?

Why Singapore?

Businesses and institutions in Singapore benefit from free trade agreements (FTAs), which ease trade in goods, services and investment, and double tax agreements (DTAs), which set out tax liabilities on income rising from cross-border economic activities between two jurisdictions. In September 2021, Singapore had in place as many as 26 implemented agreements -- 15 bilateral FTAs and 11 regional FTAs -- and close to 100 DTAs, all of which ease trade with economies worldwide.

Attracting Entrepreneurs to Singapore

Singapore has various programs to assist entrepreneurs and family businesses who are interested in investing in and relocating to Singapore. Its global investor program (GIP) grants Singapore permanent resident status to individuals who meet specific criteria.

To qualify for Permanent Resident status an individual must work in an industry approved by Singapore’s Economic Development Board and have an active role in the company, such as a position on the board or in the senior management team.

There are also stipulations that they must be a member of the family that runs the business, and the family must be the largest shareholder of the firm or own at least 30% of the company’s shares. The company’s annual turnover must be at least S$500 million per annum on average in the three previous years before the year the application is submitted.

The Singaporean government administers other programs aimed at attracting and retaining the talent of individuals and families from around the world.

Three of the main ones are described below.

EntrePass

The EntrePass is intended to attract serial entrepreneurs, high-caliber innovators and/or experienced investors wanting to operate a business in Singapore. The business needs to be venture-backed or own innovative technologies.

You can apply for an EntrePass if you have started, or intend to start, a private limited company registered with ACRA that is venture-backed or owns innovative technologies.

There are three main types of EntrePass:

i. Entrepreneur

- A company that has raised funding of at least S$100,000 from a government investment vehicle, venture capitalist (VC) or business angel that is recognized by a Singapore government agency; or

- Is incubated by an incubator or accelerator recognized by the Singapore government; and/or

- Has an established business network and entrepreneurial track record.

ii. Innovator

- Someone who possesses intellectual property;

- Has research collaborations with a Singapore-based institute of higher learning or credible research institute; and

- Has a record of extraordinary achievements in key areas of expertise.

iii. Investor

- Someone with a track record of solid investments.

Unlike the traditional employment pass, the EntrePass has no stipulated minimum salary and is not required to meet foreign worker levy or quota requirements.

Singapore’s Foreign Artistic Talent Scheme (ForArts)

The Foreign Artistic Talent Scheme (ForArts) was introduced in 1991 and allows international arts professionals to become permanent residents in Singapore. ForArts’ aim is to recognize the cultural significance and contribution an artist can play in helping Singapore’s art and culture landscape.

ForArts considers the applicant’s professional experience, achievements, ability and commitment to contribute to the advancement of the local arts scene. Applicants must also demonstrate a track record of engagement with the local public and arts community.

To be considered for the ForArts scheme, applicants must:

- Possess relevant training/education in their field of practice;

- Possess relevant professional experience, with outstanding achievements, in the field of performing, visual or literary arts, design or media;

- Have made significant contributions to Singapore’s arts and cultural scene, including a strong track record of local engagements at leadership level; and

- Have concrete future plans to be involved in Singapore’s arts and cultural sector.

Single Family Office

The Monetary Authority of Singapore provides tax exemption for specified income derived from designated investments for funds and family offices.

The exemptions, which are subject to approval on a case-by-case basis, means that, family wealth managed by a single family office in Singapore can enjoy tax exemptions from schemes granted under 13R & 13X of the Income Tax Act.

These are known as enhanced tiered fund exemptions.

Alongside the approval granted by Monetary Authority of Singapore, a single family office may apply (subjected to approval) to the Ministry of Manpower for an employment pass, allowing one family member to work for the single family office in Singapore under the 13R exemption or three family members under the 13X exemption.

While establishing their single family office, families should also consider how they can transfer family wealth to the next generation in an organized and structured manner.

According to the Monetary Authority of Singapore, ‘single family office’ typically refers to an entity which manages assets for or on behalf of only one family and is wholly owned or controlled by members of the same family. The term ‘family’ in this context may refer to individuals who are lineal descendants from a single ancestor, as well as the spouses, ex-spouses, adopted children and step-children of these individuals.

Individual Taxation

Individual Taxation in Singapore

Personal income tax in Singapore is based on a progressive structure.

The personal income tax rate in Singapore is one of the lowest in the world. In order to determine the Singapore income tax liability of an individual, the first thing that needs to be determined is the tax residency and amount of chargeable income and then apply the progressive resident tax rate to it. Key points of Singapore income tax for individuals include:

- Singapore follows a progressive resident tax rate starting at 0% and ending at 22% for income above S$320,000.

- There is no capital gain or inheritance tax.

- Individuals are taxed only on the income earned in Singapore. The income earned by individuals while working overseas is not subject to taxation barring a few exceptions.

- Tax rules differ based on the tax residency of the individual.

- Tax filing due date for individuals is April 15 of each year. Income tax is assessed based on a preceding year basis.

Corporate Tax in Singapore

Singapore’s headline corporate tax rate is 17%. Subject to certain exceptions, Singapore income tax is imposed on income accruing in or derived from the Republic of Singapore and on foreign-sourced income received or deemed received in the Republic of Singapore.

Section 13R and 13X Tax exemptions

Any income earned from “designated investments” for a fund with approved Section 13R/13X exemptions would be exempted from tax in Singapore for the life of the fund. There are qualifying conditions to apply for these exemptions. The exemptions are currently available until 31 December 2024, unless further extension is granted.

Conclusion

Singapore is an attractive jurisdiction for family offices to be headquartered. Many prominent global families have set up in Singapore. Advantages include very encouraging regulatory and tax environment to operate and the warm weather throughout the year. Clear paths to live and work in Singapore are available to encourage investors to operate there.

Our Current Issue: Q4 2021

Contact EisnerAmper

If you have any questions, we'd like to hear from you.

Receive the latest business insights, analysis, and perspectives from EisnerAmper professionals.