Outlook for Private Equity Dealmaking in 2023

- Published

- Feb 22, 2023

- Share

Private market investments this year are in a state of uncertainty following a slowdown in M&A activity in 2022 after an active 2021.

Contributing to the state of uncertainty are record-high inflation, rising interest rates, tight supply chains and uncooperative labor markets, all of which are still weighing on buyers’ and sellers’ minds. And further, these recession indicators are factoring in on the market and hence, we are starting to see some difficulty in deals closing as senior lenders grow increasingly more cautious about leverage and industries with cyclical activity.

However, volatility in markets can create attractive opportunities and we believe patient capital will be able to take advantage of opportunities when they present themselves. As we shift back to an “Old New Normal,” private equity buyers will be able to adjust transaction structures and shift more of the distribution of investment risk toward sellers through seller notes, increased amounts of equity rollover and contingent purchase price considerations via earnout or growth targets tied to purchase price. We believe companies with strong balance sheets, existing management teams, high recurring revenues and limited correlation to recessions will still see strong interest from private market participants in 2023.

Robust Due Diligence is Key for M&A Transactions

M&A activity is slowing down as buyers are asking for more time to execute due diligence. However, as a buyer’s market emerges in 2023, acquirers will have to conduct robust due diligence on companies. Specifically, cash flow implications to higher interest rates and leverage levels, the ability to pass on inflation to suppliers and customers, labor market implications and the ability to obtain portfolio company talent to execute a growth strategy all must be succinctly analyzed together with some understanding of the sensitivity of how they interplay.

In the back half of 2021 and 2022, due diligence processes were happening in a compressed timeframe as sell-side processes had transaction leverage; deals were ultra-competitive, forcing buyers to rely on sell-side due diligence findings.

In late 2022, we saw due diligence processes extending over a longer time period, which is expected to continue throughout this year and into 2024. As a result:

- The due diligence process has returned to a phased approach as financial/tax/commercial are the first in, followed by legal, environmental and insurance processes.

- Pro forma EBITDA adjustments related to synergies and future events are being heavily discounted. Value considerations for these are now moving towards part of structured contingent future payments based on actual realization as risk is shifted away from buyers and back to sellers.

- In LOI’s we routinely saw 45-60 days to close negotiated in good faith to keep both parties moving to close. Currently, we are seeing 60-90 days to close, as buyers want multiple looks at the business and roll-forwards to ensure they are not buying at peak EBITDA.

Private Company Valuations to Reset

How far private market valuations will fall is yet to be seen; however, on the back of a higher cost of capital alone, we would expect to see private company valuations fall 10%-15% from peak 2022 levels by the end of 2023.

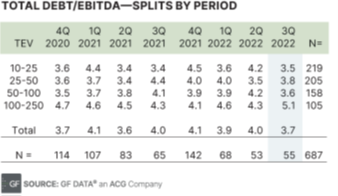

GF Data reports the following data highlights:[1]

- Leverage multiples retreated. Total debt averaged 3.7x for the third quarter in 2022, compared to 3.9x in the first half of 2022.

- Buyers addressed the shortfall by upping the amount of equity they contributed to deals. Average equity commitment on platform deals in the year-to-date increased by 2.5 percentage points to 57% in 2022, compared to an average of 54.5% for all of 2021.

- Federal Reserve interest rate increases earlier in 2022 did not translate into higher borrowing costs on private transactions. In the third quarter, those increases became evident. Initial pricing on senior debt leapt from 4.5-4.7% in the first two quarters to 6.5% in the third quarter of 2022.

- Average valuations peaked in the third quarter of 2022; transaction volume was down considerably when compared to prior years.

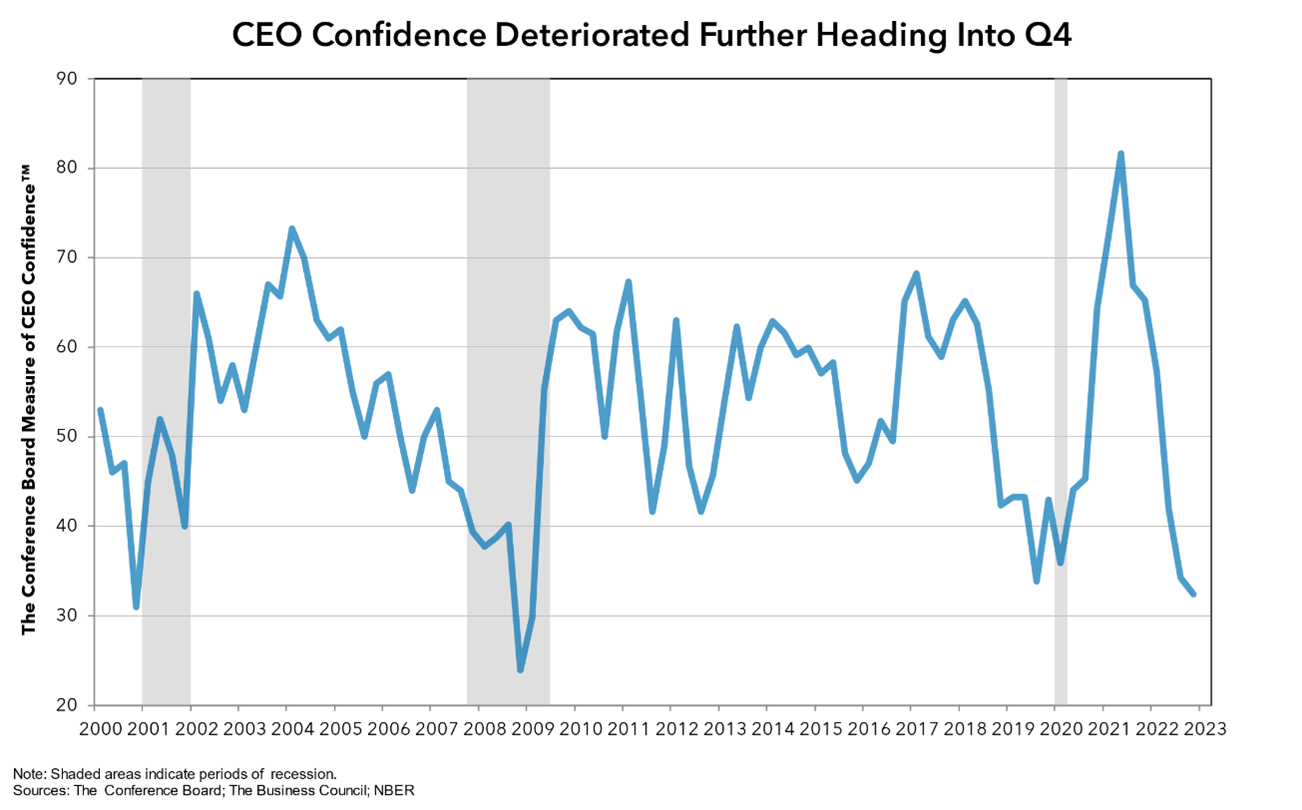

While changes to interest rates and weighted cost of capital affect the duration sensitivity to long-dated cash flow and exit values, concerns regarding macro growth and recession chatter are here to stay. The Conference Board Measure of CEO Confidence™, in collaboration with The Business Council, stands at 32 to start the fourth quarter of 2022, down from 34 in Q3. The recent survey asked CEOs to describe the economic conditions they are preparing to face over the next 12-18 months. An overwhelming majority — 98% — said they were preparing for a U.S. recession.[2]

Highlights from the survey:

CEOs’ assessment of general economic conditions deteriorated further to start the fourth quarter of 2022:

- About 5% of CEOs reported economic conditions were better compared to six months ago, and compared to 6% in the third quarter of 2022.

- 81% said conditions were worse, up from 77%.

- Employment: 44% of CEOs expect to expand their workforce over the next 12 months, down from 50% in the third quarter of 2022.

- Hiring Qualified People: 68% of CEOs report some problems attracting qualified workers, down from 73%. Of those, 39% report difficulties that cut across the organization, rather than concentrated in a few key areas — down from 44% in the third quarter.

- Wages: 85% of CEOs expect to increase wages by 3% or more over the next year, down from 89% in the third quarter.

- Capital Spending: 86% of CEOs expect their capital budgets to increase or remain the same over the next year, versus 82% in the third quarter of Q3.

Distressed Investing to Make a Comeback

Distressed investors now have an opportunity to capitalize on overleveraged investments that have been able to weather thin operating margins and limited free cash flow generation because of low debt service costs due to near zero interest rates. With potential liquidity drying up for overleveraged companies, there will likely be increased opportunities for distressed investors to acquire debt as a means to the acquisition of a target.

Since the end of 2021, U.S. distressed loan volume has meaningfully increased to $110 billion in value. This is currently trading below 80% of par and is nearly 10x higher that at the end of December 2021. Default rates on these loans are projected at 0.72%.

Conclusion

2023 is expected to be a year of transition for the private capital markets as asset prices attempt to clear slowing growth combined with a higher cost of capital and waning market confidence. While volatility does bring uncertainty, it also provides opportunities with attractive valuations. Private market investors with targeted investment thesis, extended due diligence and the ability to shift risk back to sellers will be rewarded.

[1] https://www.conference-board.org/topics/CEO-Confidence/press/CEO-confidence-Q4-2022

[2] https://www.conference-board.org/topics/CEO-Confidence/press/CEO-confidence-Q4-2022

Our Current Issue: Q1 2023

What's on Your Mind?

Start a conversation with Cory

Receive the latest business insights, analysis, and perspectives from EisnerAmper professionals.