Private Equity: CFIUS Awareness from the Start

- Published

- Aug 24, 2020

- Topics

- Share

The pandemic has contributed to the slowing of M&A activity in the beginning of 2020. That fact, coupled with increased global tension, means that non-U.S. private equity looking to invest in U.S. companies and companies looking to sell U.S. assets to a non-U.S. private equity should be aware of the potential impacts of the U.S. Foreign Investment Risk Review Modernization Act of 2018 (FIRRMA), which expanded the oversight of the Committee on Foreign Investment in the United States (CFIUS) when foreign direct investment (FDI) is involved, on the transaction.

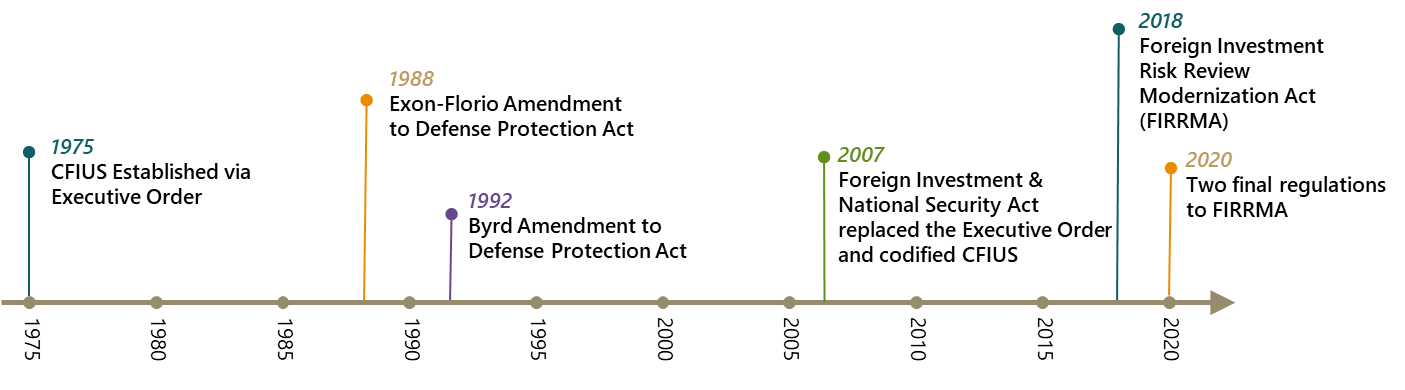

How has CFIUS evolved?

For a quick recap, the timeline highlights a few of the key milestones in the progression and strengthening of CFIUS regulation:

What should non-U.S. private equity firms consider during deal due diligence?

A transaction selected for CFIUS review may take additional time to complete due diligence, delaying transaction closure. Some points for acquiring non-U.S. private equity firms to consider include, but are not limited to, whether the targeted U.S. asset:

- Operates in one of the specified industries;[1]

- Produces, designs, tests, fabricates or manufactures any critical or foundational and emerging technology; and

- Impacts national security, and to what extent.

In conjunction with retaining CFIUS counsel, private equity firms may want to undertake a pre-filing transaction risk assessment to facilitate deal closing. A pre-filing transaction risk assessment, by either the selling or the purchasing transaction party, may be beneficial to:

- Assess the potential national security risks of the private equity;

- Determine if the purchasing private equity is foreign or qualifies for exemption, contingent on satisfying certain metrics; and

- Determine if the transaction requires a voluntary or mandatory[2] CFIUS filing.

Do voluntary notices have to be filed?

While voluntary filings may cost time and money, there are possible benefits of voluntary submission for CFIUS review. Voluntary notification may foster a proactive, participatory approach and if CFIUS extends pre-closing clearance, the transaction may occur without further CFIUS considerations.

However, the stakes are higher and risk significant for private equity firms that elect not to voluntarily submit a covered transaction for CFIUS review. CFIUS is empowered, by FIRRMA, to identify and investigate transactions where a voluntary notice should have been submitted but was not. In this instance, CFIUS has a look-back period after deal closure to determine if the transaction results in national security concerns and the authority to review the transaction. This may result in increased mitigation or, more extremely, CFIUS may elect to unwind or compel divesture in the transaction altogether, such as with iCarbonX and PatientsLikeMe Inc.

What are some outcomes after filing a notice?

Once a notice, voluntary or mandatory, is submitted to CFIUS, the transaction parties should be prepared and educated on the possible outcomes of CFIUS’ review. CFIUS may extend clearance of the transaction, require mitigation measures, or, potentially, block the transaction if mitigation is not achieved.

In instances where a mitigation agreement is required, the transaction parties should seek assistance from firms in negotiation and potential acceleration of the transaction based on the pre-filing risk assessment and knowledge of the potential risks involved in relation to the company’s internal processes.

Per CFIUS’ 2019 Annual Report to Congress published July 2020, there were 231 voluntary notices filed.

- 113 of the 231 notices went into the 45-day investigation phase.

- 30 of the 231 notices filed were withdrawn.

- 33 of the covered transactions were approved by CFIUS, subject to the acceptance of mitigation arrangements.

For private equity managers operating under mitigation, it is prudent to allocate funds for continued compliance and factor this expense during deal due diligence. CFIUS monitors and enforces mitigation measures established with national security agreements through “on-site compliance reviews; third-party audits and monitors; investigations if anomalies or breaches are discovered or suspected; and remedial action, as appropriate” and may impose monetary fines for violations.

[1] There are 27 designated CFIUS ‘pilot program industries’ defined by North American Industry Classification System (“NAICS”) Code. However, it should be noted that on 5/21/20 the Investment Security Office submitted a proposed rule change to move away from the NAICS codes to export codes.

[2] On January 13, 2020, the U.S. Department of the Treasury, on behalf of CFIUS, issued two final regulations for implementing FIRRMA. As part of these regulations, transaction notice to CFIUS is mandatory in certain circumstances, altering past procedure of transaction notice submission to CFIUS being voluntary.

What's on Your Mind?

Start a conversation with Nina

Receive the latest business insights, analysis, and perspectives from EisnerAmper professionals.