EisnerAmper Hosts NYSSCPA Family Office Committee

- Published

- Aug 16, 2019

- Share

Cristina Wolff, a tax partner and member of the firm’s International Services Group, recently hosted Eva Minsteris, chair, and the members of the NYSSCPA’s Family Office Committee at EisnerAmper’s NYC office and discussed the issues surrounding global mobility and their impact on international family offices.

Cristina moderated a panel discussion that featured Richard LeVine, a tax attorney with Withers Bergman LLP and Megan Worrell, a wealth advisor in JPMorgan Chase’s Private Bank & Global families Group.

The discussion focused on several topics including cybersecurity, personal security, the global market and the tax impact of cross-border mobility for wealthy families situated outside the United States. The increased mobility of family members sometimes results in unintended consequences for family offices and family members. Essentially, family members must be educated on how and when they become U. S. residents for both income tax and estate tax purposes.

Family members need to be aware of the different ways one may become a U.S. resident; as a citizen, as a green card holder, or as a result of the substantial presence test (a day count). Planning is highly recommended to minimize the adverse consequences of inadvertently becoming a U.S. resident for tax purposes.

The start date of U.S. residency depends on which bucket the individual falls into. As a green card holder, a taxpayer is a resident on the first day in the U.S. When in the U.S. on a visa, a taxpayer is a resident on the first day of physical presence when the individual meets days count threshold. If both the green card test and substantial presence test are met, the residency start date is the earlier of the two dates.

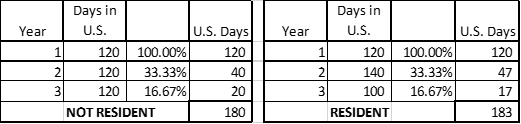

Under the days count, to be taxed as a resident, an individual must be present at least:

- 31 days in the current year, and

- 183 days during the three-year period that includes the current year and the two years immediately before that, counting

- All days an individual is present in the current year,

- 1/3 of the days in the year immediately before the current year, and

- 1/6 of the days in the second year before the current year.

To illustrate, the charts below show how over a three-year period two individuals may have the same aggregate days, but one will be not resident and one will be a resident for tax purposes:

To further complicate matters, since the estate tax is based on domicile, an individual may be subject to the U.S estate tax if he/she meets the physical presence test and intends to remain in the U.S.; a green card holder will be subject to estate tax only on his/her U.S. assets. In addition, a U.S. domicile that makes gifts to a non-U.S. citizen spouse is not eligible to claim the unlimited marital deduction, but the annual gift tax exclusion is $152,000 (in 2018, increasing to $155,000 in 2019.

Another compelling issue is the foreign reporting requirements when one is a U.S. resident. A U.S. Tax resident must disclose foreign assets, which can be a burdensome compliance issue, depending on the types of assets held by an individual. There are also myriad elections available to avoid adverse consequences on income from foreign entities, but one must know about them to take advantage of them. One such election is the qualified electing fund (or “QEF”) election for passive foreign investment companies. The QEF election allows a taxpayer to report foreign income and capital gains as it is earned; absent the election, the income is reported when distributions are received and if there are accumulated earnings and profits, the taxpayer will pay ordinary income tax rates on all income and be required to pay interest on the tax attributable to earnings from a prior year.

Furthermore, there are significant penalties for noncompliance with foreign assets disclosures, even if they do not generate any taxable income. An individual may be subject to these penalties simply because they are unaware of assets placed in their name in foreign countries by parents and grandparents starting a dowry!

The resounding theme throughout the presentation was to seek out advice on the complexities of residency status and foreign asset reporting requirements. What you do not know may hurt you financially, but advance planning on the simplest of matters may bring big rewards.

What's on Your Mind?

Start a conversation with James

Receive the latest business insights, analysis, and perspectives from EisnerAmper professionals.