Is Your Employee Benefit Plan Adequately Covered by an ERISA Fidelity Bond?

- Published

- Jun 28, 2022

- Share

Section 412 of the Employee Retirement Income Security Act of 1974 (“ERISA”) requires every person who handles funds or other property of a plan to be bonded (excluding certain exempted individuals). Such persons include plan fiduciaries but may also include any director, officer or employee of the fiduciary. This is referred to as ERISA’s bonding requirement. The ERISA fidelity bond, also known as an employee dishonesty bond, is a legal requirement arising from ERISA to protect plans against losses resulting from an act of fraud or dishonesty by persons handling a plan’s assets.

The Department of Labor (“DOL”) notes that: “In a typical ERISA fidelity bond, the plan is the named insured and a surety company (insurer) is the party that provides the bond. The persons covered by the bond are the persons who handle funds or other property of the plan.” 1It is important to note that the plan must be named as the insured party in the bond. In certain cases, the insured party is named as plan sponsor, and it is worthwhile to note that there should be a provision that covers any ERISA plan sponsored by the insured. As an insured party, the plan can make a claim on the bond if a plan official causes a covered loss to the plan due to fraud or dishonesty.

There are minimum and maximum limits prescribed for the ERISA fidelity bond value, with a requirement of a minimum bond value of $1,000 and a maximum bond value of $500,000 (or $1 million if the plan has investments in an employer’s securities). Each person who needs to be bonded as described above must also be covered for at least 10% of the amount of plan assets they handled or had access to in the year prior. The coverage should be measured on the first day of the plan year. Deductibles or other similar features are prohibited for coverage of losses.

Generally, a fidelity bond’s term cannot be less than one year. However, bonds with a longer period are permissible.

According to the DOL: “Every person who ‘handles funds or other property’ of an employee benefit plan is required to be bonded unless covered under an exemption under ERISA. Generally, this includes the plan administrator or employees of the plan or plan sponsor who handle the funds or other property of an employee benefit plan.”2 It may also include other persons such as service providers to the plan who are involved in accessing the plan funds or decision-making authority that can cause loss through fraud or dishonesty. If any person “receives, handles, disburses or otherwise exercises custody or control of plan funds or property” without being properly bonded, it is considered as an unlawful act under ERISA.

The Department of Labor also notes that: “The ERISA fidelity bonds must be obtained from a surety or reinsurer that is named on the Department of the Treasury’s listing of approved sureties, except under certain conditions, where the bonds may also be obtained from underwriters at Lloyds of London.”3 The Department of the Treasury’s listing of approved sureties, Department Circular 570, is available here. As the ERISA fidelity bonds are generally obtained from a surety or reinsurer, the difference between an ERISA bond and other types of insurance coverage obtained by the plan administrator or plan sponsors (generally a fiduciary liability policy) is often a source of confusion.

ERISA Fidelity Bond Versus Fiduciary Liability Insurance

Companies can also purchase fiduciary liability insurance, in addition to an ERISA fidelity bond, to protect the assets of the company's retirement plan against an employee's unintentional actions resulting in losses to plan’s assets. This is additional coverage obtained to reduce the increased risk of breach of fiduciary duty. The important feature to note here is unintentional acts, which are not covered by ERISA fidelity bonds. For instance, an employee acting in good faith may make a mistake in administering the plan according to plan documents or fail to monitor third-party service providers, which may result in penalties or losses arising to the plan. Because these acts were taken in good faith and are not acts of dishonesty or fraud, they are not covered under an ERISA bond.

Fiduciary liability insurance policies can be purchased through many insurance carriers; there is no specific list of surety or reinsurer, as in case of the ERISA bond. Also, there are no minimum or maximum limits on the policy value as these are not legal requirements.

As we can observe from above discussion, there are significant differences between ERISA fidelity bonds and fiduciary liability insurance. Both serve to protect different stakeholders of benefits plans. Failing to meet the ERISA’s bonding requirements could lead to compliance issues, whereas the fiduciary liability insurance is voluntary safeguard and no compliance issues are involved.

Reporting and Compliance:

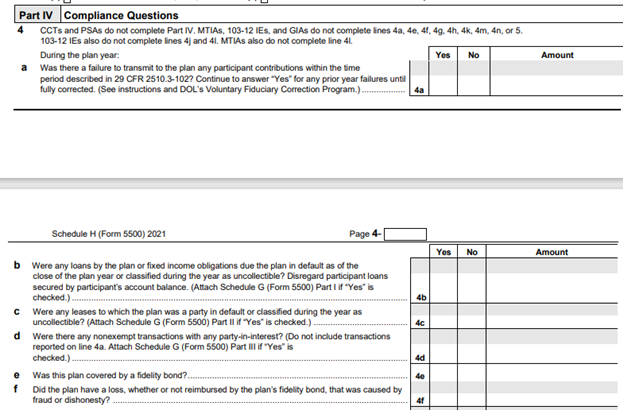

Within Part IV Compliance Questions in Schedule H of Form 5500, the DOL requires plan sponsors to report whether the plan was covered by an ERISA fidelity bond and the amount thereof.

Based on our analysis of 2020 plan year 5500s, nearly 10% of plans were inadequately covered by their fidelity bonds.

While there are no specific penalties associated with inadequate fidelity bond coverage, there are several risks associated with not meeting the requirements, which include, but are not limited to, the following:

- Failing to report a sufficient bond on the Form 5500 can trigger a plan audit.

- It is considered as an unlawful act under ERISA if any person “receives, handles, disburses or otherwise exercises custody or control of plan funds or property” without being properly bonded.

- Plan fiduciaries can be held personally liable for losses that could have been covered by a fidelity bond.

It is highly recommended that each plan sponsor frequently assess the bonding coverage to comply with requirements and to prevent any associated risks. ERISA does not require fiduciary liability insurance, however, it should be considered as protection against fiduciary breaches. Fiduciary liability insurance is designed to provide defense costs and applicable damages for actual or alleged breaches of fiduciary duty. Unlike the fidelity bond, fiduciary liability insurance offers plan fiduciaries protection of personal assets.

1,2,3protect-your-employee-benefit-plan-with-an-erisa-fidelity-bond.pdf (dol.gov)

Contact EisnerAmper

If you have any questions, we'd like to hear from you.

Receive the latest business insights, analysis, and perspectives from EisnerAmper professionals.