Building a Sustainable AML Program

The responsibility of compliance with NYDFS Part 504 must be shared across the Bank. Compliance, Technology, Operations, and other functional areas all have a role to play.

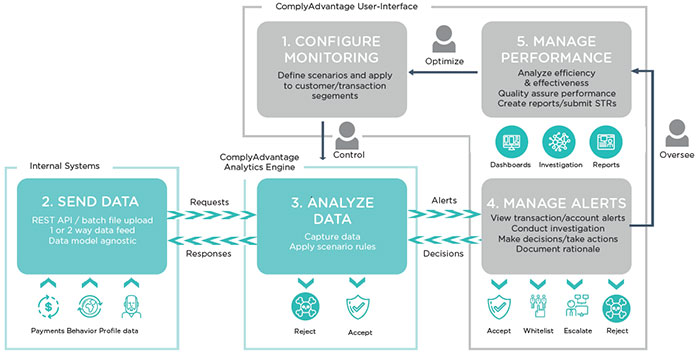

Maintaining compliance with regulation requires a centralized risk management tool that integrates multiple data sources, streamlines the processes, manages accountability, and provides management oversight to continually optimize compliance.

Our Unique Approach

We utilize the next generation of screening and monitoring technology, powered by artificial intelligence to provide the required transparency into the end-to-end program.

Recognized Benefits:

- Performance: Artificial Intelligence and machine learning enables automation across broader sources, deeper profiles, and real-time updates.

- Data Integrity: Consistent across Customer Identification, Sanctions Filtering and Payments programs.

- Accountability: Workflow tool with full audit history of completed searches, when they were done, by whom, and levels of escalation required to drive accountability and data ownership.

- Governance: Customizable dashboard reporting with real-time snapshots, for continual review.

powered by ComplyAdvantage

What's on Your Mind?

Start a conversation with the team