Partner Home Office Deductions Under COVID-19

- Published

- Jan 14, 2021

- Topics

- Share

This article discusses the basics of the home office deduction in light of the current pandemic, the considerations for whether or not it can taken, and how to claim that deduction. Here, we will focus specifically on how members of a partnership can take this benefit.

Who Qualifies?

Only workers with self-employment income can take advantage of the home office deduction. Self-employment income is derived from carrying on a trade or business as a sole proprietor, independent contractor, or owner in certain partnerships. Additionally, the home office must be (1) used regularly and exclusively for work; and (2) your principal place of business.

What Qualifies as Exclusive Use?

The home office must be a separately identifiable space that is used exclusively for a singular business. It cannot be used for personal matters or multiple businesses. And, it does not need to be a whole room or divided by a permanent structure.

What Qualifies as the Principal Place of Business?

A home office is the principal place of business if it is used exclusively for management and administrative activities. It is possible to have a home office and rent commercial space, but the home office must be the place where these activities are generally conducted.

Special Considerations for Partners

You may be allowed to deduct unreimbursed ordinary and necessary expenses that you paid on behalf of the partnership (including qualified expenses for the business use of your home) if you were required to pay these expenses under the partnership agreement or practice and they are trade or business expenses (IRS Publication 587, Private Letter Ruling 9316003).

Partners in partnerships deduct their home office deductions and other unreimbursed partner expenses on Schedule E, page 2, as a separate line item that reduces their partnership income. The tax return instructions indicate that the deduction should be captioned Unreimbursed Partner Expenses (“UPE”).

Example

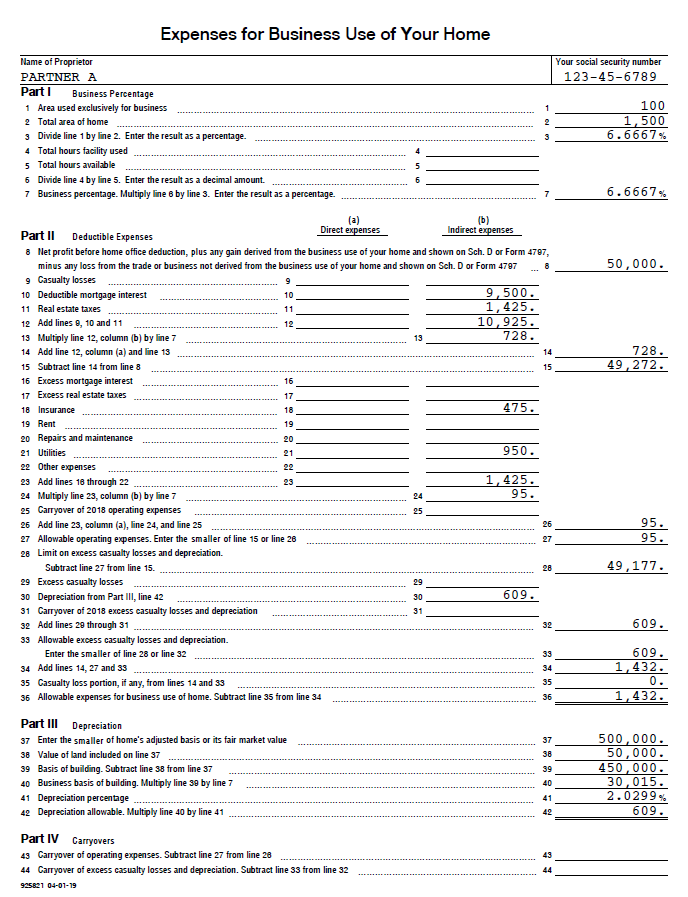

In mid-March, Partner A began to work exclusively from home due to COVID. The house was purchased on January 1, 2015, for $450,000. However, home office activity didn’t start until March 15, 2020. With a total space of 1,500 square feet, the home office space represented 200 square feet. The partner met all of the aforementioned requirements. Additionally, he had $50,000 of self-employment income from the partnership. The following expenses were not reimbursed (mid-March – December):

- Mortgage interest – $1,000 a month x 9.5 months = $9,500

- Real estate taxes – $150 a month = $1,425

- Insurance – $50 a month = $475

- Utilities – $100 a month = $950

If property is sold later, there may be income recapture if you take depreciation as a deduction now. While partners are able to benefit from home office deductions, it is important to be aware of the wrinkles involved.

Contact EisnerAmper

Ready to take the next step? Share your information and we’ll reach out to discuss how we can help.