Accounting: Presentation of an Operating Measure in the Statement of Activities

- Published

- Jan 10, 2020

- By

- Jimmy Mo

- Share

Nonprofit organizations should consider using an operating measure if it would paint a more accurate picture of the nonprofit's financial performance for its fiscal year.

Introduction

During a recent Parent-Teacher Association ("PTA") meeting, the Head of School of a private independent school is talking to the students' parents about the need for a sizeable tuition increase for the next school year. The parents in the meeting are upset upon seeing a positive change in net assets without donor restrictions balance for the last two fiscal year-ends in the school's audited financial statements. The school's statement of activities only presents total revenues and total expenses to calculate one bottom-line change in net assets amount. Without any further information, the Head of School is having a difficult time appealing to the parents.

A loan officer of a financial institution is in the process of reviewing a social service organization's application for a new line-of-credit. The social service organization's latest audited financial statements indicate a significant amount of management and general expenses, resulting in a large negative change in net assets without donor restrictions balance. The negative balance resulted in a very small net assets without donor restrictions balance as of the last fiscal year-end. The loan officer is worried about the possibility of the large management and general expense balance occurring in future years and, therefore, the social service organization's ability to continue as a going concern over the period of the line-of-credit request.

In both of these scenarios, the bottom-line results of the audited financial statements do not portray the most accurate financial picture for these not-for-profit entities ("NFPs").

Recent and current authoritative guidance

On 4/22/2015, the Financial Accounting Standards Board ("FASB") issued an exposure draft on what would ultimately become Accounting Standards Update ("ASU") 2016-14, Presentation of Financial Statements of Not-for-Profit Entities. Part of the main provisions in this exposure draft would require not-for-profits to present a subtotal for operating activities on the statement of activities. This subtotal would be distinguished from other activities on the basis of whether the resource inflows and outflows are from or directed at carrying out an not-for-profits purpose for existence and available for current-period operating activities.

The FASB contends that requiring a not-for-profit "to present more standardized intermediate measures of operations in the statement of activities would be helpful in communicating the not-for-profits financial performance. The proposed measures, the operating excess (deficit) both before and after transfers, should result in greater comparability of information across the NFP sector, especially within industries. Those proposed measures also allow an NFP to show creditors, donors, and others how the NFP is managed by reflecting a measure (subtotal) before and after discretely presented internal (self-imposed) constraints placed on resources by governing board actions and the removal of such constraints." 1

When ASU 2016-14 was finalized in August 2016, the FASB did not include a standardized intermediate measure of operations requirement. Instead, the FASB plans to address this issue in a future project (known as Phase 2 of the FASB's NFP project). The FASB did not provide a timeframe for the completion of Phase 2.

The current accounting standards discussing operating measures for NFPs are addressed in FASB Accounting Standards Codification ("ASC") 958-220-45-9 and 958-220-45-10, which state the following:

45-9 Classifying revenues, expenses, gains, and losses within classes of net assets does not preclude incorporating additional classifications within a statement of activities. For example, within a class or classes of changes in net assets, an NFP may classify items as follows:

- Operating and non-operating

- Expendable and nonexpendable

- Recognized and unrecognized

- Recurring and nonrecurring

- In other ways

45-10 This subtopic neither encourages nor discourages those further classifications. However, because terms such as operating income, operating profit, operating surplus, operating deficit, and results of operations are used with different meanings, if an intermediate measure of operations (for example, excess or deficit of operating revenues over expenses) is reported, it shall be in a financial statement that, at a minimum, reports the change in net assets without donor restrictions for the period. Example 1 (see paragraph 958-220-55-5) illustrates a statement of revenues, expenses, and other changes in net assets without donor restrictions that subdivides all transactions and other events and circumstances to make an operating and non-operating distinction.

Although there is no requirement to do so, NFPs should consider using an operating measure if it would paint a more accurate picture of the NFP's financial performance for its fiscal year.

Accounts to consider removing from an operating measure

One of the challenges in defining a consistent definition of an operating measure in NFPs is that different subindustries within NFPs will have different points of view on what is an appropriate operating measure. For example, a museum that has multiple revenue streams could choose to exclude investment income from its operating measure, while a private foundation whose only income stream is investment income could choose to include interest, dividends, and realized gains and losses while choosing to exclude unrealized gains and losses.

While different subindustries within NFPs will have different opinions on what is considered an appropriate operating measure, the following are some accounts that all can consider removing from an operating measure:

Nonprogrammatic expenses. If an NFP has certain expenses that the NFP does not consider part of its normal operations (such as changes related to split-interest agreements or swap agreements), the NFP may choose to exclude them in order to show income from program operations. Therefore, an NFP's operating expenses would then likely consist of expenditures related to the generation of the NFP's programmatic revenues, which includes supporting activities.

Components of investment income. If an NFP wants to show to a user of its financial statements that it relies primarily (or mainly) on its program-generated revenue, the NFP may choose to exclude investment income.

An NFP could also choose to exclude certain components of investment income, such as unrealized gains and losses. Since investments at NFPs are recorded at fair value on their statement of financial position, a significant increase or decrease in stock market prices on the last day of the NFP's fiscal year-end could result in large unrealized gains or losses. The stock market prices could then swing back to their previous prices on the first day of the next fiscal year, therefore making the unrealized gain or loss temporary in nature.

An NFP could also sell a high-dollar investment, resulting in a large nonrecurring realized gain or loss for the fiscal year. An NFP could determine that these temporary or nonrecurring investment gains and losses would inaccurately present the normal annual operating income of the NFP to the user of the NFP's financial statements and could elect to exclude them from the operating measure.

Contributions revenue restricted for a nonprogrammatic purpose. At times, an NFP will solicit donations through a capital campaign to raise significant funds over a specified period of time. Usually the money raised is used to fund the acquisition, construction, or renovation of a building or to create or increase an NFP's endowment. The NFP may choose to bifurcate these contributions from the general programmatic contribution revenues that the NFP receives, thus removing them from its operating measure and carving out large, temporary inflows of nonrecurring or nonprogrammatic contributions revenue.

Nonrecurring transactions. An NFP may consider removing nonrecurring transactions from its operating measure to ensure that these transactions do not inflate or deflate operating income for a given fiscal year. Examples of these transactions include gains or losses associated with the disposal or sale of property, impairment of assets, litigation related expenses, and contributions or expenses related to new ventures (such as joint ventures).

Examples of using an operating measure

Examples of how an operating measure would benefit an NFP are further illustrated below, using the two scenarios noted in the Introduction section.

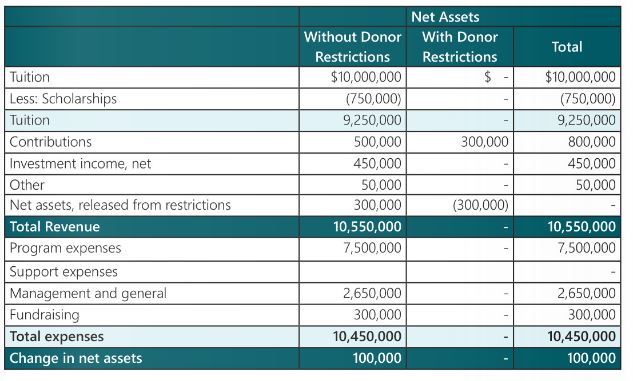

Example 1. Assume that the private independent school presents its statement of activities as shown in Exhibit 1. As noted earlier, the Head of School is attempting to justify the need for the sizeable tuition increase for the next school year while the parents are fixated on the $100,000 surplus for the year. The parents cannot understand why the Head of School is trying to increase tuition when this surplus is presented.

The presentation in Exhibit 1 does not clearly communicate that the school is currently relying on investment income to support its current operations. Since NFPs typically report investments at fair value, investment income normally includes unrealized gains and losses. Suppose that $200,000 of the $450,000 investment income, net balance relates to unrealized gains on the school's investments. Therefore, in order to utilize the entire $450,000 investment income, net amount, the school would need to sell its entire investments portfolio to receive funds associated with the unrealized gains.

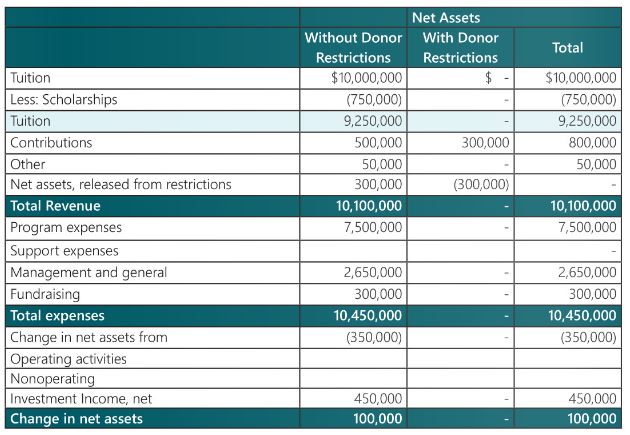

Now suppose the school determines that the investment income, net balance is not part of the operating measure of the school. As a result, the school presents its statement of activities as shown in Exhibit 2.

Using this presentation in Exhibit 2, the Head of School can make a clear case for a tuition increase. The school now shows a $350,000 operating loss by using the presentation of an operating measure. Therefore, the school's current non-investment related income is clearly insufficient to support the current operations of the school.

The school can also show variations of an operating measure. For example, the school could consider only the unrealized gains or losses portion of the investment income, net balance as non-operating income. By doing so, the school would include interest, dividends, realized gains and losses, and investment fees in the operating measure.

The school's governing board should determine what presentation paints the desired picture and then be consistent from year to year.

As noted earlier, a social service organization provided financial statements indicating a $500,000 net loss in its statement of activities as part of a loan application. The result of the net loss has significantly decreased the social service organization's net assets without donor restrictions, which were positive in the previous fiscal year by $450,000.

The loan officer is concerned that a recurring net loss in a future year will reduce the social service organization's net assets without donor restrictions to a negative number and, therefore, the social service organization may not have the ability to pay back any funds drawn down on the line-of-credit.

Unknown to the loan officer is that the social service organization restructured its management during the fiscal year and incurred $300,000 of restructuring costs. The social service organization presents its expenses in a functional classification on its statement of activities. Therefore, the restructuring costs are not readily apparent.

As an alternative, the social service organization can exclude the restructuring costs from its operating measure within its statement of activities. In doing so, the social service organization would present an operating net loss of $200,000. While the net assets without donor restrictions balance would still be a deficiency of $50,000, the social service organization would be able to indicate that $300,000 of the net loss is nonprogrammatic and nonrecurring.

This information could possibly present the loan officer with more accurate information on the liquidity of the social service organization over the next year since the loan officer can obtain a clearer picture of the social service organization's recurring operating net loss.

Disclosure requirement when reporting an operating measure

Unless clearly apparent, the operating measure should be defined in the footnotes as noted in FASB ASC 958-220-45-12, if an NFP chooses to present an operating measure with its statement of activities.

"If an NFP's use of the term operations is not apparent from the details provided on the face of the statements, a note to financial statements shall describe the nature of the reported measure of operations or the items excluded from operations. If an NFP presents internal board designations, appropriations, and similar actions on the face of the financial statements, a note to financial statements shall provide an appropriate disaggregation and description by type of these actions if not provided on the face of the financial statements."

Conclusion

Presenting all revenue together and all expenses together may not provide a clear picture of an NFP's "normal" operations. Excluding non-operating transactions from an NFP's operating measure is one way to clearly show the NFP's financial picture and the message it is trying to send.

Exhibit 1. Private Independent School-Statement of Activities

Exhibit 2. Private Independant School-Statement of Activities - Investmetn Income, Net Balance Not Part of Operating Measure

1 https://www.fasb.org/jsp/FASB/Document_C/DocumentPage?cid=1176165949852&acceptedDisclaimer=true

© 2020 Thomson Reuters/Tax & Accounting. All Rights Reserved.

What's on Your Mind?

Start a conversation with Jimmy

Receive the latest business insights, analysis, and perspectives from EisnerAmper professionals.