Not-For-Profit Board Compensation

- Published

- May 2, 2024

- Share

While still a rare practice, increasing attention is being paid to nonprofit board compensation. Nonprofit organizations generally do not compensate board members for several reasons, some of which may be:

- Heightened scrutiny under the IRS Intermediate Sanctions,

- Various protections under the Federal Volunteer Protection Act,

- The perception that board tenure is an act of public service.

However, there are a variety of reasons why some organizations might see board compensation as the right move for them, including:

- An increase in organizational size and complexity which makes the job of board members more demanding,

- Organizations seeking to grow their mission might need to recruit board members with subject matter expertise in particular areas,

- Competition for board talent,

- A desire for board members from diverse socioeconomic backgrounds who may be unable to devote time to unpaid work.

More organizations are beginning to ask whether this general guideline is outdated. Since both approaches have trade-offs, determining whether an organization should pay its board members should be driven by the organization’s unique needs.

To help facilitate discussions on nonprofit board compensation, Compensation Resources conducted an analysis of nonprofit board compensation using publicly available information reported in IRS Form 990s.

Methodology

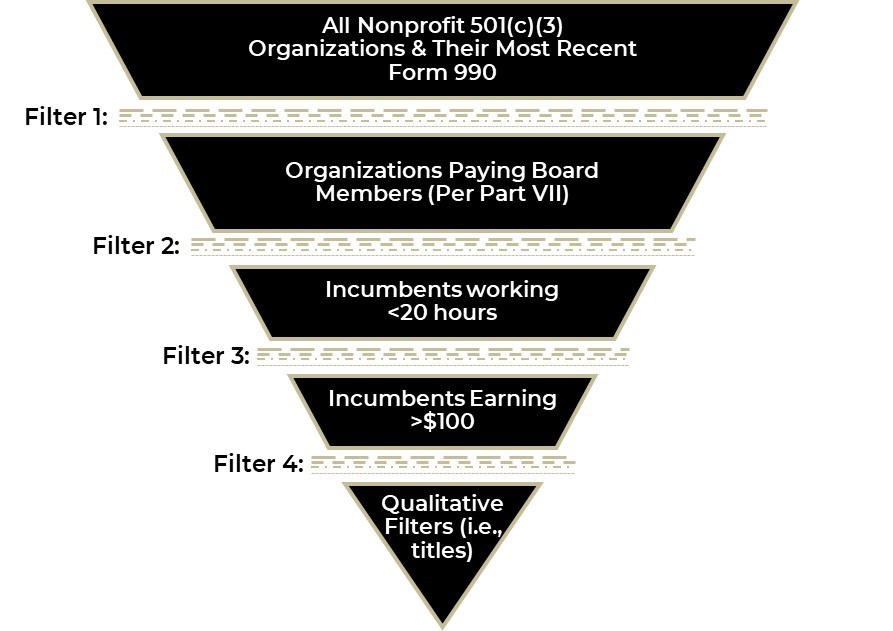

Below is an overview of our data collection process illustrating which organizations were analyzed:

Summary statistics of the dataset can be seen here:

|

Total IRS Form 990s Filed in 2023 |

501(c)(3) Organizations |

Organizations in Sample |

Total Paid Board Members |

|---|---|---|---|

|

~350,000 |

~260,000 |

~7,000 |

~20,000 |

Roughly 2-3% of 501(c)(3) organizations pay their board members for their service, with most organizations only paying one or two board members.

An overview of board compensation practices among this sample can be seen here:

|

|

# Paid Board Members |

Total Board Member Comp. |

Assets ($M) |

Revenue ($M) |

|---|---|---|---|---|

|

75th %ile |

2.0 |

~$30,000 |

$6.4 |

$3.8 |

|

Median |

1.0 |

~$12,000 |

$1.0 |

$0.8 |

|

25th %ile |

1.0 |

~$4,000 |

$0.3 |

$0.3 |

These summary statistics are useful in painting a general picture of the 501(c)(3) organizations that compensate their board members.

Results

Regressions are a way of testing and quantifying the relationships between a group of variables. We tested various data points found in the Form 990s using regression to see which variables have the most insight into what drives board compensation. The following table illustrates our findings:

|

|

R2 Values (Goodness of Fit) |

|

|---|---|---|

|

|

Total Assets |

Total Revenue |

|

Number of Paid Board Members |

12.9% |

12.6% |

|

Total Board Member Compensation |

9.5% |

11.1% |

|

|

|

|

|

Average R2 |

11.2% |

11.8% |

In quantifying the above board compensation, we used the amounts reported in Part VII Column (D), which reflect reportable W-2 compensation from the filing organization for each 990. Part VII also includes two other sources of compensation: W-2 compensation from related organizations and “other compensation” from the filing organization and related organizations, which could include deferred compensation, reimbursements, and various perquisites.

Focusing on this component of compensation, we identified approximately 1,500 incumbents across approximately 400 organizations who do not receive W-2 compensation from the filing organization but do receive “other compensation.” The compensation range for this component is $100 at the low end, $1,000 at the median, and $200,000 at the maximum.

Conclusion

Mission-driven organizations remain sensitive to perceptions around the allocation of funds for compensation. Providing compensation to board members may give pause to donors and the community at large. However, if the organization can show value in the contributions made by board members in furthering the organization’s mission, the appetite to provide compensation may increase.

Properly documenting the roles and responsibilities of board members and how compensation for these individuals has been determined is imperative. Reasonable compensation guidelines have continually been applied to highly compensated officers of NFPs through IRS 4958 (Intermediate Sanctions); a test of reasonableness may also be used here. Preserving the nonprofit’s reputation and avoiding any conflict of interest or perception of misappropriation of funds are guiding principles to be applied when deciding whether to provide compensation to its board members.

What's on Your Mind?

Start a conversation with Mary

Receive the latest business insights, analysis, and perspectives from EisnerAmper professionals.