Elevate Your Insurance Customers’ Experience Through Conversational AI

- Published

- Oct 6, 2022

- Topics

- Share

By Deepti Sameera

Since COVID-19, technology disruptors have transformed the insurance industry for the better. In partnership with Intone, EisnerAmper recently hosted the webinar “Elevate Your Insurance Customers’ Experience Through Conversational AI,” addressing how insurance customers can employ Digital Transformation strategies using tools such as InsurAI (an automation bot that leverages conversational AI) to augment, enhance and elevate customers’ experience, be it product selection, filing claims/underwriting processes and more.

Panelists included:

- Ken Croarkin, partner-in-charge of insurance, EisnerAmper;

- Nitin Kumar, senior solutions manager, Enterprise Bot; and

- Ashok Panigrahi, senior vice president of sales & operations, Intone.

COVID-19 has dynamically impacted customer interactions, and virtual interactions are on the rise compared to face-to-face interactions.

Customers are constantly re-routed to digital channels for information, service and queries, and deploying digital technology is key for insurance companies in customer satisfaction.

During COVID-19, insurance companies faced a handful of operational challenges that made them realize digital transformation is crucial. They included:

- Managing channel overload;

- Mitigating fraud risk; and

- Running on outdated processes.

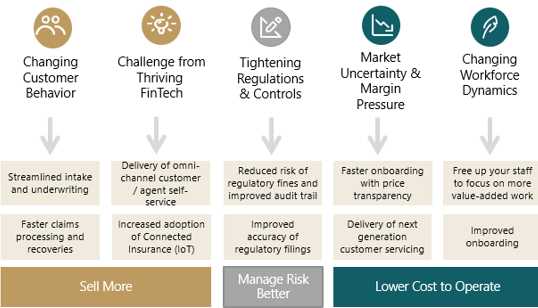

Those insurance companies that have laid out a digital transformation roadmap will gain a competitive advantage and a boost to their bottom line. Insurance companies will have to leverage such technologies to streamline operations, including claims processing and underwriting, to improve efficiency. InsurTech should inevitably focus on omnichannel distribution and robust automation of various tasks to refine customer services. One of the keys these packages bring to the table is the end-to-end omni-channel experience.

Shifting Trends Within Customers’ Journey

Claims Processing Automation

In the insurance industry, claims processing requires multiple interactions between people and systems, gathering a vast amount of information from several sources and manual data entry, often leading to human errors or omissions. This results in delays while submitting claims.

To resolve this issue, business process automation (BPA) and robotics process automation (RPA) come as a boon, helping to automate time-consuming insurance claim processing activities like updating client’s information and uploading medical reports and images of the damaged property onto the system by interfacing with RPA tools. Thus, RPA in insurance enables insurers to speed up their business processes while keeping costs under control.

24x7 Availability

Customers are requesting 24x7 availability of customer service representatives and the best way to manage that is through deployment of conversational AI chatbots.

Need for Omni-Channel Experience

Customers are now requesting a more seamless and cohesive customer experience with quicker solution delivery times no matter where or when the customer reaches out.

Personalization and Policy Selection

Chatbots have been instrumental in increasing customers’ experience helping customers in a timelier fashion.

In addition, AI can be implemented in underwriting since a major amount of unstructured data comes to the underwriter. Since extracting data from thousands of customers can be time-consuming and more likely to cause errors, AI and machine learning can be integrated into legacy applications, helping insurers simplify the underwriting process. It is important to note that these packages will not replace underwriters but only help them augment their work. InsurAI, for instance, which is now being used by major insurance companies in Europe, addresses many of the shifting trends within insurance post COVID-19.

The webinar can be viewed here.

EisnerAmper does not represent or warrant that any product(s) or service(s) depicted in this content are appropriate for any particular business purpose or use. The material contained in this presentation is for the general information of our clients and business associates and should not be acted upon without prior professional consultation with a legal, accounting, or other professional.

Contact EisnerAmper

If you have any questions, we'd like to hear from you.

Receive the latest business insights, analysis, and perspectives from EisnerAmper professionals.