QUALIFIED OPPORTUNITY ZONES: Tax Act’s Overlooked Provision

- Published

- Nov 2, 2018

- Share

Previously published on Bloomberg.com

A little-noticed provision of the Tax Cuts and Jobs Act of 2017 holds the promise of providing long-term economic growth to parts of the country where recovery from the Great Recession is still largely a rumor. It will also provide a windfall to investors looking to defer or eliminate capital gains taxes.

State and federal officials have designated almost 8,000 Qualified Opportunity Zones, in places where job growth and income have lagged behind national averages. Investors with capital gains on existing investments, such as those generated by the sale of stock or a business, are being encouraged to plow those monies into businesses or real estate developments in these zones.

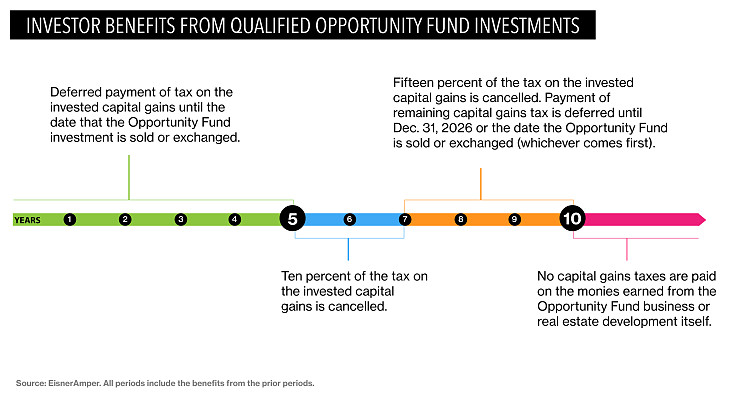

If they maintain the investments for more than 10 years, 15 percent of the tax on the capital gains they invested is cancelled, and they pay no capital gains tax on the income from the business or real estate development they funded.

The investor community is only now coming to understand the magnitude of the provision, according to Kenneth Weissenberg, Tax Partner and Partner-in-Charge of the Real Estate Services Group at accounting firm EisnerAmper. "These zones will provide an enormous benefit" to investors, he says.

They'll also help the designated communities, says Lisa Knee, Tax Partner at EisnerAmper. "The premise behind this was to incentivize growth and renewal, bringing the recovery to pockets of America, both urban and rural, in which it has yet to show itself."

Uneven Recovery

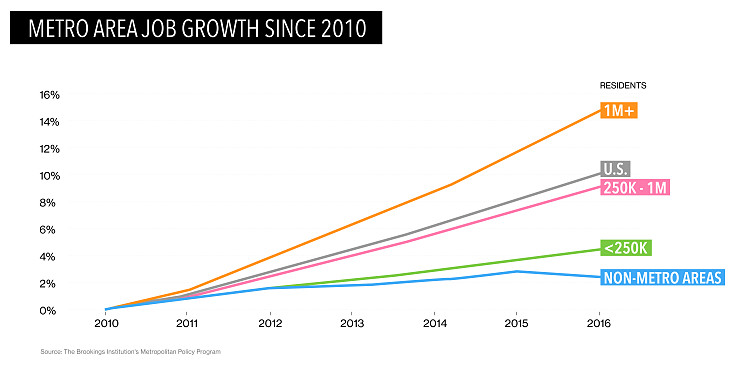

With national unemployment at its lowest level in almost five decades and equity markets near historic highs, it would seem America has more than recovered from the catastrophe of 2008. But job growth has barely budged in non-metro areas, while most cities with 1 million or more inhabitants have seen double-digit increases.

The zones are meant to reduce this disparity. They were inserted into the act by Senator Tim Scott, a South Carolina Republican, who worked closely with the Economic Innovation Group (EIG), a Washington, D.C. think tank funded by Sean Parker, Facebook's first president and cofounder of Napster. (An earlier bill that would have created the zones, co-authored by Scott and New Jersey Senator Cory Booker, attracted bipartisan support.)

The zones range from most of 125th Street in Harlem to all of downtown Detroit, to large swaths of rural Arizona.

Rather than set aside part of the federal budget to fund development, the Qualified Opportunity Zone provision taps capital gains. At the end of 2017, Americans had $6.1 trillion dollars in unrealized capital gains, according to an EIG analysis of Federal Reserve data.

Tapping Capital Gains

Under IRS Code Section 1031, real estate investors have long been able to defer capital gains taxes when they swap one investment property for another. The Qualified Opportunity Zones provision takes that concept and extends it to almost any kind of capital gain, including those from the sale of a stock, a business asset, or any other property.

Those gains can be invested in Qualified Opportunity Funds (QOFs), which must have 90 percent or more of their assets invested in the zones, according to Weissenberg. The funds can invest in any business or real estate development in the zones, except those on a list of so-called “sin businesses,” such as sun tanning studios, liquor stores and racetracks, he explains. After realizing their gains, investors have up to 180 days to roll them over into a fund.

While the biggest benefits are reserved for those who hold investments for a decade or longer, there are lesser advantages for shorter-term investors.

The zones have a sunset date of Dec. 31, 2026. An open question is whether investors will be required to liquidate their funds as of that date, or whether they can sell later and still realize the provision's benefits, says Knee. The IRS is expected to issue guidance on that and other details later this year.

An interesting planning idea would involve combining the New Markets Tax Credit (NMTC) with a QOF. There are enough similarities between the two provisions that would allow an investor to receive a deferral and a tax credit. Once detailed regulations are issued however, they may somewhat limit the ability to benefit from both provisions. “There are a lot of nuances,” says Knee, “and we are working on making sure that our clients are aware of how to structure for the possibility of both benefits to its investors.”

In the meantime, major banks have begun exploring setting up funds for their institutional clients and high-net-worth individuals, Knee says. Weissenberg says he's fielded questions from two dozen individuals, who are each planning to sell a significant asset soon.

“This section on Qualified Opportunity Funds is the definition of a win-win for both investors and communities looking to close the growth gap.” says Weissenberg. Knee says that she expects to see interest in this area build up. “The growth opportunity here is just too good to ignore,” she says.

Contact EisnerAmper

If you have any questions, we'd like to hear from you.

Receive the latest business insights, analysis, and perspectives from EisnerAmper professionals.