Pandemic Uncertainty Has Put Commercial Real Estate Capital on the Sidelines

- Published

- Oct 20, 2020

- Topics

- Share

The numbers are in and as expected commercial real estate transaction volume continued to fall in the third quarter of 2020, the second quarter of the pandemic. No property type or market was spared, although some clearly performed worse than others. Investors truly do not like uncertain returns. Even when real estate capitalization rates provide a historically wide spread over fixed income alternatives, capital is staying put. Rental revenues remain unpredictable, and demand for space in many sectors had been decreasing even before the spring. As a result, price discovery remains elusive. Nonetheless, some real estate, perhaps the highest quality and the most distressed, is trading.

Transaction volumes

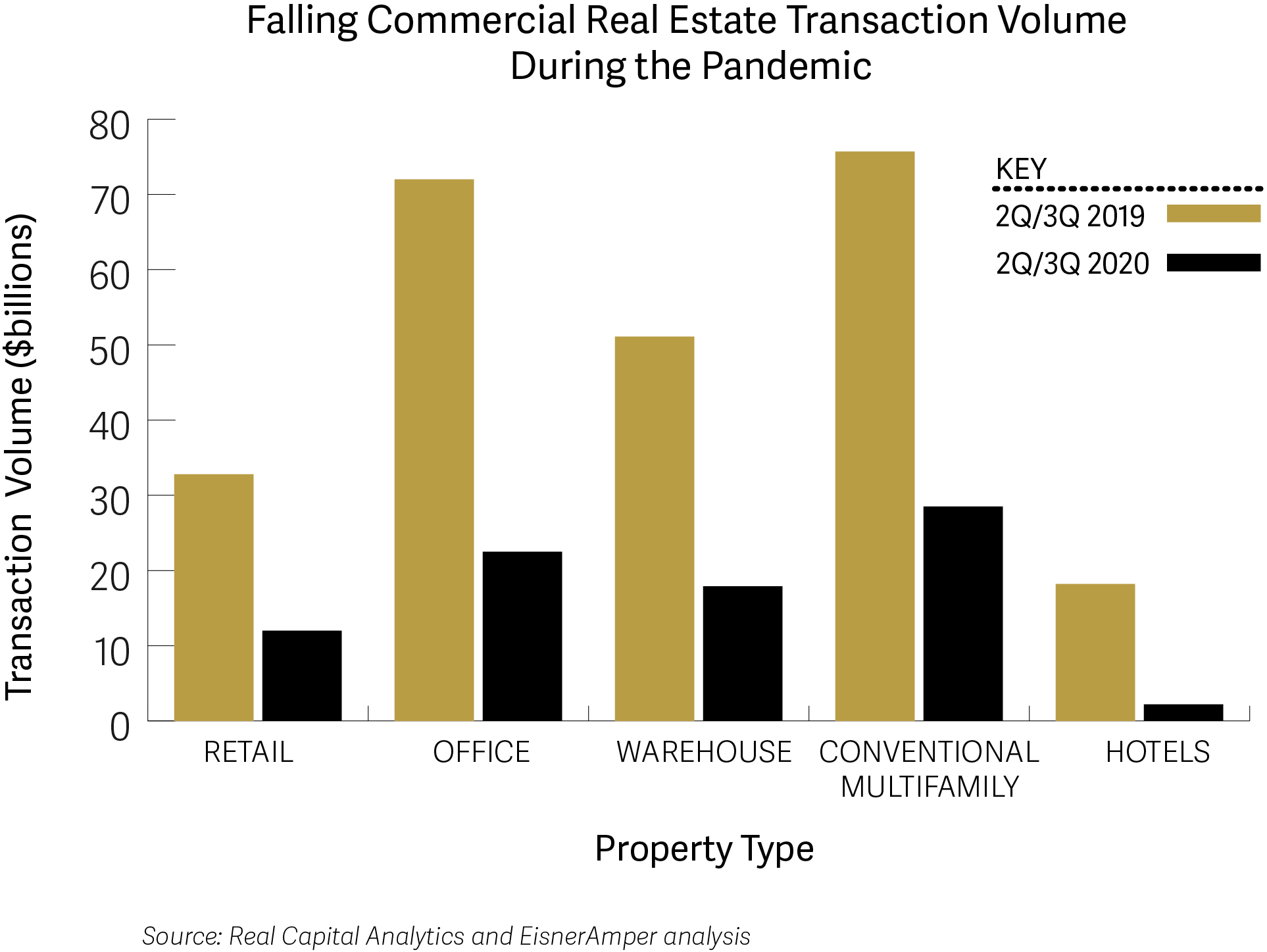

For this analysis we are measuring the dollar value of transaction volume during the combined second and third quarters of 2020, the period during which the pandemic most greatly impacted business. Sales across the major property types were down an average of 70% over the corresponding six months of 2019; 65% when excluding hotel transactions (see chart).[1] Hotel deals fell 88% compared to a 68% decline in office sales, a 65% decline in warehouse sales, a 63% decline in retail sales, and a 62% decline in the sales of conventional multifamily. The data suggests that irrespective of the property type, most buyers and sellers are stepping back until there is more certainty about the future. What makes these statistics even more concerning is the realization that many of the deals that closed were likely in the works before the pandemic struck. That momentum likely ended months ago, so the volume of fourth quarter trades is likely to remain low.

Focusing on retail, which has suffered the most from tenant financial distress: It is a bit surprising that grocery anchored retail transactions fell 82%, well above the average for all retail sectors. Although many of these centers have performed relatively well since lockdowns were lifted, investors appear to be undecided on whether consumers will return to stores to smell the produce or now prefer to order online from the comfort of their couches, or both. Until that question is answered, owners may want to hold on to these local shopping centers.

Looking more closely at the office market, there were fewer urban office sales than suburban: Central business district (CBD) sales were down 77% while suburban office sales were down 60%. Suburban properties may become more attractive to investors if companies and their employees continue to avoid urban density and long commutes. COVID-19 has accelerated the growth of e-commerce and warehouse distribution centers remain the darling of the real estate industry. Even so, warehouse transactions have fallen, particularly in the third quarter of 2020 when sales were down 78% from the third quarter of 2019. It should be noted that from the third quarter of 2019 through the first quarter of 2020 there was almost $90 billion of property sales, many of which were portfolio trades, while in the third quarter of 2020 most of the $7.7 billion traded were individual properties.

Pricing

It appears that a broad decline in prices or an increase in capitalization rates has not followed the falling volume of transactions. According to Real Capital Analytics, average hotel capitalization rates have stayed in the 8.6% to 8.7% range since early in 2019. Similarly, retail has remained in the 6.5% to 6.6% range. Of course these are overall property sector numbers and individual deal pricing varies widely by market, use, and tenancy. However, the relative stability of capitalization rates is partially explained by the remarkable drop in Treasury rates. During the second and third quarters of 2019, 10 year Treasury rates fell from 2.25% to 1.75%. In the third quarter of 2020 they fell to almost 0.50% before settling in around 0.65%. As a result, the spread between capitalization rates and Treasury rates has widened by over 100 basis points since last year, and is now an average of 550 basis points across property sectors.[2] And it is interesting to note that even before the pandemic capitalization rates did not trend down with Treasuries, but appeared to have found a floor. Anecdotally, many market players are expecting capitalization rates to trend higher in the next few quarters.

Markets

The trend in transaction volume varied greatly across major urban markets. In retail, there were virtually no grocery-anchored center sales in Seattle, or big box retail sales in Dallas or Chicago. The drop in hotel transactions was particularly steep in such markets as Los Angeles, New York, Miami, Chicago and Seattle, the types of cities where hotel performance is reliant on fly-in tourism, business, and convention travelers, all of which are substantially on hold. CBD office sales dropped significantly in Dallas and Seattle. Overall, it appears Seattle had a proportionately larger drop in property transaction volume than other major cities.

Conclusion

We remain in a period of great uncertainty for the real estate industry. Perhaps the greatest unknown is the duration of the pandemic and its ultimate toll on tenants’ ability to pay rent. The answer will determine whether commercial real estate is experiencing a short-term, pandemic-related interruption, or the long-term cycle has pivoted from positive to negative. The reduction in property sales during the second and third quarter of 2020 is evidence that buyers and sellers haven’t yet figured out which scenario to bet on. Price discovery will take time and, other than some players pursuing specific tax strategies, sales are not likely to pick up the fourth quarter. When sales do begin, it is expected that values will fall based on reduced cash flow, irrespective of the advantages of the low interest rate environment, and on the increasing number of distressed deals hitting the market. Ultimately, equity returns and capitalization rates will be determined in the battle between those investors who believe in a permanent change in the use of space and those who are confident that behavior will quickly return to pre-COVID-19 norms.

[1] All data sourced from Real Capital Analytics with EisnerAmper analysis.

Contact EisnerAmper

If you have any questions, we'd like to hear from you.