Maneuvering a Cash Flow Crisis During COVID-19

- Published

- Apr 28, 2020

- Topics

- Share

Having available cash during times of crisis, such as COVID-19, could be the difference between the life and death of a business. Cutting costs on operations, putting emphasis on cash conversions, leveraging government programs, and utilizing other unconventional ways to produce cash flow are options available to businesses in any industry. Let’s examine a few strategies a business can consider taking to survive a cash flow crisis.

Reduce Variable Costs

Operations have shrunk tremendously for many companies during the COVID-19 pandemic. It is situations like this where many managers are re-evaluating their costs as revenues decline and where cash is quickly running out. Reducing variable costs is a quick way of reducing cash outflow, as opposed to reducing fixed costs. Examples of this include suspending travel for non-essential events, putting a hold on hiring, and cutting entertainment costs. It is also a big challenge when labor is the highest cost to a business, such as professional services. There are different paths to consider to help avoid layoffs, such as encouraging employees to take PTO, reducing contract and consulting labor, and redistributing work to full-time staff.

A/R and Discounts

The cash conversion cycle during a pandemic is severely disrupted, and businesses must take necessary precautions to ensure payments on receivables. One method to quickly generate revenue is asking for deposits. Having an upfront cost ensures some type of payment, and the amount can be determined on a case-by-case basis, because other businesses are having the same issues. Businesses that have cash on hand may also be able to take discounts for early deposits and payments. This transaction satisfies both sides, especially those that desperately need cash. Charging interest or a late penalty may also be necessary for the opposite scenario.

Inventory Management

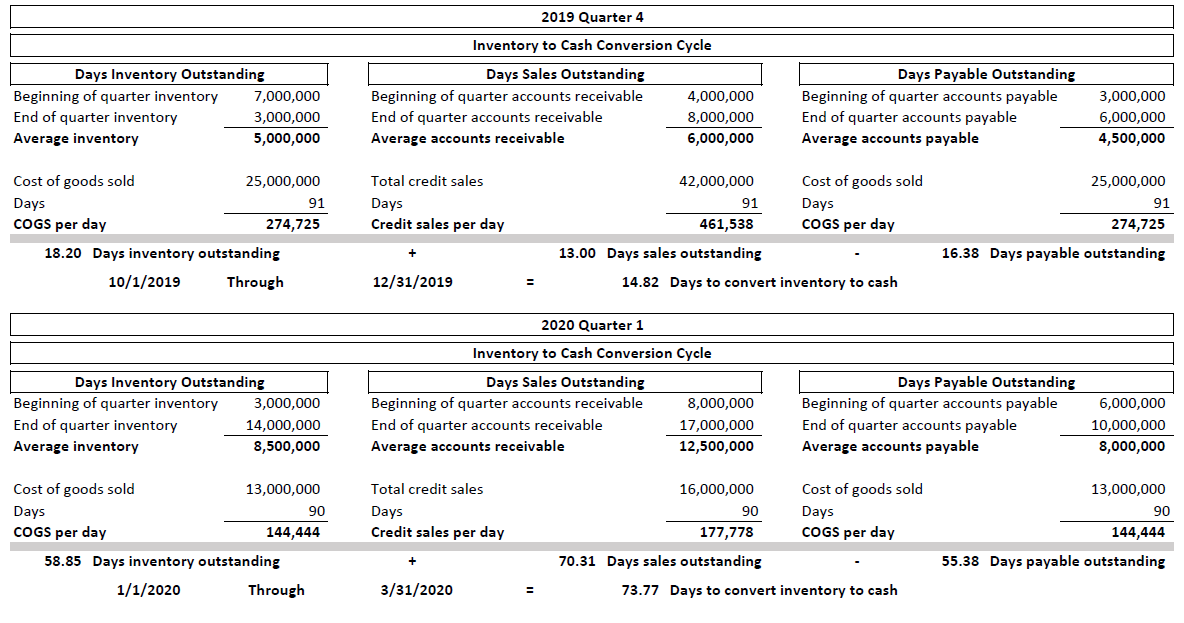

The inventory component of the cash conversion cycle may be more important to some businesses as opposed to others. Measuring this performance is simple. Measure the inventory conversion cycle by taking average inventory divided by cost of goods sold per day. This efficiency ratio equals days in inventory. This tells the number of days’ funds tied up in inventory. The days in inventory ratio figure is then used in the cash conversion formula. This is another simple formula that is calculated by adding days in inventory (previously calculated above) plus days sales outstanding (average accounts receivable divided by credit sales per day) minus days payables outstanding (average accounts payable divided by cost of goods sold per day). This formula equals the amount of days a company turns its initial investment into cash. If the ratio appears to be much higher than normal, a business should consider ways of reducing its production of finished goods, decreasing the purchase of raw materials, or selling excess inventory. An example of this scenario follows:

Outside-the-Box Options

There are many unconventional strategies to produce quick cash flow if desperately needed. The procedures should include, but not be limited to:

- Leasing Assets – Any type of equipment that can be useful to another organization can be rented to raise cash.

- Considering Crowdfunding – A newly popular option where companies can raise funds at a low cost via online fundraising platforms like Indiegogo, Kickstarter and others.

- Vendor Financing – Leasing options may be available for equipment or software, as it reduces upfront costs and cash going out.

- Factoring – This is where a company can convert its receivables to cash by assigning them to a factor with or without recourse. The receivables are often sold at a discount, depending on how collectible they are. Assigning them without recourse indicates the sale is final and the assignor assumes no risk of any losses on collections. An assignment with recourse means the assignor is required to repurchase the occurrence of uncollectible receivables or replace them with other receivables.

- Selling-Off Assets – While this may harm a business in the long run, a company that cannot survive in the short term may consider selling off excess inventory, customer lists or intellectual property. These may generate the necessary cash to survive, and they may have cash value when it is needed the most.

- Forming a Buying Cooperative – Companies can negotiate lower prices with suppliers if they work together to order goods in large quantities.

- Optimizing Online Presence – Online strategic marketing can help generate revenues for products and services that are needed during a pandemic, such as COVID-19.

Certainly, some of these measures are more on the extreme side. But this pandemic will no doubt force many business to seriously consider these measures to survive.

Contact EisnerAmper

If you have any questions, we'd like to hear from you.

Receive the latest business insights, analysis, and perspectives from EisnerAmper professionals.