Understanding Why Fraud Occurs and How to Take Action When It Does

- Published

- Nov 15, 2022

- Share

By A.J. Woloszynski

For many business leaders, the thought of falling victim to fraud can be easily written off as an impossibility by their confidence and trust in those around them. Though, with the possibility of a looming recession, it is important to keep the threat of fraud at the forefront of our minds. The reality is, due to various factors, during times of economic downturn the risk of falling victim to fraudulent activities is heightened.

Because of these factors, it’s more important than ever for all organizations to be proactive about not only understanding their risk exposure to fraud but having a plan of action once it’s identified.

Here, I’ll cover why fraud risk increases with economic uncertainty, how to identify and react to fraud, as well as a valuable resource for business leaders to identify potential gaps in their prevention, identification and response strategies.

Understanding Why Fraud Occurs

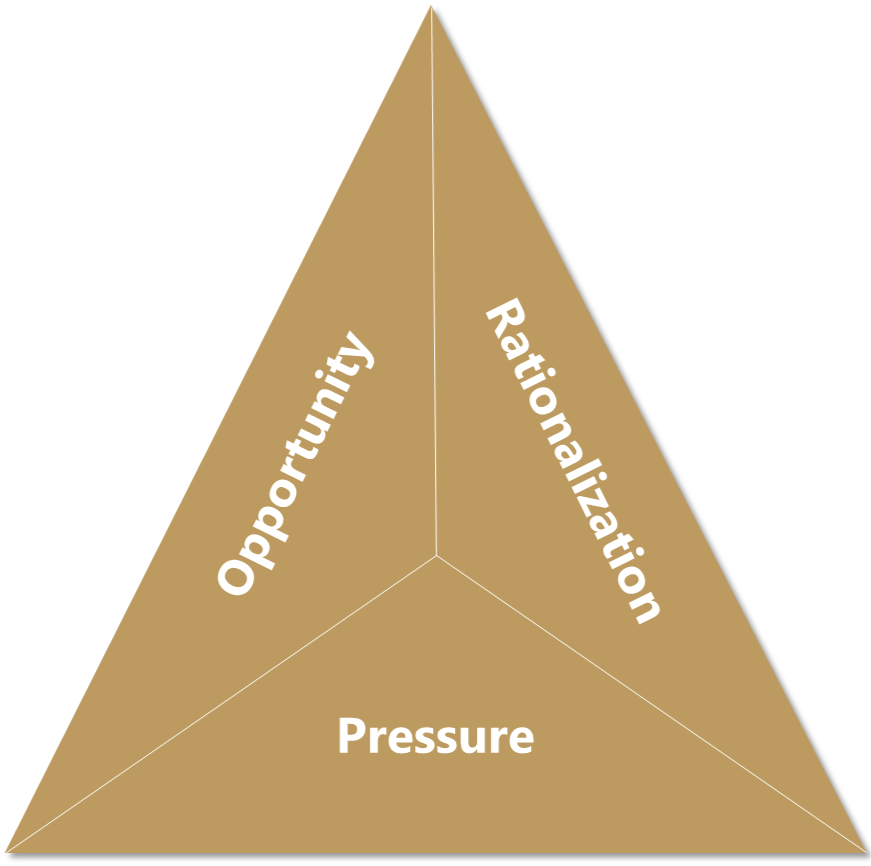

To help us understand why fraud occurs, forensic professionals have long used an idea known as the Fraud Triangle. Developed by Dr. Doanld Cressey, the Fraud Triangle outlines three variables that are all generally present when someone decides to pursue fraudulent activities, which holds especially true during times of economic uncertainty. Here are the three pillars that make up this concept.

Opportunity

Opportunity

Whether it’s a lack of implementation of internal controls all together or weaknesses in the operating effectiveness of controls, control deficiencies are exploited in one way or another in most fraud schemes. During difficult economic times, companies often do not consider the ramifications to the control environment of their organization when they let employees go and consolidate responsibilities that should generally be split across two or more individuals. This concept is known as having proper segregation of duties, which in crucial in the defense against fraud.

Pressure

As people fall on hard times, they are motivated to do whatever it takes to sustain the lifestyle to which they are accustomed. For example, shortly after the recession in 2008, the Association of Certified Fraud Examiners (“ACFE”) conducted a survey where more than half (55.4%) of respondents indicated an increase in fraud had occurred over the previous 12 months. In the same survey, 49.1% of respondents also indicated financial pressure was the primary driver of increased fraudulent activity. In other words, desperate times can lead people to take desperate measures.

Rationalization

There are various reasons why one would consider fraudulent activities. Whether individuals view the funds they plan to misappropriate as a temporary way to float through a difficult period—and intend to replant the funds in the future before anyone notices—times of economic uncertainty seem to expand the lengths individuals will go to rationalize breaking the law.

Steps to Take When You Suspect Fraud

Take a Breath

Identifying and confronting fraud can be shocking and often is perpetrated by individuals you might least suspect. The adrenaline rush that comes with the realization that fraud has occurred can lead to rash decisions. Although fraud can have crippling effects to a company, there are resources to help. With upfront fraud response plans in place, having the proper tools to lean on in a difficult time is crucial.

Contact an Expert

If you are a larger organization with in-house counsel, your first call should be to their office. In situations where you do not have counsel at your disposal or an attorney on retainer, a law firm geared to handle white-collar crime is a safe bet. In many instances, these attorneys will have relationships with forensics and accounting experts who will assist in identifying exactly what happened and assist in preparing a proof of loss to be filed with an insurance provider. An example of the importance of involving experts early on is highlighted by companies falling victim to ransomware attacks. In many cases, it might seem easier to simply pay the amounts demanded; however, this can open an organization up to severe legal consequences should they pay funds to sanctioned entities.

Pencils Down and Hands Up

It can be tempting to seize laptops or email accounts and start sifting through documents to determine if your intuitions are correct and be able to confront the individual with a “got you” moment. However, when dealing with serious white-collar crimes, one of the most important things to remember is chain-of-custody of evidence. If laptops or evidence are seized without proper oversite and controls, this could yield an easy defense.

Confronting Those Involved

It is important to not let your emotions get the best of you when identifying fraud. For one, it is important not to tip your cap too soon and inform the suspect right away, as this could make gathering all evidence to support your suspicion difficult. However, it is equally important to begin restricting their access to any systems they may be using to perpetrate their fraud. This requires a delicate balance of ensuring all potential evidence remains with the organization while simultaneously restricting the day-to-day abilities of the individual(s).

Contact Your Insurance Company

Depending on the nature of the fraud and the insurance available, it is important to loop your insurance provider in as soon as possible, because some policies may include clauses requiring a timely notification. Fidelity Bond Insurance is the most common form of business insurance that protects an employer against losses due to fraudulent activity.

Prevention Going Forward

Once fraud has been identified and addressed at an organization, it is often thought that it will never happen again. In many cases this is true, and controls are put in place to ensure the same mistakes are not made twice. That said, many times the focus of implementing change is closely associated with the specific fraud that occurred and not at the entity level. If fraud was able to occur in one area of the organization, there are likely other cracks as well. It is important to evaluate the organization, understand where vulnerabilities are, and not simply focus on patching the issue that was exploited.

Tools at Your Disposal

The ACFE Fraud Prevention Checklist is a great starting point in the defense against fraud. This checklist allows an organization to understand what preventative measures may already be in place and where the organization is falling short. Below are some of the questions an organization might want to ask itself to get a sense of how equipped it currently is to defend against fraud.

- Is ongoing anti-fraud training provided to all employees of the organization?

- Is an effective fraud reporting mechanism in place?

- Is the management climate at the top level one of honesty and integrity?

- Are fraud risk assessments performed to proactively identify and mitigate the company’s vulnerabilities to internal and external fraud?

- Are strong anti-fraud controls in place and operating effectively?

- Does the internal audit department, if one exists, have adequate resources and authority to operate effectively and without undue influence from senior management?

Are employee support programs in place to assist employees struggling with addiction, mental/emotional health, family or financial problems?

The Bottom Line

Whether it is someone going through difficult times or simply a bad egg taking advantage of an opportunity, keeping fraud at the forefront of your organization's mind is particularly paramount during times of economic uncertainty. Beyond any monies lost when falling victim to fraud, the reputational harm weighed upon an organization can be equally, if not more, damaging. So stay vigilant, be prepared, and remember that there are resources available to help prevent and respond to fraud.

This article is part of EisnerAmper’s Fraud Week Series. For more information on fraud awareness week, visit www.eisneramper.com/fraud-awareness.

Contact EisnerAmper

If you have any questions, we'd like to hear from you.

Receive the latest business insights, analysis, and perspectives from EisnerAmper professionals.