The CFO 2.0: The New Frontier

- Published

- Dec 6, 2017

- Share

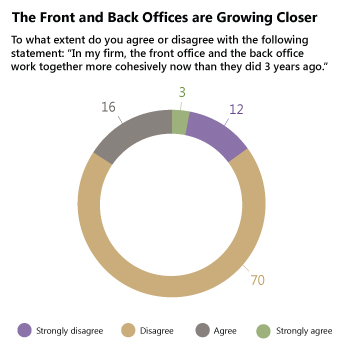

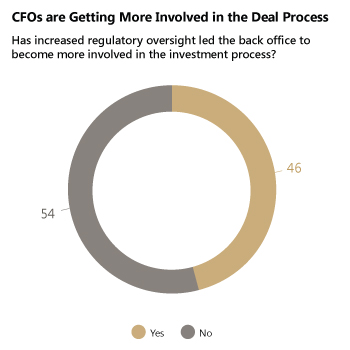

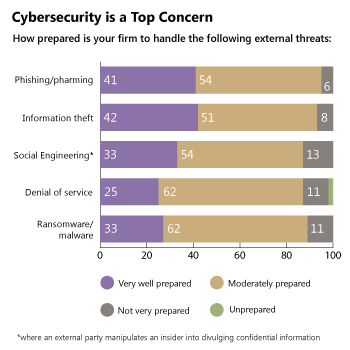

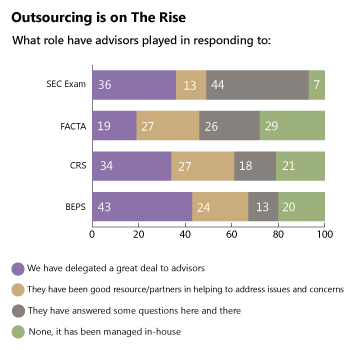

The role of the CFO has changed enormously over the last two decades as the private equity industry has developed. To find out exactly what is different, EisnerAmper and Private Funds Management (PFM) undertook a two-year survey of more than 150 private funds finance professionals. The results of this in-depth analysis and research are presented in the online publication and reveal the regulatory and technological issues that are reshaping the CFO function across the private equity funds industry.

How has the role of the CFO changed?

The survey sought to define the role of today’s CFO amid greater disclosure demands additional compliance requirements, increasingly complex US and global tax reporting, and a steady stream of new regulatory requirements.

See highlights below on the seven things you should know about CFO 2.0

Download The CFO 2.0: The New Frontier

Contact EisnerAmper

If you have any questions, we'd like to hear from you.

Receive the latest business insights, analysis, and perspectives from EisnerAmper professionals.