Family Office Technology Solutions: How Information Facilitates Family Cohesion

- Published

- Jun 2, 2022

- Topics

- Share

One of our Partners and Natalie McVeigh, Managing Director, respectively, at EisnerAmper presented the third webinar is a series on “Family Office Technology Solutions.”

M and Natalie discussed the importance of communication in creating and maintaining family cohesion among generation 1 (“G1”) and the younger generations (“G2” and “G3”). Family governance is a slippery slope among the generations. The senior family members commonly institute a junior board to indoctrinate the next generation into the decision-making process. Although the junior board makes insignificant or inconsequential decisions at the outset, it is a great training tool to prepare them for a more senior role within the family office/enterprise. The key takeaway was how G1 communicates the continuum of the family enterprise, be it a family office or a family enterprise, as control transitions from G1 to G2 with the Kirby Rosplock proviso that: “Ultimately, family governance that integrates a family office will become a way of life for the family.” Kirby is co-founder and chief learning officer of Tamarind Learning and provides vision, leadership and strategic direction for families.

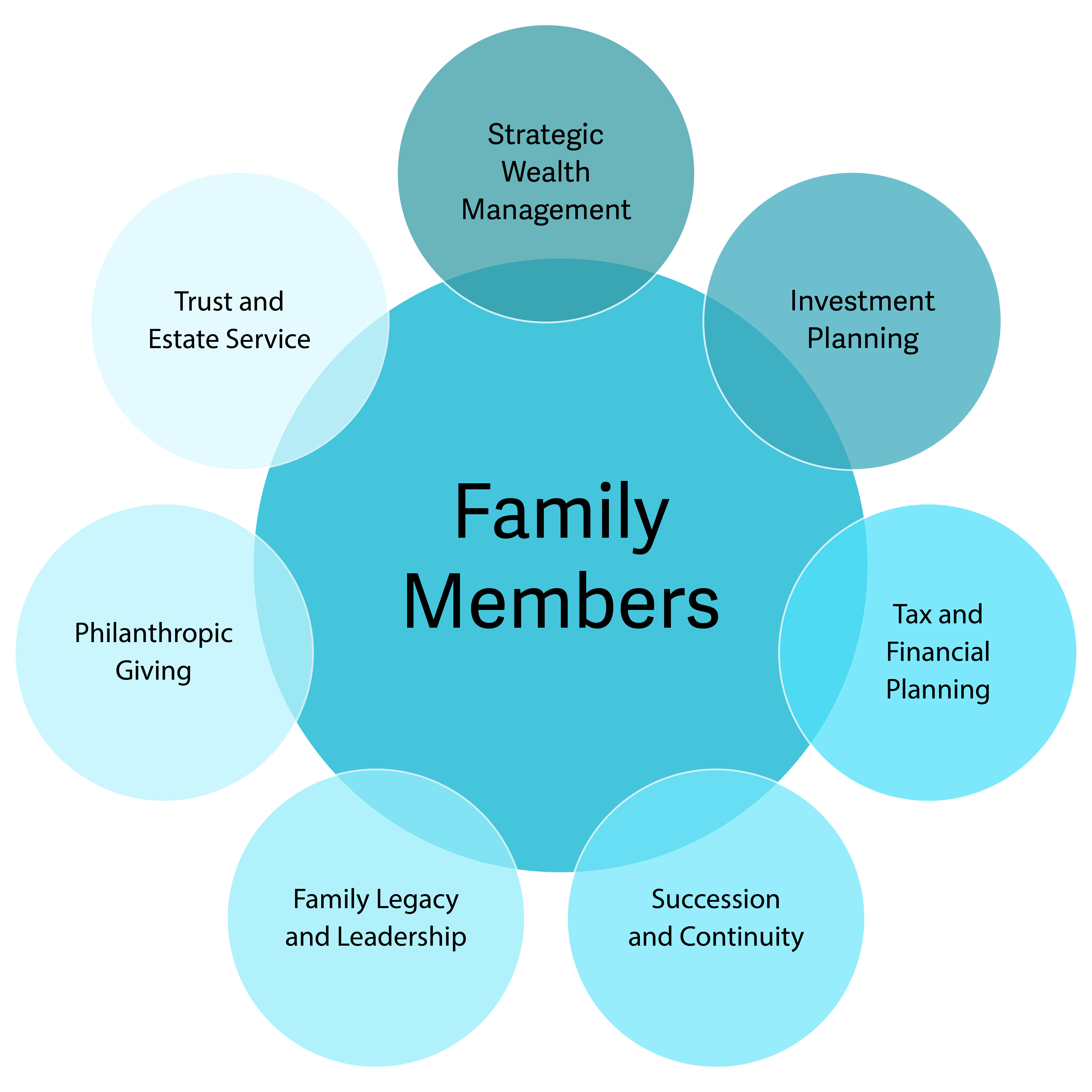

With the emergence of a family enterprise or family office, family members have common service lines to consider, illustrated by this graphic:

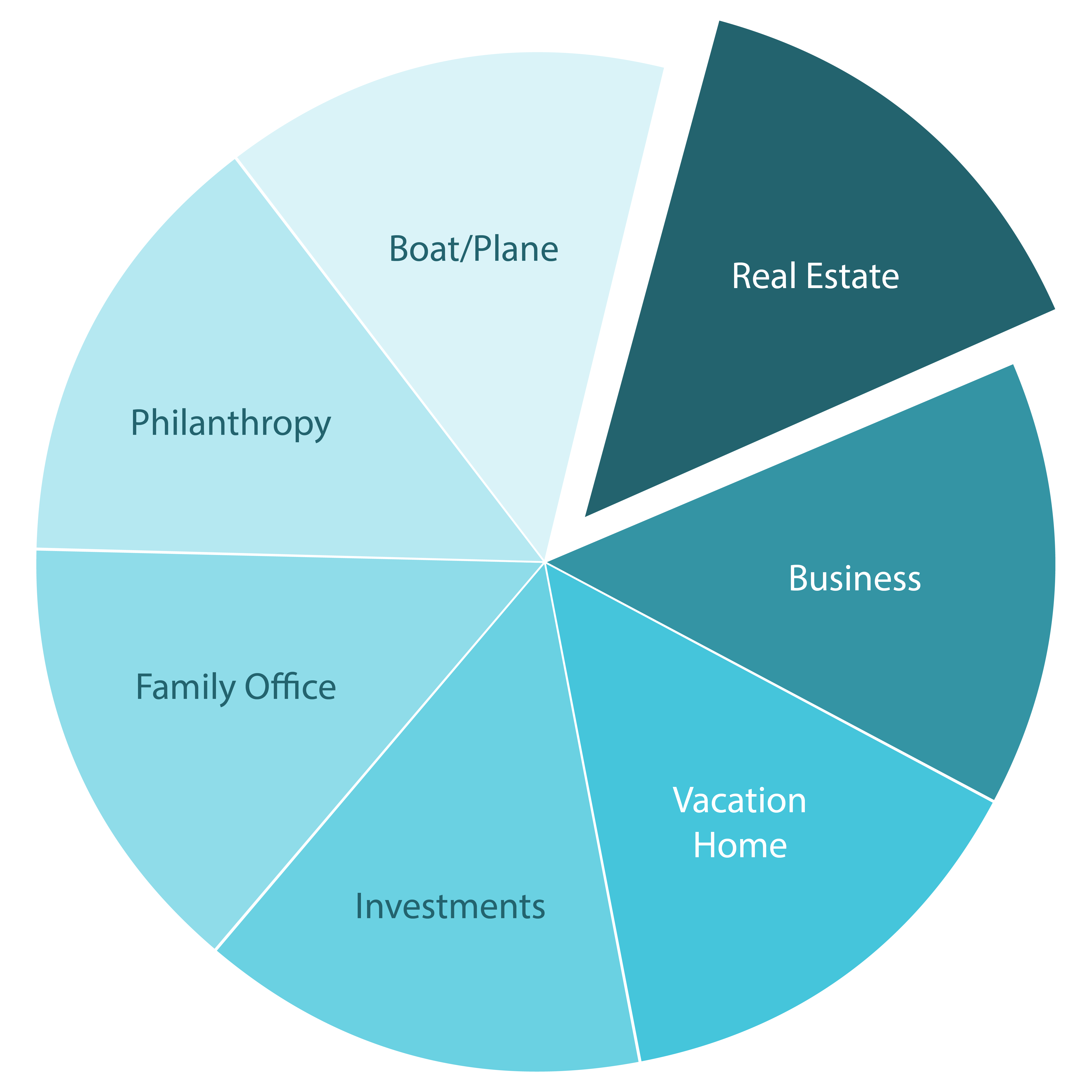

The family enterprise is anything with shared ownership, shared management or shared decision-making; and it may take many different forms as depicted in this pie chart:

As first-generation wealth founders seek to cement their legacies through the continuation of their successful business endeavors and the wealth they have created, there is a need to create a family office for smooth cohesiveness in attaining family goals and the family legacy. The family office is created with a board comprised of family members and trusted advisors to the family. They look to bring the next generation into the family enterprise or business.

The success of the family office depends on the shared goals, communication and trust among the family members. The biggest obstacle to the achievement of any of these initiatives is the relinquishment of control by the patriarch/matriarch or the sharing of such control. With trust comes open communication; with communication comes obstacles. Adult development theory, which is a progression from simple to complex behavior from a less differentiated state to a more differentiated state, unconsciously comes into play. Adult developmental theory often encompasses stages sand phases.

Some stages, phases and obstacles of communication are:

- Fear of hurting feelings

- Knowing family, history, precedent

- Boundaries

- Distance

The components of trust are:

- Sincerity

- Reliability

- Competence

It is a best practice for family offices to be transparent and accountable to family members and provide them with relevant and timely financial reports. Keeping family members informed of the status of the family enterprise on a timely basis fosters trust and confidence in the family office. The accounting staff of a family office often works with outdated technologies and/or may have multiple projects going on at the same time, thus slowing down the delivery time of rendering reports to family members. Having an automated and integrated accounting system improves the timeliness and efficiencies of financial records. Providing such reports can create opportunities for in-person or virtual meetings to discuss the financial results, thus increasing communication amongst family members.

It is also a best practice to make the financial reporting clear and understandable for readers. Visualization of data for family reporting, such as dashboards or snapshots, can provide on-demand, easy-to-understand information for family members. The focus should be on the needs of multi-generational family members. This fosters a sense of trust and communication among the family members, thus keeping the family cohesive.

The takeaways from this webinar are:

- Family dynamics are complex.

- Transitioning control is complex.

- Commonality of objectives are difficult.

- Trust must be earned.

- Use of technology to provide relevant financial information to family members will increase trust and communication.

What's on Your Mind?

Start a conversation with James

Receive the latest business insights, analysis, and perspectives from EisnerAmper professionals.