Avoid Being a Consumer Fraud Victim During COVID-19

- Published

- Apr 27, 2020

- Topics

- Share

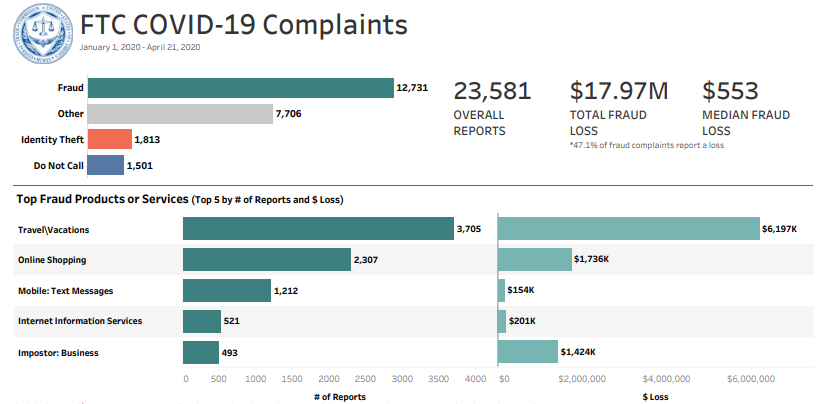

Consumer fraud has risen significantly due to the coronavirus pandemic. Scammers are out in full force distributing a lot of false formation in order to take advantage of others during this crisis. According to the Federal Trade Commission (“FTC”), as of April 21, 2020, there has been more than 23,000 new reports of COVID-19-related scams with a related loss of approximately $18 million. The top complaints highlighted in the chart below center on travel and online shopping. Let’s take a look at how to spot some scamming methods currently being used

Advanced Fee/Prepayment Scams

A consumer who is shopping online more frequently while at home during this crisis is susceptible to this common fraud tactic. Here, an individual or business will ask that you electronically pay upfront fees for goods or services that will never be provided. This can be nuanced very well in an email, for example, that bypasses your spam folder. Online ads, text messages, phone calls and mail are various ways that fraudsters lure consumers into this trap. Scammers will often pose as legitimate companies that are offering a onetime deal or a highly incentivized credit card. If it seems too good to be true, it probably is and should be avoided.

Internet Purchase Scams

This is the most common type of consumer fraud. While there are many legitimate online shopping and travel websites, there are also many fraudulent ones that you need to be careful of when online shopping. The COVID-19 pandemic has led to an explosion in e-tailing, and the demand for household products is higher due to the short supply. The biggest red flag is when it comes time to pay for the product and the method of payment that is requested. Scammers frequently ask for payment with money orders, preloaded debit cards or wire transfers. When making an online purchase, make sure you’re using a secure payment method and avoid paying the individuals directly over the internet. Consider where your money is going. If the business uses a P.O box or a mail drop, be suspicious. A business with a non-working or unanswered telephone number is another red flag.

Phishing Scams

This involves a fraudulent attempt to obtain sensitive information (e.g., usernames, passwords and credit card details) by disguising oneself as a trustworthy entity in an electronic communication. Scammers will often reach out via email, text and other platforms to entice consumers to simply click on a link or open an attachment in order to access their personal information.

There is a viscous shopping and travel scam going around where people looking for refunds on cancelled trips or products receive a fake notification to confirm bank account or credit card information to process a “refund.” With many people sharing users for shopping and travel accounts, they may be unaware if something was actually bought by another person on the account and automatically assume the refund is legitimate. They are also desperate to get their money back as hotels, booking sites and other travel-related companies are scrambling to process an unprecedented number of cancellation requests due to COVID-19.

Shortage Scams

High-demand supplies—like masks, sanitizers, toilet paper, rubber gloves—are essentially unavailable. Scammers are re-selling these products online for an outrageous price. Known as price gouging, it is illegal and also includes fraudsters selling the goods as damaged, used, or non-existent. Based on the severely limited supply, consumers are turning to other options out of desperation. You need to maintain, or even heighten, you level of due diligence during this public health crisis. Read reviews, email friends and family for proven product sources, be aware of unusual payment methods, double-check return policies, and examine the location and contact information of the seller.

It is unfortunate that fraudsters are taking advantage of the current crisis, but it’s neither the first nor last time this will happen. That’s why you need to be able to recognize and avoid these schemes before you become an FTC statistic..

Contact EisnerAmper

If you have any questions, we'd like to hear from you.

Receive the latest business insights, analysis, and perspectives from EisnerAmper professionals.