Wyden’s “Ending the Carried Interest Loophole Act” Would Require Annual Ordinary Income Inclusions

- Published

- Aug 24, 2021

- Topics

- Share

Background and Applicability

On August 5, 2021, Senate Finance Committee Chairman Ron Wyden (D-OR) and Senate Finance Committee member Sheldon Whitehouse (D-RI) introduced the "Ending the Carried Interest Loophole Act" (the "Bill" or the "Proposal").

Managers of various types of investment funds that are structured as partnerships often receive a profits interest in the fund, commonly referred to as a "carried interest," in exchange for their services. Under general principles of partnership taxation, the carried interest can be issued by the partnership without current tax. The partner holds the interest as a capital asset and generally recognizes income only when the partnership disposes of its investments, realizes income from them, or when the partner sells its partnership interest. The character and timing of the income is generally determined by reference to the timing of recognition and character of profits made by the partnership.

In recent years, there have been multiple proposals to change the taxation of carried interests. Most notably, IRC Sec. 1061 was enacted as part of the Tax Cuts and Jobs Act of 2017, which generally treats gain recognized in respect of applicable partnership interests ("APIs") held for less than three years as short-term capital gain. More recently, the Biden Administration has proposed that all partnership income earned from carried interest allocations be taxed as ordinary income and subject to self-employment taxes if the taxpayer's taxable income exceeds $400,000.

The Bill would apply to partners of a partnership in which a taxpayer holds one or more APIs at any time during the tax year. API is defined in the Bill to be largely consistent with the term as currently used in IRC Sec. 1061 and generally covers the typical activities of fund managers that hold partnership interests in connection with the performance of services. If enacted, the Bill would repeal IRC Sec. 1061 and instead subject the holder of an API to current inclusion of compensation income, taxable at ordinary income rates and subject to self-employment tax, in amounts that approximate the interest that would accrue on a hypothetical loan equal to the capital required to generate an amount of profits allocable in respect of the carried interest.

Deemed Compensation Amount

Under the Proposal, a taxpayer holding an applicable partnership interest is treated as recognizing ordinary income equal to the partner's "deemed compensation amount." A taxpayer with a deemed compensation amount is concurrently treated as realizing a long-term capital loss in an equal amount.

The deemed compensation amount is recognized annually by the taxpayer, regardless of whether the partnership recognizes income or gain and regardless of whether and when the API holder receives distributions in respect of their carried interest.

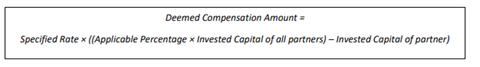

The deemed compensation amount with respect to any API for any partnership taxable year is the product of the "specified rate" multiplied by an amount equal to the "applicable percentage" of the weighted average of "invested capital" of all partners of the partnership over the weighted average invested capital with respect to the API at each "measurement date."

The Detailed Summary released with the Proposal provides the following formula for calculating the deemed compensation amount:

Specified Rate

The specified rate is a deemed interest rate which is the sum of a statutory rate determined by the Treasury (1.21% for June 2021) plus nine percentage points. The statutory rate equals the par yield for five-year High Quality Market corporate bonds for the first month of the calendar year with or within which the partnership's tax year begins.

Applicable Percentage

The applicable percentage is the highest percentage of profits of the partnership that could be allocated with respect to the partner (consistent with the partnership agreement and determined as if all performance targets with respect to such interest had been met). In a fund context, this would typically be the general partner's 20% interest in profits after the limited partners have received a preferred return.

In certain circumstances, such as with "catch-up" provisions, it is possible for the API holder to be allocated 100% of the profits in a given tax year. The Proposal suggests that Treasury Regulations would be issued to modify the calculation in such instances.

Invested Capital

Invested capital is analogous to the partner's capital account and generally equals capital contributions to the partnership and income allocations less distributions by the partnership and loss allocations.

Measurement Date

Invested capital is measured on the last day of the partnership tax year, on each day in which the Treasury Regulations allow the partnership to revalue its property for the purpose of determining capital accounts and on any other date provided by the IRS.

Essentially, the API holder is treated as having borrowed an amount equal to the capital that supports the partner's highest possible share of profits under the applicable partnership agreement, assuming that all performance targets have been met, minus any capital actually invested by the partner. The Proposal would seem to argue that the amount of interest the API holder did not have to pay is representative of a carried interest compensation which should be characterized as ordinary income.

Other Provisions

Accelerated inclusion of deemed compensation amount: Under the Proposal, if a partner sells an API within the ten-year period following the acquisition of the interest, the partner is required to accelerate the future deemed compensation amount by requiring the partner to include in income the sum of all deemed compensation amounts that would have been included through the end of the ten-year period.

IRC Sec. 83: The Proposal provides for a deemed election under IRC Sec. 83(b) in the event of a transfer of an API, unless the partner affirmatively opts out.

EisnerAmper Observations

The “Ending the Carried Interest Loophole Act” goes a step further than previous proposals, as it not only changes the character of income in respect of the carried interest, but also changes the timing of such income.

While the Proposal provides that the API holder would simultaneously recognize long-term capital loss equal to the deemed compensation amount, the holder's ability to utilize the capital loss will depend on the holder having at least that amount of capital gain (from the partnership or other sources). Since the API holder is taxed annually at ordinary rates, a taxpayer may ultimately be taxed on income that the taxpayer did not earn and be left with a capital loss of limited or no use.

The Proposal would repeal IRC Sec. 1061 and, therefore, ordinary income treatment would apply regardless of holding period (i.e., long-term capital gains held for less than three years would be characterized as ordinary income as opposed to short-term capital gain under IRC Sec. 1061). Though there is currently no rate differential between ordinary income and short-term capital gains, the change in character could raise state-sourcing and other issues. Fund managers located in New York City, for example, could see an increase in unincorporated business tax liability as a result of the deemed compensation inclusion.

Tax policy changes need thoughtful analysis of what is likely to become law. Fund managers should seek counsel from their tax advisors in order to plan accordingly.

What's on Your Mind?

Start a conversation with Brett

Receive the latest business insights, analysis, and perspectives from EisnerAmper professionals.