IRC Sec. 1202 Capital Gains Exclusion (Part II)

- Published

- Mar 12, 2021

- Topics

- Share

The qualified small business stock (QSBS) exclusion for IRC Sec. 1202 has been a hot topic as it provides large tax savings to taxpayers when selling shares of QSBS. During a recent EisnerAmper webcast led by Jeff Kelson, Partner, panelists reviewed specific case studies and how they satisfied each section of IRC Sec. 1202 to take advantage of this tax deferral provision. Panelists included:

- Jeff Kelson, Partner, Firm-Wide Service Area Leader, EisnerAmper

- Kayla Konovitch, Partner, EisnerAmper

- Ben Aspir, Senior Manager, EisnerAmper

History

IRC Sec. 1202 stock exclusion was enacted on August 10, 1993 with the goal of encouraging long-term investment in start-up companies and other small businesses by exempting capital gains from taxation upon the sale of stock in these entities. Exclusions can range from 50% to 100% of gain on qualifying stock sales. In addition, excluded QSBS gains are also excluded from the 3.8% net investment income tax, further encouraging taxpayers to invest in QSBS. This has led to tremendous interest by private equity and venture capital managers as it offers an incredible tax incentive to their investors and general partners increasing their rate of return on investments.

| IRC Sec. 1202 Stock Acquired | Capital Gain Exclusion |

AMT Addback |

Tax Rate on Gain Not Excluded |

|---|---|---|---|

| 8/11/93 - 2/17/09 | 50% | 7% | 28% |

| 2/18/09 - 9/27/10 | 75% | 7% | 28% |

| 9/28/10 - Present | 100% | 0% | n/a |

A non-corporate taxpayer can potentially exclude (per issuer) 50%, 75% or 100% of the gain realized from the sale of QSBS held for more than five years; however, limitation rules must be applied.

Limitation

- IRC Sec. 1202 gain exclusion is the greater of $10 million ($5 million, if married filing separately) from QSBS stock in that corporation (lifetime limit) or ten times the taxpayer’s basis in the QSBS stock (annual limit).

QSBS Requirements

- Issued by a domestic corporation after August 10, 1993;

- Aggregate assets of the corporation do not exceed $50 million before and immediately after issuance;

- Issued by a corporation that uses at least 80% of its assets in active trade or business (other than personal services);

- Held by a non-corporate taxpayer (partnerships and S corporations – underlying partners, individuals);

- Acquired by taxpayer on original issuance; and

- Held for more than five years.

Further discussion took place around the active business requirement. In order to meet this requirement, at least 80% by value (not adjusted basis) of assets must be used by the corporation in the active conduct of one or more “qualified trades or businesses” – the business cannot be personal services, financial sector, or in the farming, mining, oil/gas, or hospitality industry. There are some exceptions from the active business requirement:

- Reasonable working capital needs;

- Research and Development (R&D) expenses;

- Start-up expenses.

The corporation also generally cannot own (1) real property that is not used in the active conduct of a qualified trade or business with a value exceeding 10% of its total assets; or (2) portfolio stock or securities with a value exceeding 10% of its total assets in excess of liabilities.

Another key factor to consider is the provision provides restrictions governing redemptions to prevent abuse.

Replacement QSBS

A federal rollover provision under IRC Sec. 1045 allows a taxpayer to potentially roll-over gain from the sale of QSBS that has been held for more than six months where replacement QSBS is acquired within 60 days of sale. A taxpayer seeking the rollover benefits under IRC Sec. 1045 must make an election on or before the due date (including extensions) for filing the tax return for the tax year in which the QSBS is sold.

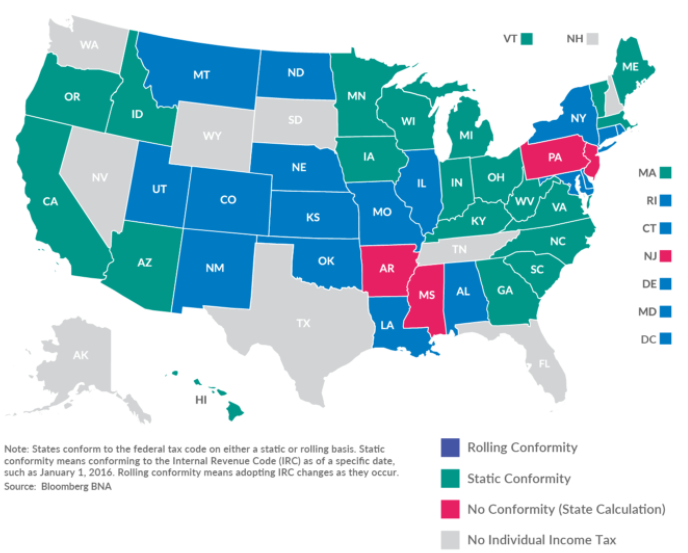

State Conformity

- In general, states with rolling conformity will follow federal income tax treatment for QSBS.

- States with static conformity and states with no conformity may not allow QSBS exclusion.

- Taxpayers should check if their state of residence conforms with the QSBS exclusion.

Closing

There is a current trend in proactive structuring and engineering in private equity and venture capital to maximize on the QSBS exclusion of gain. Given the fact that the Biden administration has stated that it will raise certain levels of income tax rates, there may be a greater incentive to strategize and find ways to qualify for the QSBS exclusion of gain.

Contact EisnerAmper

If you have any questions, we'd like to hear from you.

Receive the latest business insights, analysis, and perspectives from EisnerAmper professionals.