Converting Pass-Through Entity to QSBS: Benefits and Pitfalls

- Published

- Feb 16, 2024

- Topics

- Share

Many pass-through entities are considering converting to C corporation to take advantage of the lucrative qualified small business stock (“QSBS”) exclusion under IRC Sec. 1202. This can provide the owners of these entities with significant excludable gain in the right circumstances but can be detrimental in the wrong fact pattern.

IRC Sec. 1202 allows holders of QSB stock to exclude, for federal income tax purposes, up to 100% of capital gains on the sale of QSBS. States should be analyzed separately for QSBS exclusion, as each state has its own set of rules on whether it conforms or decouples from federal. This article is limited to the federal income tax considerations.

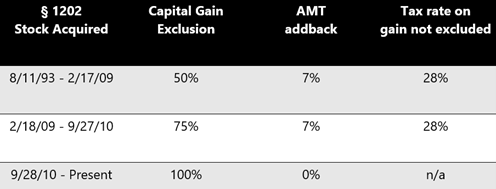

The amount of gain eligible for exclusion is limited to the greater of $10 million or 10 times the taxpayer’s basis in the QSBS and is dependent on when the qualifying stock was acquired.

See chart below for the details:

Requirements for QSBS Treatment

There are a number of requirements for the stock to be eligible for QSBS treatment. One being that the stock must be originally issued by a C corporation with no more than $50 million of tax basis gross assets at any time before and immediately after issuance. We further explain the $50 million gross asset limitation below.

What if a pass-through entity wants to benefit from the potential tax savings under Section 1202? With the reduced corporate tax rate of 21%, converting to a C corporation is becoming more attractive. Here are some of the methodologies and risks in converting a pass-through entity to a QSBS:

Converting a Limited Liability Company

For a limited liability company (“LLC”) taxable as a partnership, the LLC can simply make a check-the-box (“CTB”) election on Form 8832 to be treated as a corporation for tax purposes. The reason this works so well is because CTB is tantamount to an issuance of shares, making the LLC a qualified corporate entity. Another option to accomplish the conversion would be via a statutory conversion under state law.

Converting an S Corporation

Qualifying an S corporation for QSBS is a little more complicated. It’s nothing akin to a CTB election for LLCs, as terminating an S corporation is not deemed to be a new issuance of shares.

Since an S corporation cannot simply convert to a C corporation and satisfy the original issuance requirement of IRC Sec. 1202, an F-reorganization under IRC Sec. 368(a)(1)(F) should be considered as a possible option. For this instance, it can be effectuated by:

- Creating a new S corporation (“NewCo”) and shareholders contribute their stock of the old S Corporation (“OldCo”) to NewCo in exchange for stock.

- OldCo makes a qualified S corporation subsidiary (“QSub”) election.

- Once the F-reorganization is in place, OldCo is converted into a single member LLC (“SMLLC), resulting in NewCo owning the SMLLC.

- Create a new C corporation and contribute the SMLLC interests to the corporation in exchange for QSB stock. This is treated as a qualifying transfer of property under IRC Sec. 1202. Many will find this administratively easier than contributing the assets, as it avoids retitling of the assets.

The result is the S corporation owning 100% of the QSBS, and its shareholders can qualify for the exclusion. It’s important to note that a valid business purpose for the restructuring should be established, other than just to qualify for QSBS, to avoid the IRS contesting the validity of the transaction, and ultimately the intended tax benefit.

Recent Case Regarding S Corporations

In a recent U.S. District Court opinion granting the government’s motion to dismiss, Leto v. U.S., a taxpayer was denied a refund for taxes paid on the sale of stock in a C corporation because his stock was held to not be QSBS.

The taxpayer originally invested in an (Arizona) LLC that had checked the box and simultaneously elected to be treated as an S corp for federal income tax purposes. The LLC subsequently merged with a C corporation, where the taxpayer exchanged his LLC interest for C corporation stock. More than five years later, the taxpayer sold his C corporation stock and later filed an amended return to claim QSBS exclusion related to this sale, which the district court denied.

The court’s decision was based on the holding that even though the entity was an LLC in form, for federal income tax purposes it was an S corporation, and accordingly the exchange of LLC interest essentially did not satisfy the original issuance requirement under IRC Sec. 1202.

Important Considerations in a Pass-Through Entity Conversion

Whether the conversion is by an LLC or S corporation, the $50 million gross asset test must be considered prior to conversion. Since this is essentially a transfer of property, under IRC Sec. 1202(d)(2)(B) the basis of the assets for the purposes of determining the $50 million test would be equal to their fair market value (“FMV”) at the time of conversion – a notable distinction. While it may seem like a disadvantage for the gross asset test, it can be good news on the flip side as no less than the FMV is now considered in determining the 10x basis limitation, which can increase the amount of excluded gain.

One other notable consideration is that any built-in appreciation at time of conversion will not qualify for the exclusion since it was earned prior to QSBS status. Only post-conversion appreciation earned as a QSBS would be eligible.

Here are two examples of this:

Example 1

- In 2012, A contributes $500,000 to LLC for 50 units.

- A few years later the LLC checks the box and converts to C corporation status when the value of those units are $7 million (and the LLC has no liabilities).

- Five years later, the 50 units are sold for $70 million, resulting in $69.5 million of realized gain (the taxpayers federal income tax basis of the stock was $500,000).

- A’s exclusion under IRC Sec. 1202 is limited to $63 million ($70 million proceeds less $7 million value at time of conversion), resulting in taxable gain of $6.5 million.

- A’s tax bill will be based on the long-term capital gain (“LTCG”) rates on the $6.5 million gain.

Example 2

- Similar facts as above, but the units were sold for $12 million instead of $70 million, resulting in $11.5 million of realized gain.

- A’s exclusion under IRC Sec. 1202 would be limited to $5 million of gain ($12 million of proceeds less $7 million value at time of conversion), resulting in taxable gain of $6.5 million.

- The $6.5 million would be taxed at LTCG rates, same as in Example 1.

- In this case, if the conversion would have occurred earlier at a $500,000 value, the excludable gain under IRC Sec. 1202 would be $10 million (and up to a $500,000 tax basis recovery).

It’s imperative for taxpayers to carefully analyze each situation and consult with their advisors before implementing such a conversion, to maximize tax savings.

Should a Pass-Through Entity Convert to a C Corporation?

The decision to convert a pass-through entity to a C corporation to qualify for QSBS status must be approached with careful consideration and a bit of foresight. Key factors would be tax rates, single versus double taxation, annual taxable activity, and perhaps most importantly, exit strategy.

Mapped out here are four possible scenarios from most beneficial to most detrimental in converting a pass-through to a C corporation, based on timing and type of exit.

Scenario 1: Hold QSBS for more than five years and sell the stock

This is the most beneficial, as all post appreciation gain is excludable, subject to ten times the IRC Sec. 1202 tax basis.

Scenario 2: Hold QSBS for more than five years and sell the assets

This is not as beneficial as the 21% corporate tax rate would be invoked on the sale. Any shareholder gain on liquidation should be eligible for the Section 1202 exclusion, as in Scenario 1. The benefit here is avoiding the second layer of tax.

If the pass-through had not converted, the gain to the active owners of the pass-through entity would be taxed at 20% LTCG rates, with any Section 751 “hot assets” or S Corporation ordinary income assets being taxed at the highest ordinary rate.

Scenario 3: Hold QSBS for less than five years and sell the stock

Here, the shareholders pay tax on the gain at 23.8% (LTCG + net investment income tax [NIIT]). Contrast to pass-through active members, who will pay 20% LTCG with any Section 751 “hot assets” being taxed at the highest ordinary rate.

Scenario 4: Hold QSBS for less than five years and sell the assets

This is the worst possible outcome. The corporation pays tax at 21%, and the remaining assets that are distributed in liquidation are subject to a second layer of tax by the shareholders at 23.8%. The taxpayer would have been better off remaining a pass-through in this situation.

These scenarios do not consider any qualified business deductions under Section 199A which would be beneficial for pass-through entity owners.

Final Considerations for QSBS Conversion and Section 1045 Rollovers

Conversion to QSBS for a pass-through entity might make sense for owners that plan to hold the stock for longer than five years and ultimately sell the stock. It has declining benefits in the other scenarios. It can be detrimental, versus remaining a pass-through, if the exit occurs prior to five years.

One last consideration is the effect of Section 1045 rollovers. In those situations, if taxpayers sell QSBS after holding it for six months and less than five years, it can defer the gain by reinvesting the proceeds in another QSBS within 60 days, tacking on the QSBS holding period. This may not be practical in all situations, given the tight 60-day time frame to identify and purchase a new QSBS.

Taxpayers need to consider future possible scenarios before looking to convert their pass-through entities and be mindful of the potential detrimental tax impacts of certain exits.

What's on Your Mind?

Start a conversation with the team

Receive the latest business insights, analysis, and perspectives from EisnerAmper professionals.