403(b) Plans Must Be Universally Available – Is Yours?

- Published

- Sep 12, 2017

- Share

With IRS audits of 403(b) plans on the rise, it is critical that 403(b) plan sponsors review how they are applying the universal eligibility rule in operation under their plan. A 403(b) plan must be universally available to all employees with respect to elective deferral contributions by plan participants. With some limited exceptions, if any employee of the plan sponsor has the right to make deferral contributions, then all employees of the plan sponsor must be eligible to make elective deferrals. Plan sponsors sometimes run into confusion regarding which employees may be excluded from making salary deferral contributions under their plan. Below is a discussion of the rules to help clarify which employees may be excluded

Explanation of the Rule

With respect to elective deferral contributions, a 403(b) plan must meet the ‘universal availability’ rule as outlined in Internal Revenue Code (“IRC”) section 403(b)(12)(A)(ii). Under this rule, if any employee of the employer maintaining a 403(b) plan may make salary deferral contributions, then all of the plan sponsor’s employees must be given the opportunity to make deferral contributions. Please note that this rule does not apply to a church, as defined in IRC section 3121(w)(3)(A), or a qualified church-controlled organization, as defined in IRC section 3121(w)(3)(B).

For purpose of this rule, certain employees may be excluded, including:

- Employees who normally work less than 20 hours per week*. Please note that a plan may also choose to apply a threshold lower than 20 hours per week for this purpose.

- Students performing services in the employ of a school, college, or university, if the services are performed by a student who is enrolled and is regularly attending classes at the school, college, or university [IRC section 3121(b)(10)]. *

- Non-resident aliens as described in IRC section 410(b)(3)(C).

- Employees who are eligible to make elective deferrals under another 401(k), 403(b) or 457(b) plan sponsored by the same employer

*For the less than 20 hours per week exclusion and for the student exclusion, if any employee who falls under one of these exclusions has the right to make elective deferrals, then all employees who fall under such exclusion must be allowed to make elective deferral contributions.

Unlike a plan that is subject to IRC section 401(a), a 403(b) plan may not exclude employees based on a generic classification such as:

- Part-time

- Temporary

- Seasonal

- Substitute teacher

- Adjunct professor

- Collectively bargained employee

However, if these employees fall under the “normally work less than 20 hours per week” criterion, then they may be excluded on that basis.

The ‘Normally Works Less Than 20 Hours per Week’ Exclusion

An employee normally works less than 20 hours per week only if during their initial year of employment (the 12-month period beginning on the date employment began), the employer reasonably expects the employee to work fewer than 1,000 hours, and for each plan year ending after the close of the initial year (or, if the plan provides, each subsequent 12-month period based on the date of hire), the employee works fewer than 1,000 hours of service.

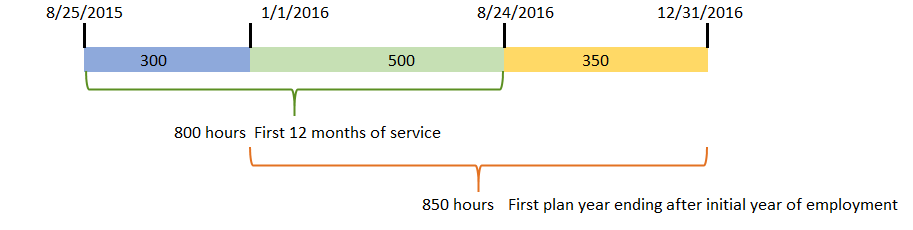

Example: John is hired on August 25, 2015, and the 403(b) plan’s plan year ends on December 31. Assume it is reasonable to expect that John will normally work a total of 17 hours per week. John works 800 hours in the first 12 months of employment and 850 hours during the plan year ending after his initial year of employment as follows:

If the 403(b) plan provides an exclusion for employees who normally work less than 20 hours per week, then John may be excluded for purposes of making elective deferrals under the plan.

However, if John works 1,000 hours in any subsequent plan year he will become eligible to make elective deferrals and must be given the opportunity to do so. Once he meets the 1,000 hour threshold, he can no longer be excluded under the “normally work less than 20 hours per week” exclusion, even if he works less than 1,000 in a subsequent year.

Employees who are eligible to make elective deferral contributions must be given an “effective opportunity” to participate. Whether the employee has an effective opportunity to participate is determined by all of the facts and circumstances, including notice of eligibility, the period of time an election may be made, and any other conditions on elections. At least once during a plan year, the plan must provide an employee (whether part-time or full-time) with an effective opportunity to make or change an elective deferral election, up to the dollar limit in effect, including any catch-up deferrals permitted under the plan, as well as Roth contributions, if the plan permits.

Common Operational Error in Applying the Rule

A frequent error occurs when plan sponsors automatically exclude employees working less than full-time from making elective deferral contributions under a 403(b) plan. A 403(b) plan that wants to apply the statutory exclusion for part-time employment must determine the employee’s eligibility for the 403(b) elective deferral contributions based on whether the employee is reasonably expected to normally work less than 20 hours per week and has actually never worked more than 1,000 hours in the applicable 12-month period.

Conclusion

The IRS frequently finds operational errors in the application of this universal eligibility rule, so it is imperative that plan sponsors review the decisions they are making with regard to eligibility and correct any errors prior to an IRS audit.

What's on Your Mind?

Start a conversation with Peter

Receive the latest business insights, analysis, and perspectives from EisnerAmper professionals.