New Not-for-Profit Reporting Presentation - ASU 2016-14 Not-for-Profit Entities (Topic 958): Presentation of Financial Statements of Not-for-Profit Entities

- Published

- Nov 8, 2016

- Share

This is Part 2 of a 2-part blog series. To see Part 1, please click here.

In this blog I will recap the presentation of ASU 2016-14 Not-for-Profit Entities (Topic 958): Presentation of Financial Statements of Not-for-Profit Entities that was presented by Jimmy Mo at EisnerAmper Not-for-Profit Industry Update held recently.

FASB issued ASU 2016-14 Not-for-Profit Entities (Topic 958): Presentation of Financial Statements of Not-for-Profit Entities on August 18, 2016 which contains dramatic changes to not-for-profit financial statements. ASU 2016-14 is effective for fiscal years beginning after December 15, 2017 and therefore will be applicable for not-for-profits with year-ends of December 31, 2018, June 30, 2019, or September 30, 2019.

The goal of ASU 2016-14 is not to overhaul but to update the current not-for-profit financial statement presentation and to provide the users of those financial statements with more useful information. ASU 2016-14 will improve the net assets classifications requirements and information regarding liquidity, financial performance, expenses, and cash flows.

The following is a summary of the five key changes that are included in the ASU 2016-14.

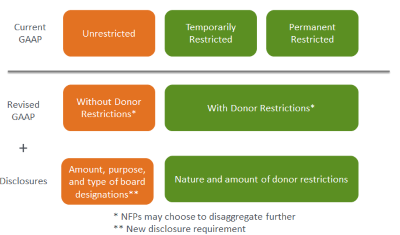

Net Assets Classification

Liquidity and Availability of Resources

Under ASU 2016-14, not-for-profits are required to provide qualitative and quantitative information on how the organization plans to manage its liquid available resources to meet cash needs for general expenditures within one year of the date of the statement of financial position.

Expense Reporting

Under ASU 2016-14, not-for-profits must report expenses, either on the face of the financial statements or in the notes, by both functional classification (program, management and general, and fundraising) and natural classification (salaries, rent, utilities, etc.). Not-for-profits must also disclose the method used to allocate cost amount program and support functions.

Statement of Cash Flows

Not-for-profits will continue to be allowed to choose between the direct method and the indirect method when presenting operating cash flows, which is in line with current GAAP. However, ASU 2016-14 removes the requirement to present an indirect reconciliation when presenting the statement of cash flows using the direct method.

Investment Returns

ASU 2016-14 requires the net presentation of investment expenses against investment returns. Investment expenses will now include both external and direct internal investment expenses. Internal investment expenses include costs associated with internal management and oversight of investments.

What's on Your Mind?

Start a conversation with Brian

Receive the latest business insights, analysis, and perspectives from EisnerAmper professionals.