Life After Your First Private Equity/Growth Capital Investment

- Published

- Sep 10, 2021

- By

- Priti Gupta

- Topics

- Share

In recent times, the investment sector has experienced massive turbulence. The pandemic taught investors the importance of a diversified portfolio and the need to look for alternative opportunities to increase their returns. Investors always look for high returns in a low yield market.

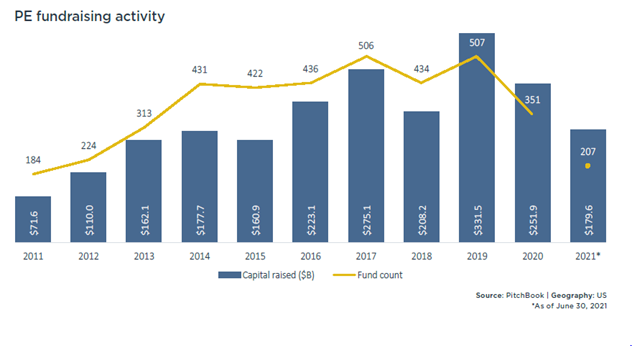

Historically, private equity (PE) fundraising activities have shown an upward trend. In spite of witnessing a downward slope in 2020, PE funds are expected to recover in 2021. The below graph depicts the fundraising activity of PE up to June 2021.

PE fund managers focus on generating returns for investors by influencing private company strategy, creating value for the entity and assessing exit strategy; i.e., through mergers and acquisitions, completing an IPO, or selling stake to another firm at the right time. After the pandemic, both entrepreneurs and investors have started to focus on the businesses’ sustainability in challenging situations and future growth plans. Questions like how well an entity can adapt to the rigorously changing economic conditions are pertinent nowadays.

Entrepreneurs’ responsibilities and challenges have also increased lately. Remote working, changes in government and economic conditions and investors’ high expectations have increased the burden of PE fund managers. Entrepreneurs look for sources of financing for expansion and growth. Key aspects to consider for businesses and entrepreneurs as they seek growth capital or finance from PE include:

- Dilution of Control

PE firms generally invest in businesses with the goal of increasing the value of the business over time and eventually selling that business. In order to increase the value of a business over time, PE firms typically prefer a majority or significant stake in the companies they acquire which a) will eventually dilute the entrepreneurs’ equity and b) may allow a PE investor to get representation in the board and eventually be involved in or even direct the key strategic decision- making of the business like hiring of key personnel, go-to market strategy, acquisition strategy, etc. PE investors often suggest strategic operations based on detailed market analyses, spreadsheets and analytics and make suggestions based upon the probabilities and analytics (sounds like a baseball manager). The entrepreneurs may feel like they have lost some control over the business operations after an investment from PE. - Investor Reporting

PE investors generally ask for periodic reporting like annual audited financials, investor summary, and monthly financial and performance summary reports so that they can track business key performance indicators (KPIs) and remain abreast of the businesses’ performance. A PE investment would bring in additional reporting requirements for the entrepreneur. - Sustainability

Even if a business is doing well, to maintain an edge over competitors and remain ahead in the market, the company needs to invest in developing new products or technology, expanding their market share, and people. An entity needs surplus funds to foster hiring the right talent to promote for expected future growth. People are changing their traditional way of doing businesses and looking for sustainable development and growth. The world is changing rapidly and running out of natural resources and thus, innovative and ESG-friendly operations have a tremendous value. Growth capital would not only give entrepreneurs the funds they need to take their businesses to the next level but would also help them to sustain/pivot and re-grow the business in challenging situations like the COVID-19 pandemic. - Multiple Avenues of Growth and Market Expansion/Increased EBITDA

People are attracted to new ideas, products and services. A PE investor will challenge the entrepreneurs to identify and exploit these growth opportunities. As discussed earlier, a PE investment will dilute entrepreneurs’ equity, but it will enable the entrepreneur to pursue facility expansion, sales and marketing initiatives, equipment purchases and new product development which in turn will increase their EBITDA (which in turn will help the entrepreneurs increase the valuation of their entity). - Capital Re-Structuring/Leverage

Growth capital can also be used to effect a restructuring of a company's balance sheet, particularly to reduce or increase the amount of leverage (or debt) the company has on its balance sheet. A PE investment could also mean a complete restructure of the acquired business with an attempt to resell at a higher value, aiming for a high return on equity. The restructuring often involves cutting costs, which produces higher profits in the short term.

While a PE investment could mean restructuring by way of reducing existing debt, it could also mean bringing additional debt on the business. That can be jarring since additional debt may add pressure to a business’s ongoing operations as a result of having to meet interest-payment obligations. PE firms do this because this is how they can maximize the cash return on the deal. By putting a small amount of cash up front and leveraging up the business with debt, they can get a much higher return on their investment. However, increased leverage also increases the risk of bankruptcy, particularly in the face of adverse conditions, such as an economic recession, product recall or lawsuit.

PE firms may also restructure companies by laying off staff or putting off capital expenditures that may hurt the company's competitiveness in the long-term. Business owners should discuss ahead of time what changes the buyers propose to make and whether they're acceptable or not. There are many entrepreneurs that cancel potential deals because of concern of the changes in the corporate culture and strategic direction of the business. - Going Public

Proven strong revenue growth rates, stable cash flows, profitability and a large total addressable/available market (TAM) could enable businesses to go public. The public markets have been very robust, especially in the technology, biotech, and consumer products sectors. Going public means more creditability, visibility and transparency. However, it would also bring in added obligations and responsibilities for the entrepreneurs. Going public would mean adherence to additional regulatory and legal compliances, increased governance, quarterly reporting to investors, getting audit ready, more robust HR policies, stronger internal controls, etc. The business needs to be ready and have all the systems in place for complying with all of the additional obligations and they need to be thoroughly tested before it plans to go public. These would mean additional operations cost and burden on entrepreneurs.

There are numerous reasons why PE investors make investments, including:

- Diversification and Better Yield

PE funds look for opportunities which provide better yield than the market. Businesses with great prospects and the ability to survive in challenging economic conditions are always prioritized for investments. PE investors target growth companies having great, unique, and sustainable business models and which can generate more return in near future. PE investors would also want to understand the entity’s plan of utilization of additional funds. A strong past performance coupled with future goals and well-thought-out prospective strategy help PE investors make a sound decision. - Mergers and Acquisitions (M&A)

PE investors also look for entities which can be acquired by or merged with existing market players. M&A opportunities will not only help companies associate themselves with bigger brands, but also provide greater returns to the investors. It will be a win-win situation for both entrepreneurs and investors. Merging with existing and well-established entities will provide entrepreneurs an early access to skilled talent, well-developed technology and better market visibility which will help the investors to multiply their returns rapidly. - Market Position

A PE investment would enable entrepreneurs to have a strategic position in the market which in turn will help them plan their exit strategy which could be through M&A or by going public. PE investors search for private companies performing better than their overall sector and with great potential to capture the market. Due to the pandemic, sectors like health care, insurance, technology, and e-commerce have performed well. On the other hand, travel, tourism, real estate, food outlets, cosmetics, infrastructure, and oil and petroleum sectors have been hit hard by the pandemic and are still recovering. If we look at the past and study all the successful business models, we note that timing can be key for business growth. - Technology

Automation and technology are always an integral part of any sector or entity. These days, entities are investing heavily in technology which will facilitate them to run their business better than others as well as provide better products, services and experience to their customers. Having a technical advantage over others helps an entity be ahead in the game and capture more market. Hence most of the investors are targeting entities which are technologically sound, innovative and also investing time and talent for better and efficient tomorrow.

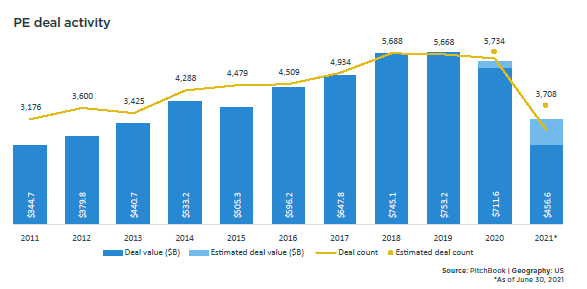

The PE market is reviving in 2021. The below graph depicts the PE deal activity up to June 2021.

There is an enormous amount of cash available to invest, and PE firms are spending significant time performing due diligence and market analyses to truly understand the value proposition and growth opportunities.

Our Current Issue: Q3 2021

What's on Your Mind?

Start a conversation with Priti

Receive the latest business insights, analysis, and perspectives from EisnerAmper professionals.