Part 2: Considerations (or Opportunities) for Growing a Family Owned Real Estate

- Published

- Sep 14, 2020

- Share

Owning and managing a real estate company is dynamic. Property and asset managers are focused on ensuring portfolios are fully leased, properly maintained, efficiently run and appropriately financed. Over time, buildings and businesses are purchased and sold. As the activity increases, so do the number of decisions. The family owning the company must make decisions about further investment and growth, and the primary goal is making a decision that is not only right for the business, but also right for the family. Governance is simply how families decide to make decisions with one another.

Owning and managing a real estate company is dynamic. Property and asset managers are focused on ensuring portfolios are fully leased, properly maintained, efficiently run and appropriately financed. Over time, buildings and businesses are purchased and sold. As the activity increases, so do the number of decisions. The family owning the company must make decisions about further investment and growth, and the primary goal is making a decision that is not only right for the business, but also right for the family. Governance is simply how families decide to make decisions with one another.

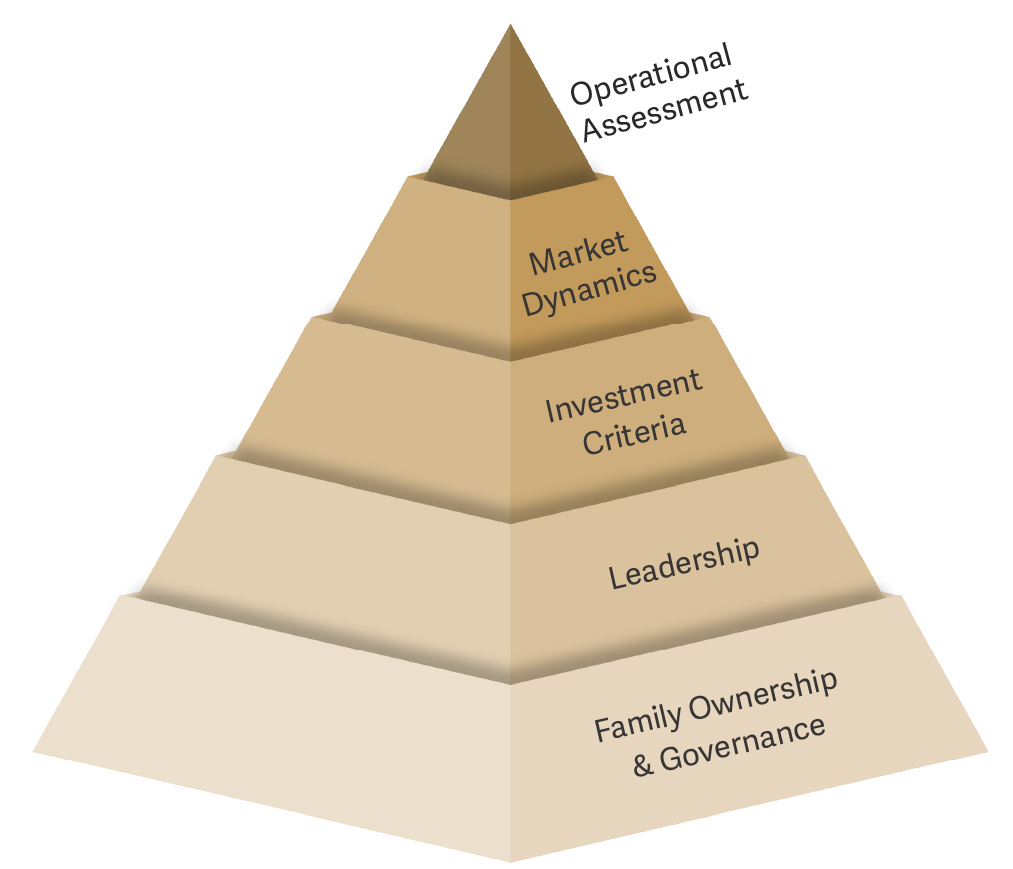

To support families in making critical business decisions, we have created a decision hierarchy that describes the many factors families should consider when exploring the benefits and risks of growth opportunities. The pyramid below illustrates not just the typical decision criteria for any real estate investment, but also shows the additional layers in the decision hierarchy that apply specifically to a family held real estate business.

Real estate investors usually begin the decision-making process with the various investment goals for the project or acquisition, such as the required risk-adjusted return. However, decisions in a family business, where many people are owners, may start with a more fundamental set of criteria, such as understanding the goals of the family involved in the real estate enterprise.

How families make decisions when they are in business together is called governance. Often in family real estate enterprises, the founder has his/her own governance called ‘what I say goes’ and it is simple, streamlined and quite agile. As the family expands, decision-making becomes more complex. Understanding the process for making joint decisions and how to communicate transparently charts the course for future success.

A family might have similar views on risk, or certain family members may be willing to aggressively invest for higher returns, while others want to conservatively invest to maintain liquidity and stable distributions. Through open dialogue, family members can proactively create an investment policy that aligns the group’s thinking on risk appetite. Family leaders should also be aware of the impact of changing distributions on particular family members. This is not to say that any one family member has the right to stop decision-making, and setting forth a formal co-created investment policy will reduce disputes and make investing more efficient.

As the family ownership grows, many times the needs of the business also grow. It is important to consider whether current leadership has the experience, runway and appetite to integrate the future direction with existing company activities and ability to maximize returns. At some point in the growth curve, the number and complexity of issues to be dealt with may benefit from outside management. This is particularly relevant if the company moves into a new strategic direction, such as a different property type or market, starting a fund, or moving beyond equity ownership into creating a debt platform. Bringing in a non-family manager is not a small decision nor a small task. We advocate for creating a position description early, so that position dictates the role and evaluation is not personal but, rather, about performance. Accordingly, family members should carefully and collectively assess whether the skill sets of current management are aligned with the competencies required to effectively run the growing business and manage its risk. It’s not all or nothing either. A healthy mix of family and outside leadership often brings fresh perspectives to the organization, while keeping the owners firmly in control.

Additional considerations for real estate family investments include how the new investment entities will fold into existing estate and trust planning, how the ownership will be divided among the family members, and which family members will be required to contribute capital to the venture. Particularly relevant to certain family members is whether there will be any disruption to current cash distributions to fund the growth. Distributions, although at times a tricky subject, are best coordinated with a conversation about a re-investment policy. It makes sense that owners receive a distribution, because their capital is at risk, but not at the expense of the business functioning. This is where education for shareholders and owners is key, so that owners understand their rights as well as responsibilities.

Once the foundational criteria have been established, the more usual investment process begins. In addition to return requirements, the family can create established investment criteria through their governance process, which includes components such as acceptable time horizons, willingness to include non-family member capital, and leverage limits. These metrics will take into account the family’s comfort with where to invest in the real estate lifecycle: development, construction, transitional properties or stable properties. Additionally, the family may be more familiar with particular property types and choose to stay with what they know.

The next level in the decision hierarchy is the state of the market(s) in which the family will invest. The first consideration is whether the investment will be made in a down cycle, in a well-advanced up cycle, or somewhere in the middle. Position in the cycle will inform both acceptable pricing and required risk-adjusted returns. Depending on the type of growth strategy, the due diligence program should include a detailed look at supply-and-demand trends, measured not only in rent and occupancy, but in the competitive landscape and the pipeline of potentially competing projects.

Moving from external to internal considerations, the family should assess whether its operational platform is ready for growth. Operations include staffing levels, management and asset management procedures and systems, accounting and reporting. We encourage families to candidly evaluate the capacity of each of these functions to take on the new project, portfolio or business, including a review of the adequacy of the company’s control environment. Of particular importance is having the analytical capability and skill sets to reasonably forecast investment profitability.

Real estate is a unique business, and the process for investing in growth is dynamic and full of opportunities, especially when the business is family owned. The goal is to successfully grow the business, while using the family’s vehicle for wealth to enrich their lives through legacy and cohesion and through shared ownership and education that can last throughout generations. Transparency throughout the due diligence process, including reports on the opportunity and how management is leading the company through the decision hierarchy, is a critical success factor in maintaining both profitability and family harmony.

Foundations for the Future: Real Estate Succession Planning

- Part 1: The Real Estate Family’s Considerations for Success

- Part 2: Considerations (or Opportunities) for Growing a Family Owned Real Estate

- Part 3: A Dispute Resolution Guide for Real Estate Families

- Part 4: More than Transferring a Title: How Do I Successfully Transfer Responsibility and Ownership of My Real Estate Empire?

What's on Your Mind?

Start a conversation with Natalie

Receive the latest business insights, analysis, and perspectives from EisnerAmper professionals.