Can Biotechs Use a Virtual Model to Combat R&D Costs?

- Published

- Sep 29, 2017

- Share

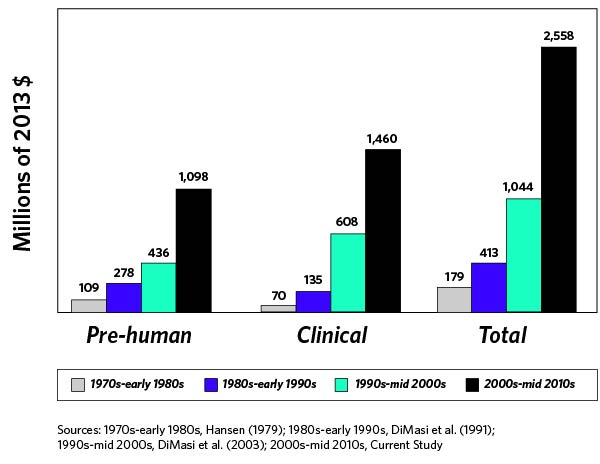

The exorbitant costs incurred by biotech companies to bring new products to market are certainly no secret. According to a May 2016 Journal of Health Economics article, the average total cost to develop a new drug and bring it to market is approximately $2.6 billion (Figure 1). New product development costs have increased exponentially as regulatory requirements and formulation complexity have been accelerating, and there does not appear to be any signs of this trend abating.

Figure 1

The above graph takes into account both out-of-pocket costs and opportunity costs. Because a new product can take a decade or more to achieve FDA approval, you can see how costs rapidly mount. (Programs entering Phase I clinical development have a less than 10% chance of advancing to FDA approval, noted the Biotechnology Innovation Organization.) Biotech companies also need to consider product failure at different clinical trial phases, such as lost time and money, investors pulling funding, and decreased company share price.

As such, it is no wonder biotech companies are looking for innovative ways to curtail some of the heavy R&D financial burden. The virtual company model presents a potential avenue for biotechs to mitigate some of these enormous costs.

The Virtual Company Model

In recent years, an increasing number of companies are being constructed under the virtual model. A virtual biotech company generally has only a handful of employees—typically higher-level management—and outsources much, if not all, of the R&D and clinical work to contract research organizations (“CROs”). These CROs are built specifically for outsourced work in a particular field and can provide specialized research and development to a small pharmaceutical or biotech company at a fraction of the cost it would have taken had the company performed all of those activities internally. The virtual model could also entail outsourcing accounting and tax functions.

As costs continue to mount, the savings from going virtual should continue to grow, too. This particularly benefits small pharma and biotech companies because it allows them to avoid spending large portions of their funds on constructing physical lab space containing expensive equipment. The virtual model also helps lower potentially expensive staffing costs as a company no longer has to maintain its own research team. CROs employ their own specialized researchers and have their own lab equipment. Many CROs can leverage resources from throughout the globe managed by their C-suite experts to keep costs down and provide focused and effective support. A company can shop around and choose the CRO that best fits its operational goals and budgetary constraints. Venture capitalist firms tend to be more attracted to these virtual companies as well, because the biotech does not have money tied up in fixed assets, such as lab equipment or personnel.

Many CROs can also guide a company through the clinical trial process. They can help a company avoid common pitfalls or mistakes during its progression through trial phases and, therefore, avoid some of the consequences of a setback or failed test. Small or emerging biotech companies usually cannot withstand a clinical failure as easily as larger, more established companies.

However, there are some potential drawbacks to using a virtual model. Because CROs could have multiple clients, a company’s product may not be the CROs’ priority because it is focusing its attention on another customer’s more promising product. The virtual model can also limit company innovation. CROs may have more access to available research and pre-existing technologies, rather than having to create a new technology from scratch, which might limit new product development.

Is Virtual Biotech a Fad or the Future?

The use of CROs in biotech has been increasing, and it is a trend that is expected to continue as more business leaders embrace this approach. According to a 2017 report by Zion Market Research, the CRO market was valued at $34 billion in 2014 and is expected to grow to more than $59 billion by 2020. Delancey Street Partners reported that new drug approvals in 2014 and 2015 were the highest they have been in the past 15 years, so there certainly is a market for CRO services. CROs are even expanding the types of services they provide to include software solutions and data analytics, among others.

Catalyst - Fall 2017

Contact EisnerAmper

If you have any questions, we'd like to hear from you.

Receive the latest business insights, analysis, and perspectives from EisnerAmper professionals.