EisnerAmper’s Virtual 5th Annual Alternative Investment Summit

- Published

- Dec 14, 2020

- Share

2020: A Year of Change: Where the Alternative Investment Industry is Headed

EisnerAmper’s 5th Annual Alternative Investment Summit 2020: A Year of Change examined where the industry is headed on the heels of dramatic upheaval: unprecedented political, social and economic change, along with the impact of the global COVID-19 pandemic. The Summit kicked off with a keynote address from Sallie Krawcheck, CEO and Co-Founder of Ellevest, followed by concurrent limited partner (LP), hedge fund, and private equity panels featuring prominent investors and fund managers who discussed issues that impacted the alternative investments industry. The virtual event concluded with a fireside chat with EisnerAmper CEO Charles Weinstein interviewing Donna Brazile, Founder of Brazile and Associates, LLC and the former Chair of the Democratic National Committee and Karen Hughes, Worldwide Vice Chair, Burson Cohn & Wolfe, who served as counselor to President George W. Bush and Under Secretary of the State for Public Diplomacy and Public Affairs.

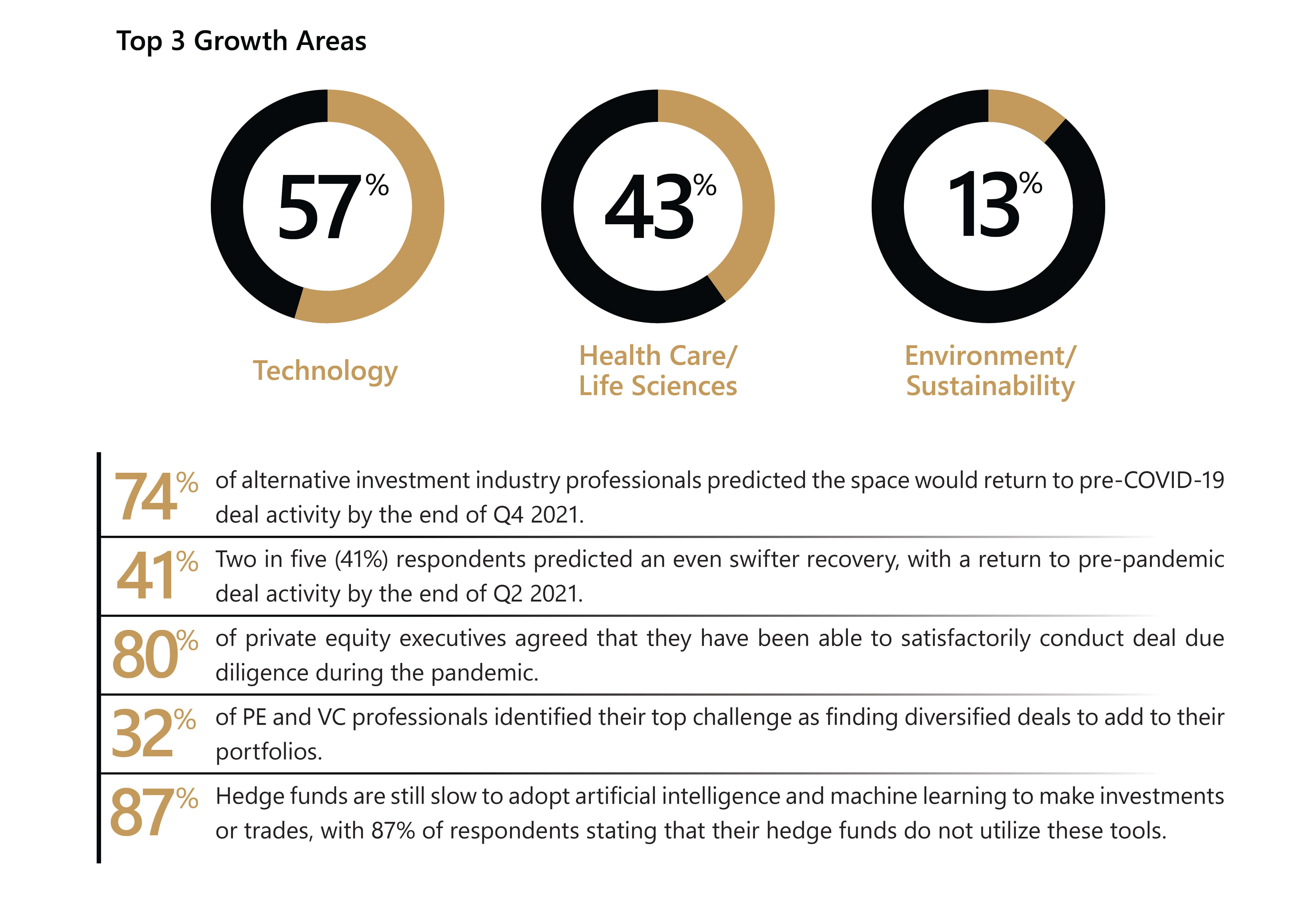

During the conference, EisnerAmper surveyed more than 250 attendees to determine where the industry is headed and 74% predicted the space would return to pre-COVID-19 deal activity by the end of Q4 2021. Two in five (41%) respondents predicted an even swifter recovery, with a return to pre-pandemic deal activity by the end of Q2 2021. With respect to the industries best poised for growth in Q4, 2020, respondents selected technology and health care/life sciences, which mirrored results from EisnerAmper’s 2019 survey, when technology, cannabis, and health care/life sciences were named as the strongest growth sectors. In addition, the survey revealed that despite the investment industry continuing to largely operate in a work-from-home setting, 80% of private equity executives agreed that they have been able to satisfactorily conduct deal due diligence during the pandemic. And further, they see potential for some elements of the virtual process to last beyond COVID-19, with 73% of respondents expecting a decrease in in-person site visits and management meetings post-pandemic. Finally, the survey revealed other industry trends including PE and VC firms continuing to seek diversified deals, hedge funds are still slow to adopt using artificial intelligence (AI) and machine learning to make investments or trades, and compliance regulations is the top challenge LPs face.

“We’re thrilled with EisnerAmper’s 5th Annual Alternative Investment Summit. Featuring a keynote from Sallie Krawcheck, thought-provoking breakout sessions, a fireside chat with a pair of nationally recognized political commentators on the presidential election, and valuable survey data attendees can use to help improve their businesses, the event had something for everyone,” said Peter Cogan, Managing Partner, Financial Services Industry and Chairman of the Board of EisnerAmper Global. “We realize financial service professionals have a variety of virtual events to choose from. And we thank all of the 700-plus attendees and thought leaders for making our Summit one to remember.”

Here are roundups of the five sessions:

Keynote from Sallie Krawcheck, CEO & Co-Founder of Ellevest

With 2020 coinciding with the 100th anniversary of the passage of the 19th Amendment and some American women’s constitutional right to vote, Sallie Krawcheck, whose firm manages a prominent mission-driven investment platform for women, discussed the importance of embracing diversity in the financial services industry and said diverse teams have the most successful investment performance. She added that despite preconceived notions, research has revealed that women are just as good as (if not better than) men at managing money. And finally, she said rather than hiring the best person for the job, firms should hire the best person for the team, acknowledging the team is better when there are different insights and backgrounds. She concluded that to achieve success, companies and individuals need to get out of their comfort zone and challenge themselves to be uncomfortable.

This Way Up: How Alternatives Should Look to Reorient in Q4 and Beyond

A trio of alternative investment professionals addressed how the asset management industry has transformed since the global COVID-19 pandemic and discussed what to expect for the remainder of this year and beyond. With respect to outperforming strategies, panelists concurred that credit strategies, structured credit in particular, along with technology investments were among the best performers. On the other hand, macro was mixed with some faring well and others underperforming. More broadly, the market volatility of this year helped some managers while hurting others.

Managers agreed that data usage has become prominent especially those utilizing quantitative, AI, machine learning or black box strategies.

Panelists included:

- Bradley Saacks, Hedge Fund Reporter, Business Insider (Moderator)

- Craig Bergstrom, Managing Partner/Chief Investment Officer, Corbin Capital

- Nancy Davis, Chief Investment Officer, Quadratic Capital Management

- Terri Lecamp, Partner and Chief Operating Officer, Melody Capital Partners

LP Perspectives in the COVID-19 Environment

Panelists discussed investor considerations when allocating to private equity and concurred that despite a slowdown in fundraising and deal-making during Q1 and Q2 of 2020, private equity has largely retained support from LPs, evident in the minimal amount of defaults on capital commitments. With the global pandemic expected to continue for the foreseeable future, they argued it’s critical for firms to retain their LP base as a solid source of liquidity and to understand their perspectives and outlook over the next several months. A few things that should be considered are market swings, different counterparty risks amongst each investor and subscription lines of credit, which have been under the spotlight as LPs are asking for more transparency in how they are being managed and their impact on reporting their internal rate of return (IRR).

Panelists included:

- Jennifer Choi, Managing Director of Industry Affairs, Institutional Limited Partners Association (ILPA)

- Wes Bradley, Senior Portfolio Manager, Florida State Board of Administration

- Marci Haydel, Managing Director, Performance Equity Management

- Anthony Minnefor and Irina Gershengoren, Partners, EisnerAmper (Moderators)

Private Equity Beyond COVID-19: Disruption, Innovation and Cultivating Evolution

Panelists discussed how private equity firms were impacted by the COVID-19 pandemic and the outlook for the future. Some of the topics discussed included fundraising, portfolio company operations, LP relations, and the role of technology. Firms most effective in raising capital were those fully immersed in their respective sectors and with the strongest relationships. The speakers said portfolio companies need to be proactive in responding to changing operations and technology-focused ones experienced the most growth. Meanwhile, they have increased communication amongst their LPs who expressed concerns on accessing information on funds’ portfolio companies. Finally, they addressed how to digitally transform their operations through various phases of the investment process including cultivating deals and valuation of portfolio companies.

Panelists included:

- Paul Gulberg, Senior Equity Analyst-Financials, Bloomberg Finance (Moderator)

- Susan Cates, Partner, Leeds Equity Partners

- John Frankel, Partner, ff Venture Capital

- Arthur Peponis, Head of Private Equity, Angelo Gordon

A Bipartisan Perspective of the 2020 Presidential Election with Donna Brazile and Karen Hughes

The Summit closed with a fireside chat with Charles Weinstein interviewing Donna Brazile and Karen Hughes. The trio discussed the 2020 U.S. presidential election and what may lie ahead for the country and world touching on the global COVID-19 pandemic, how the government and financial services industry can do a better job of embracing diversity, and more.

OUR CURRENT ISSUE: Q4 2020

- The Most Overlooked Tax Break for Long-Term Investors: IRC Section 1202 Exclusion of Gain from Qualified Small Business Stock

- ESG Outlook for Asset Managers

- Singapore’s Insolvency, Restructuring and Dissolution Act (IRDA) –A New Paradigm for Distressed Companies

- SEC Modernizes the Accredited Investor Definition

- Addressing Venture Capital Valuation Challenges

- EisnerAmper’s Virtual 5th Annual Alternative Investment Summit

What's on Your Mind?

Start a conversation with Elana

Receive the latest business insights, analysis, and perspectives from EisnerAmper professionals.