How the Government Shutdown Might Impact You

- Published

- Jan 8, 2019

- Topics

- Share

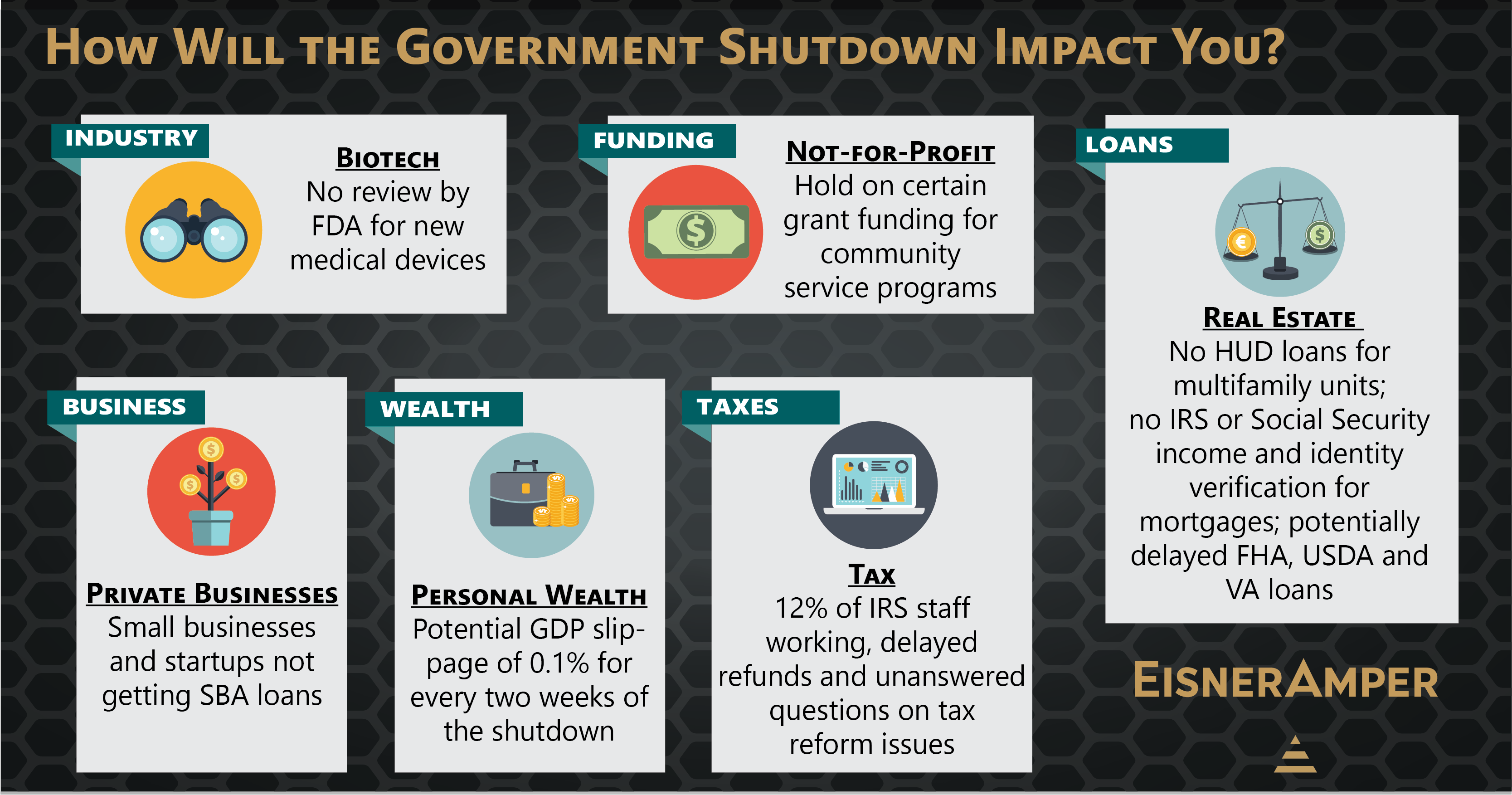

In this EisnerAmper podcast, EisnerAmper discusses ways in which, over time, the shutdown could adversely impact a growing number of individuals and businesses. We also examine the impact on state and local governments, his particular specialty, and what his advice to these types of clients is.

Transcript

Dave Plaskow: Hello and welcome to the EisnerAmper podcast series where we try to dig a little deeper on the accounting and finance issues facing business professionals and their clients. Today we're looking at some of the potential economic impacts that individuals and businesses may feel as a result of the current government shutdown. I'm your host, Dave Plaskow, and with me today to shed some light on these issues is Michael Imber. Michael is a managing director in EisnerAmper's Financial Advisory Services group and heads our public sector advisory services practice. Michael, welcome and thanks for being here.

EisnerAmper: Great to be here, Dave. Thanks.

DP: So obviously we're not a political show, so we're not going to look at the government shutdown from that standpoint. We're really going to examine it from a business and finance standpoint.

EA: I think it’s best that we save the partisan discord for the pundits on TV.

DP:Yes. So, most people may think of this shutdown as only affecting a relatively small group of government workers, but that's not necessarily the case, is it?

EA: No, not at all. In fact, the longer this drags on, the more this shutdown is going to impact our everyday lives as individuals and businesses, especially in our state and local governments.

DP:Let's start with tax. I know you're not a tax guy, but there are some definite concerns here. Why don't you share those with us?

EA:Well, for one thing, it's kind of ironic that the IRS is not considered an essential service. So they're very short staffed over there. If you pick up the phone and you've got a tax question, there's no one there to take your call. Moreover, as I understand it, preparing the new forms for 2018 is not done. So, when we all want to file our taxes it EAght be a little bit of a problem if you don't have the right forms. You know how the IRS is a stickler for that sort of thing.

DP: Yeah. In fact, the White House released a statement saying that tax returns are going to be processed as usual, and there shouldn't be any delays on people getting their refunds. That's going to be a little tricky when only 12% of the IRS is actually working at this point.

EA: I'm not holding my breath on that one.

DP: What else can you tell us that my impact individuals.

EA:Well, we're probably going to end up seeing some sort of impact in the stock market. We've seen estimates that say that the country's GDP will lose about 0.1% for every week of the shutdown after the second week. We're now entering week three. I think Standard and Poor's had estimated that the shutdown costs the economy about $25 billion a week. At some point that's going to catch up with us and rattle the confidence of the stock market where people end up losing money.

DP:They'll definitely see it in their 401(Ks). Let's look at it from an organizational perspective. What are you hearing there?

EA: Well, the government's not making loans anytime soon. The whole business of processing loans is pretty much on hold. The FDA isn't reviewing any new medical devices, certain nonprofits that have been dependent upon government grants, they're on hold. So, it reaches into a variety of business sectors. The million dollar question is what will all of this mean given the current strong economy and the historically low unemployment rate? Is it going to rattle the positive results that we've had for the last couple of years?

DP: You're particular area of expertise is state and municipal governments. What do you expect to see here as a result of the shutdown?

EA: Well, if this shutdown doesn't last more than a few more days, it won't be too bad. But the longer this persists, the bigger the impact. The real long-term implication is on state and local budgeting and fiscal sustainability. Overall, the longer this goes, the more this is a credit negative for state and local governments. There are a couple of areas in state and local government I'd like to touch on.

EA:One is public safety. Already, we've been hearing stories the last couple of days that the TSA workers are coming down with “blue flu.” These are the men and women at the security checkpoints in our airports who have to continue to report to work, but they're not getting paid. I flew back from Florida yesterday and made a point of thanking everybody, even tried handing people some donuts, but they weren't allowed to take any gratuities, but they appreciated it. But with the blue flu, people calling in sick at JFK and a few other airports around the country can create obvious safety risks and ultimately diminish economic growth for the region. So, public safety is one big area.

Another area that everybody should be able to sympathize with is the social service impact. People who are dependent upon the Supplementary Nutritional Access Program, or SNAP. Their benefits are going to run out in just in a couple of weeks and that exacerbates a hunger problem. A malnutrition problem could have a domino effect with people visiting the emergency room. Landlords, despite what some politicians may have talked about, are going to have an unreliably mixed reaction to renters who cannot pay their rent. And there could be temporary or even permanent home displacement.

The third area would be consumer prices. What's less widely understood is that January is the month when a lot of farmers go looking for crop loans. And the single biggest lender in this arena is the U.S. Department of Agriculture. And like we discussed, Dave, the government's not making any new loans. This isn't like a delay to starting an infrastructure project. The timing for seed planting is critical to having a successful harvest. So, if this shutdown compromises the planning and planting cycle, America could be looking at big price increases for bread, meat, poultry, all because grain and vegetable supplies could end up being short. If farmers are successful in getting loans from banks, say instead of the USDA, maybe they'll get the money that they need. But they're going to be paying higher prices, and that all ends up impacting the consumer.

For state and local governments, this kind of budget impact is going to have an adverse effect on public school districts and universities that have to spend more money on food and those prices get passed onto the consumer.

DP:In your public sector world, if the phone starts ringing off the hook from clients because of this, what do you tell them?

EA: What I tell them is this is just yet another example of why state and local governments need to get a grip on fiscal sustainability and tighten up the budgets. If the government is wrestling with a trillion dollar annual deficit, there's going to be a predictable tightening in block grants to states. Social programs are going to get cutbacks, and this federal shutdown is just going to exacerbate the problem. The advice I give states and local governments is eliEAnate structural deficits, make the hard decisions now, start building up your cash reserves so that you can weather this storm and others that may be coming. I think we're in for a volatile 2019 and, ultimately, if you're dependent upon the federal government to support a big chunk of your budget and you can't count on that, you're going to need some cash reserves to weather the storm.

DP:Well, let's keep our fingers crossed that the government gets their act together gets back on track in serving the public. And I thank you, Michael, for your expertise and insight.

EA: Thank you very much. I enjoyed it.

DP: And thank you for listening to the EisnerAmper podcast series. Visit EisnerAmper.com for more information on this and a host of other topics. And join us for our next EisnerAmper podcast when we get down to business.

Also Available On

Contact EisnerAmper

If you have any questions, we'd like to hear from you.

Receive the latest business insights, analysis, and perspectives from EisnerAmper professionals.