SPAC? What’s that?

- Published

- Jan 21, 2021

- Topics

- Share

There has been quite a bit of market activity around special purpose acquisition companies, otherwise known as SPACs. The U.S. stock market had 480 IPOs in 2020; slightly more than half -- 248, in fact -- were leveraged by a SPAC. SPAC IPOs in 2020 alone surpassed 2019’s total IPO transactions of 233. But what exactly are SPACs? Here we will take a look at how these vehicles are used as an alternate route to take a private company public instead of the traditional IPO process, why they are so popular now, and some of the risks and possible pitfalls.

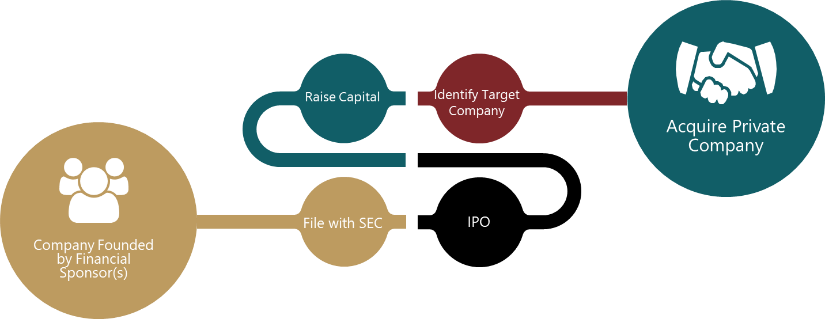

At a high level, a SPAC is shell company funded by financial sponsor(s), in exchange for founders’ stock, typically equating to 20% interest. Once formed, the shell company files with the U.S. Securities and Exchange Commission (SEC) for an IPO and raises additional capital from public shareholders in exchange for units, typically equating to 80% interest, consisting of common stock and warrants. While the shell has a management team, there is usually no operations as the sole objective of the SPAC is to find a private company target to acquire. When a target company is identified, shareholders must approve the transaction. Once acquired, the target company’s operations will then fill the shell and the private company becomes a public company.

So, why use a SPAC instead of the traditional IPO route? Well, a large contributor to the rise in the use of a SPAC IPO is market volatility. Market volatility may change a company’s valuation dramatically during the traditional IPO process. A SPAC IPO allows for less fluctuation in the pricing of the target company. Additionally, venture capital and private equity funds have capital on hand to invest known as dry powder. According to a recent Pitchbook blog post, “In early 2020, total dry powder levels in VC and PE hit unprecedented sums with more than $1.5 trillion available to fund managers worldwide.” A SPAC IPO solves both of those issues.

That’s not to say that the SPAC IPO route is easy or foolproof. There are quite a few challenges; some examples include

- Regulatory reporting considerations, such as:

- SEC filings,

- Proxy/registration requirements, and

- Super 8-K;

- Various accounting determinations are required such as is the target of an ‘accounting acquirer,’ if it qualifies as an emerging growth company (ECG), or if the transaction is an acquisition or recapitalization;\

- Post-transaction Internal Controls over Financial Reporting (ICFR) requirements;

- Timing: The merger needs to occur within 18-24 months.

Let’s examine this last detail further. If the merger does not occur within the specified time frame, the proceeds, which are held in escrow, are returned to the shareholders.

Lastly, a recent article in The Wall Street Journal titled “The SPAC Bubble May Burst – and Not a Day Too Soon” explains how the sponsor(s) and IPO investors that redeem their shares prior to the merger obtain the best rates of return, in part, because those shares are redeemed for the unit purchase price plus interest, but the warrants and rights are still retained essentially for free. However, with 46 SPAC IPOs within the first two weeks of 2021; it doesn’t appear that the popularity of SPACs is diminishing just yet.

VIEW MORE CONTENT ON SPACS

What's on Your Mind?

Start a conversation with Nina

Receive the latest business insights, analysis, and perspectives from EisnerAmper professionals.