Trends Watch: Small & Mid-Cap Emerging Markets

- Published

- Mar 17, 2022

- Share

EisnerAmper’s Trends Watch is a weekly entry to our Alternative Investments Intelligence blog, featuring the views and insights of executives from alternative investment firms. If you’re interested in being featured, please contact Elana Margulies-Snyderman.

This week, Elana talks with James Fletcher, Founder & CIO, Ethos Investment Management.

What is your outlook for investing in small and mid-cap emerging markets?

The short answer is that, over my 17-year career in investing, I find the current opportunity set of emerging small and mid-cap stocks (EM SMID) to be the most attractive and inefficient (i.e., opportunistic for alpha) in terms of finding excellent structural growth companies trading at attractive valuations. Emerging markets is home to 85% of the world’s population, now accounts for over 59% of the world’s GDP, yet comprise only 12% of global market cap and less than 6% of global institutional investors’ allocations.[1] Over time, I expect these numbers to continue to converge in favor of EM. As structural growth trends continue of a rising EM middle class, growth in innovation sectors, and access to capital, EM seems poised to continue its growth trajectory. What is especially exciting to see is that while developed markets (DM) have seen the total number of companies listed on exchanges decline over the past decades as fewer companies go public and more delist, EM has seen the number of companies listed in consumer, technology, and health care sectors more than triple over the past decade (from 455 in 2010 to 1,622 in 2020). What this gives us a much bigger opportunity set of attractive business models to invest in.

Despite the underperformance of EM over the past five years, it’s important to zoom out from the short-term trends and see the big picture as well. We are, after all, long-term investors. Interestingly, over the past 20 years, starting Nov 2001 to Nov 2021, in all indices, both EM and DM have delivered nearly identical annualized USD returns. (EM has delivered 9.85% IRR since 2001, EM SMID has delivered 9.81%, compared to S&P500 at 9.31% IRR, in USD). This is despite the recent underperformance in EM.

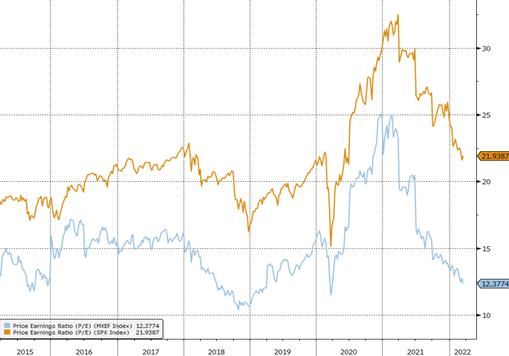

In terms of valuations, EM is currently trading at historical record discounts now to their counterparts in the U.S. and Europe, trading at over a 40% discount on a P/E basis (see chart below).

I feel that we are getting a great entry point into emerging markets right now and expect we can buy some high-quality businesses with long-term structural growth at good valuations which equates to better than average expected future returns. Of course, there are risks. Rising inflation, heightened regulatory, and geopolitical risks in China and other countries, the ongoing COVID-19 pandemic, and global supply chain shortages are all key risks that we need to weigh in the balance when underwriting any investment into the portfolio.

Emerging Markets vs. Developed Markets P/E Ratio (LTM)

Source Bloomberg

What are the greatest opportunities you see and why?

We are bottom-up, fundamental long-term investors. We don’t seek to speculate on what markets will outperform over the next six-to-12 months, and we take a benchmark-agnostic approach to how we construct the portfolio. We simply seek to assemble our highest-conviction portfolio of high-quality businesses with best-in-class ESG practices to achieve the highest expected USD returns possible for our partners.

That being said, we are commonly asked what countries our financial models, ESG risk models, quality scores, and five-year expected returns are indicating the highest expected returns are at any given point of time in EM.

Currently, the underlying dynamics are leading us to have higher exposure than the EM Index in China, Taiwan, and Brazil and leading us to have lower-than-market exposure in Southeast Asia, slightly lower in India and lower in Eastern Europe. Below, I have highlighted China and India.

China is expected to be the second largest market in our portfolio, behind Taiwan. While 2021 has been a tumultuous year for many listed Chinese equities, with heightened regulatory risks in sectors such as education, e-commerce, and health care being negatively impacted, the long-term trends in China remain promising. We find that many great, high-quality businesses with low regulatory risks and high pricing power are now trading at attractive valuations in China. I’ve personally been travelling to and investing in China for nearly two decades -- and having lived in Hong Kong for the past five years, I’ve seen both bull and bear cycles over the period, including the bear markets of 2008, 2015, and 2018 in China. Despite the cycles, China has remained undaunted in its structural growth, rising urbanization trends, investment in innovation and access to capital benefitting from a large consumer market, high domestic savings rates, and low external debt levels. Many are surprised to know that since the year 2000, China has created more unicorns than any other country in the world, including the U.S. [2]

India, on the other hand, has had an exceptionally strong run in 2021, as YTD through November 30, the India SMID Cap Index is up +41.7% in USD. We believe India has a lot of attractive long-term characteristics: a large and entrepreneurial population, a rising middle class, ongoing structural reforms led by Prime Minister Modi, and global leadership in sectors such as pharma, technology, and health care. We find numerous businesses in India that we think are exceptionally high quality led by great managements with long-term growth potential. We expect our exposure to be slightly underweight India relative to the Index due to heightened valuation levels (India is 15% of the Index). The graph below shows that MSCI India now trades at a ten-year high relative to MSCI China and MSCI EM on a P/Book basis.

India is trading at a 10Y premium vs. China and EM

What is the impact of Russia’s invasion of Ukraine on Emerging Markets?

Global markets continued to sell off during the month of February, hit by both the Russian invasion in Ukraine, as well as persistently high inflation which raised expectations for additional interest rate hikes to come. We see that the two events are undoubtedly linked, as rising oil and commodity prices caused by the Russian invasion have played a role in the higher inflation expectations. Year-to-date through February, the MSCI EM Index was down -4.9%, and the MSCI EM SMID Cap Index was down -5.6%. Despite the declines, both EM Indices have considerably outperformed developed markets, where the S&P 500 was down -8.0% and the NASDAQ was down -12.0% YTD. It may seem counterintuitive given the risks in Russia and Emerging Europe that EM has been an outperformer year-to-date, but Russia is a small part of the overall EM Index, and markets in Asia, Latin America, and the Middle East are holding up better given they came into the year trading at relatively low valuations and many EM economies benefit from higher oil and commodity prices.

We are currently positioned cautiously in Russia and Eastern Europe. The negative impacts of sanctions, currency depreciation, human rights violations and divestments are likely going to have long-term negative impacts on the country’s investment environment far into the future.

What are the greatest challenges you face and why?

Rising inflation; heightened regulatory and geopolitical risks in Russia, China, Turkey and other countries; the ongoing COVID-19 pandemic; FX depreciation and global supply chain shortages are all key risks that we need to weigh in making any investment. Over my 17-year career in emerging markets, I have seen so many cycles and I have found that the best way to mitigate them is to own high-quality businesses with strong pricing power that can thrive in any macro environment.

What keeps you up at night?

I cover Asia from Salt Lake City, Utah so I am constantly up at night! I enjoy speaking with companies and analysts and doing channel checks and staying up on the current market dynamics. The risks today are great in the global economy, but so are the opportunities. I’m as excited as ever about the future growth potential in emerging markets; we believe these are the growth markets for decades to come.

The views and opinions expressed above are of the interviewee only, and do not/are not intended to reflect the views of EisnerAmper.

[1] Data is obtained from FactSet, MSCI and eVestment, as of December 2020.

[2] https://fortune.com/2019/10/22/china-us-unicorns-beijing-silicon-valley/

What's on Your Mind?

Start a conversation with Elana

Receive the latest business insights, analysis, and perspectives from EisnerAmper professionals.