The Family Enterprise System

- Published

- Sep 29, 2021

- Share

If you own a privately held company, you are what is called a family enterprise. If your family has a cabin, compound or shared property it is a family enterprise system. Family enterprise systems exist when a family owns or manages an asset together and this blending of family with an asset has unique advantages and challenges. Matthew Kerzner and Natalie McVeigh, directors in the Center for Individual and Organizational Performance, will talk through the system, some ways to navigate it changing as well as discuss some best practices for non-family members to be successful co-stewards.

OUR CURRENT ISSUE OF RISE (Real Ideas to Stimulate Engagement)

Transcript

matt kerzner: Hello, I'm Matt Kerzner and I'm the director in the Center for Individual and Organizational Performance and the Center for Family Business Excellence. And I'm excited today to work with my colleague, Natalie McVeigh. She is also a director in the centers and part of our CIOP podcast series. I'm delighted to have Natalie here today. So Natalie, thank you for joining us.

natalie mcveigh: Thanks Matt. It's a pleasure.

mK: It's always a pleasure to be with you as well. And today's podcast. We're talking about family enterprise systems. So Natalie, can you please describe what is the family enterprise system?

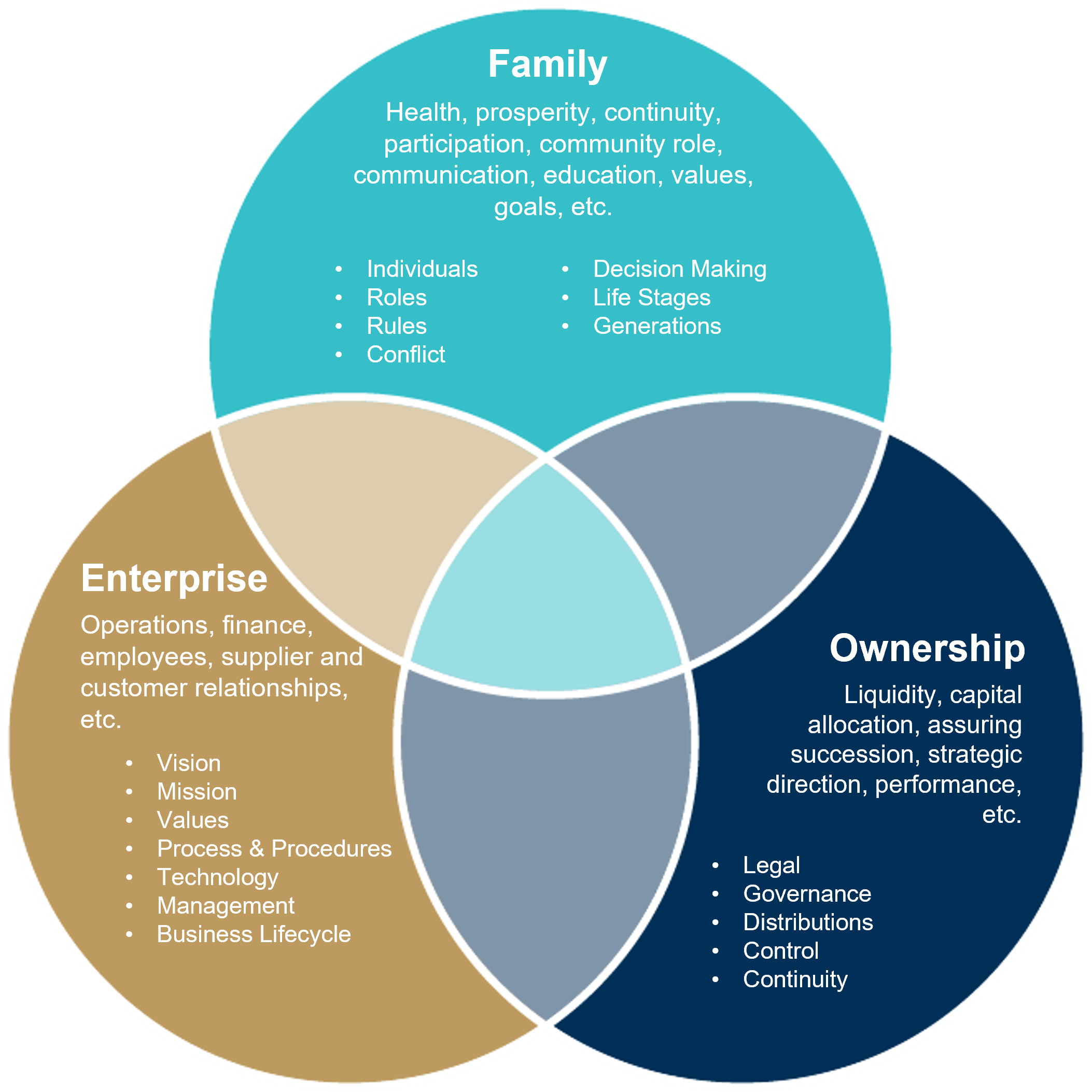

NM: Absolutely. We're using the word enterprise intentionally because it encompasses a lot more entities than just a business, but there are three circles that we find in family enterprises. There's the family circle. All of us are in a family. Two people fall in love and they have kids, right? They fight over their first Thanksgiving, whose traditions to keep. And I know everyone listening, yours are the best. So we're absolutely going to keep yours. And then at some point in time, someone starts an enterprise. It could be a family office. It could be a family business. It could be a family philanthropy, but it's something really structured. And I create that thing. It's mine. And I bring every way that I want to behave to that organization. It's my rules, my vision, my mission, the way we talked about how we compromise and families, I don't have to do that in my business.

I even hire who's in the company and half the time I don't have to listen to them if I don't want to. I also become the owner and that ownership system, we like to call that chaotic because you have the family system that's open, right? You can show up for your holiday in an aloha shirt and chinos and your family might raise an eyebrow, but they let you stay. In the enterprise system or that business, you probably would be thrown out that day if you're dressed that way. And in the ownership system, because sometimes there's documentation. Sometimes there isn't, sometimes it's known, sometimes it's not, even though there are hard and fast rules, we call it a chaotic system because anything goes and that's really who votes for seven specific things and seven specific rights in the company in the United States. It changes by country to country. So those are the three circles in the family enterprise system, and they all overlap. You'll see in the notes, a version illustrated for you.

mK: That's great. So tell me, specifically on the family enterprise system, what does this mean for the current controlling generation, the ones that are in power today?

NM: Absolutely. So we like to call that complete overlap in the center and it'll be in the notes that'll show you that. We call that A. That's the Genesis I gave this story about my own family, my own business. I'm doing everything and I didn't even know I was doing it. So it's actually a lot of responsibility. It feels really heavy. It also feels really foreign to think about occupying any role that isn't all three, because they're all how I behave. So we call this conflation. I, as the owner, I, as the manager, I, as the parent, do all of those things all of the time in one fell swoop. I don't know the difference.

So when I'm bringing my children into the company and they're not owners, but they might be managers, they might be part of the management team. They may think that my ownership role is a part of the management and so on and so forth. So one, it helps me lower my shoulders a little bit, knowing that I'm doing a lot of work. It absolutely is a lot of work leading this. Two, I'm probably not the best teacher about these roles as distinct and different, because I've never had to behave as though they're distinct and different.

mK:Very important points. Excellent. So talked about the current leadership. What about the next rising generation? The next generation; what does this mean for them?

NM:The next generation, it means that there are multiple ways to engage. There's only one role of A, and it may not be you. So there's seven other places in this family enterprise system that you can make a difference. On the family side, you can be a family champion. You can be a family historian. You can be an ambassador. On the business side, you could potentially be on an advisory board, an actual board of directors. You could be in management. Heck. You could be an operations. You don't have to try to be the C-suite executive.

And on the ownership role, there are different ways you can be an owner. You can be an active owner, a passive owner. So one it's, what are the roles? What are the options? And then what do I want to do? And thirdly, how do you figure out how to do that? Like I said, the path you're probably following is a path that's not going to look like yours. So if you're saying I'm going to do it the way mom and dad always did it, you're starting from a place that's not replicable. That's going to necessarily change with the next generation.

mK: That's great. So how do families use this family enterprise system?

NM:Yeah, there are a bunch of different ways to do it. You could try now charting it yourself, writing in names of where you think they are. And although it's a really simplistic model, it's hard sometimes getting it right. You can say what will happen at the transition? What will happen in 10 years? What would I like to see? And also in our diagram, we have a perfect version of the three of them as though they're really balanced. But what is it for you? Are the family and ownership on top of each other? Is the family really big or is it really small compared to the attention that the business takes? So you can use it as a dynamic model, update it when you're planning updates. Play with it so you understand that some of the tension and stress as well as benefit is predictable because of the systems that you're in. And it's not necessarily personal because of who you're with.

mK: That's excellent. So one of the issues that I run into is when the next generation is not ready to take the helm of being the leader of the organization, or the family or ownership in any of these three areas. And they bring in a non-family CEO or leader to sit at the helm of the business until the next generation is ready. Is there something that non-family CEO should be aware of or families should be aware of regarding this system when there's a non-family member sitting at the helm?

NM: Absolutely. I use circles a lot cause they don't know how to draw any other shapes. So if you were to write a circle around the three circle model, that circle is called stewardship. And so anyone in this model is a co-steward. Many next generation people won't be ready. The CEO next door did some great research saying it takes at least 24 years to make a CEO. So if you're trying to have an intergenerational succession, there's probably going to be an external partner with you temporarily or long-term. They're also co-stewards in this, and you're not just raising executives in a company for this family enterprise system. That is one of three roles, one of seven, actually on this company chart.

You can not neglect these other six roles because if I'm not involved and the only way to be involved is as an executive in the company, I may sell my shares. Why wouldn't I if I'm not getting a return on investment, if I'm not getting a psychological ownership? So the CEO or management team or family office executives really want to be co-stewards in this journey of learning, of ensuring that they're going in the right direction that the family's dictating so that people can feel like engaged owners. The One Hundred Year Study actually said that is the main differentiator, is psychological ownership. That is more important than adapting to executives.

mK:That's fantastic input. Fantastic input, Natalie. Well, I want to thank you so much for taking the time out to be part of this podcast series. It was a pleasure talking with you today. And for the audience out there, if there's any additional information that you'd like to have, we have plenty on our website and you can visit us at EisnerAmper.com/CIOP. Natalie, as always, thank you for being part of our podcast series.

NM: It was so wonderful. Thanks Matt.

Also Available On

What's on Your Mind?

Start a conversation with Natalie

Receive the latest business insights, analysis, and perspectives from EisnerAmper professionals.