Tim Speiss Talks Alternative Minimum Tax (AMT)

- Published

- Feb 12, 2019

- Share

In a recent New York Times article by Paul Sullivan titled “Taxing the Wealth Sounds Easy. It’s Not,” EisnerAmper Partner-in-Charge of the firm’s Personal Wealth Advisors Group Tim Speiss expounded on which groups of high net worth individuals were most impacted by the alternative minimum tax (AMT). The article went on to note that those earning $200,000 to $1 million were most impacted by the AMT, while those earning over $1 million were relatively less affected.

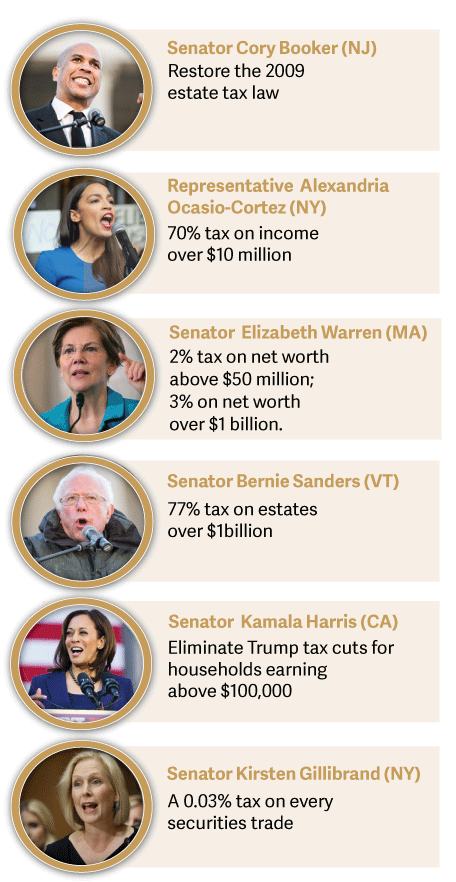

That got us to thinking about several of the high-profile progressive members of Congress and their recent stances on creating a taxation system fostering wealth equality. See what you think.

To view the full article, click here.

What's on Your Mind?

Start a conversation with Timothy

Receive the latest business insights, analysis, and perspectives from EisnerAmper professionals.